When it comes to life insurance, HDFC Life is one of the top choices for many individuals. Known for its innovative policies and excellent customer service, an HDFC Life insurance plan ensures financial security for policyholders and their families. Whether you're looking for term insurance, savings plans, or retirement solutions, HDFC Life has options that cater to diverse financial needs.

Why Choose HDFC Life Insurance?

With a strong presence in the Indian insurance market, HDFC Life is backed by a reputation for delivering customer-centric policies. Its wide variety of insurance products ensures that everyone can find a plan that suits their specific requirements. Here are some key reasons why you might want to consider purchasing an HDFC Life insurance policy:

- Customizable Plans: HDFC Life allows you to tailor your insurance plan to suit your financial goals, whether you're saving for your child's education or planning for retirement.

- Financial Protection: Like any good life insurance, an HDFC Life insurance plan provides a safety net for your loved ones in case of unfortunate events, helping them maintain their standard of living even in your absence.

- Tax Savings: Policyholders can avail of tax benefits under Section 80C and 10D of the Income Tax Act, making it a financially prudent choice.

Popular HDFC Life Insurance Plans

HDFC Life offers a variety of policies tailored to different needs:

- Term Insurance: Term plans from HDFC Life provide high coverage at low premiums, ensuring that your family is financially secure in your absence.

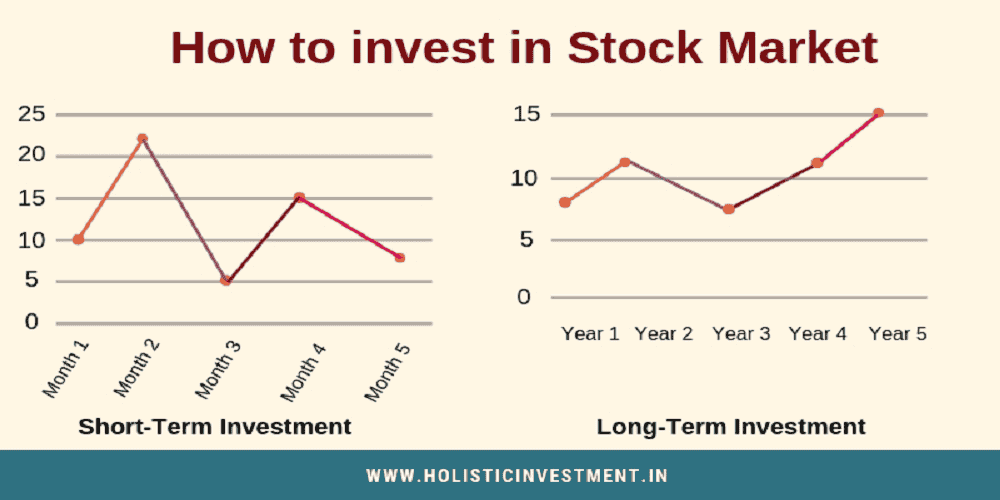

- Savings and Investment Plans: These plans help you build a corpus while providing life cover. Popular options include Unit Linked Insurance Plans (ULIPs), which offer the dual benefit of insurance and market-linked returns.

- Retirement and Pension Plans: For those planning their retirement, HDFC Life offers annuity and pension plans that ensure a steady income during your retirement years.

- Child Plans: These policies are designed to secure your child’s financial future, especially for education and other major life events.

How to Check Your HDFC Life Insurance Policy Status Online

Managing your HDFC Life insurance policy is simple and convenient with online options. Here’s how you can do it:

- Log Into Your Account: HDFC Life provides an online portal where you can register your policy and track its status anytime.

- Mobile App: You can also download the HDFC Life mobile app to view your policy details, make premium payments, and download necessary documents.

- Call Customer Service: If you prefer not to go online, you can always contact HDFC Life’s customer service for assistance regarding your policy status.

Conclusion

An HDFC Life insurance plan offers comprehensive financial security tailored to meet your specific needs. Whether you're looking for term insurance or savings plans, HDFC Life provides a wide range of policies backed by excellent customer service.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Leave A Comment

0 Comment