Property insurance price is one of the most important considerations for homeowners, landlords, and real estate investors. Whether you own a house, apartment, commercial building, or rental property, understanding how property insurance price is calculated can help you choose the right coverage and avoid overpaying. Many people buy insurance without fully understanding what affects the cost, which often leads to either insufficient coverage or unnecessarily high premiums.

In this detailed guide, we will explain what property insurance price means, how insurers calculate it, the key factors that influence premiums, average costs, ways to reduce expenses, and common mistakes to avoid. This article is written in simple language and is suitable for beginners as well as experienced property owners.

What Is Property Insurance Price?

Property insurance price refers to the amount you pay to an insurance company to protect your property against risks such as fire, theft, natural disasters, vandalism, and other covered events. This price is usually paid as an annual or monthly premium. The property insurance price depends on multiple variables, including the value of the property, its location, construction type, coverage limits, and risk profile.

Different properties have different insurance needs. A small residential house will have a very different property insurance price compared to a large commercial building. Similarly, a property located in a low-risk area will generally have a lower insurance price than one located in a flood-prone or earthquake-prone zone.

Why Property Insurance Price Matters

Understanding property insurance price is essential because it directly impacts your financial planning. Insurance is not just an expense; it is a financial safety net. If your property suffers damage and you are underinsured, the repair or rebuilding cost can become a heavy financial burden.

At the same time, paying a very high property insurance price without adequate benefits is also not wise. The goal is to find a balance between affordable premiums and sufficient coverage. When you understand how pricing works, you can make informed decisions and negotiate better terms.

Types of Property Insurance and Their Prices

Property insurance price varies based on the type of policy you choose. Below are the most common types of property insurance.

Homeowners Insurance

Homeowners insurance covers private residential properties. The property insurance price for homeowners usually includes coverage for the structure, personal belongings, liability, and additional living expenses. This type of insurance is common for independent houses, villas, and owner-occupied flats.

Landlord or Rental Property Insurance

If you rent out your property, you need landlord insurance. The property insurance price for rental properties is usually higher than standard homeowners insurance because of increased risk due to tenants. It often covers building damage, loss of rental income, and liability protection.

Commercial Property Insurance

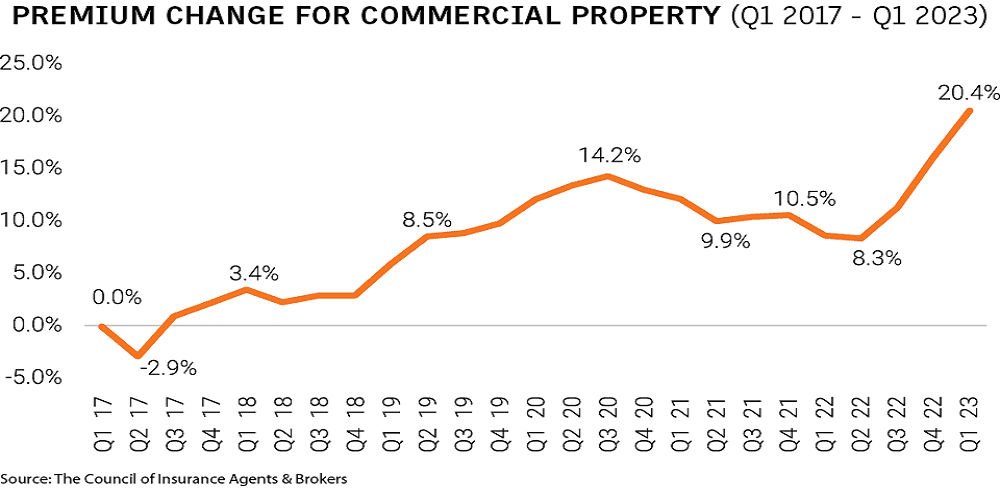

Commercial property insurance protects business-owned buildings, offices, warehouses, and shops. The property insurance price for commercial properties is generally higher because of larger property values, business equipment, and higher liability risks.

Condo or Apartment Insurance

For apartments and condominiums, the property insurance price depends on whether the policy covers only the interior or also includes parts of the structure. In many cases, the building association covers external structures, while individual owners insure their units.

Key Factors Affecting Property Insurance Price

Several factors influence how insurers calculate property insurance price. Understanding these factors can help you predict costs and take steps to reduce them.

Property Location

Location is one of the most significant factors affecting property insurance price. Properties located in areas prone to floods, earthquakes, cyclones, or high crime rates usually have higher insurance prices. Insurers assess historical data and risk maps to determine location-based pricing.

Property Value and Replacement Cost

The higher the value of your property, the higher the property insurance price. Insurance companies calculate the replacement cost, which is the amount required to rebuild the property from scratch using current material and labor costs. A higher replacement cost leads to a higher premium.

Construction Type and Age

The materials used in construction play a major role in property insurance price. Buildings made with fire-resistant materials such as concrete and brick generally attract lower premiums than those made with wood. Older buildings may have higher insurance prices due to outdated wiring, plumbing, or structural issues.

Coverage Amount and Policy Limits

The more coverage you choose, the higher the property insurance price. Policies with higher limits and broader coverage naturally cost more. Optional add-ons, such as coverage for valuables or natural disasters, also increase the overall insurance price.

Deductible Amount

The deductible is the amount you pay out of pocket before the insurance company covers a claim. Choosing a higher deductible can lower your property insurance price, but it also increases your financial responsibility during a claim.

Claim History

If you have a history of frequent claims, insurers may consider you a high-risk policyholder. This can result in a higher property insurance price. Maintaining a claim-free record often helps keep premiums affordable.

Average Property Insurance Price

The average property insurance price varies widely depending on country, region, and property type. In general, residential property insurance prices are lower than commercial property insurance prices. Urban properties often have higher premiums compared to rural ones due to higher property values and risks.

Instead of focusing only on averages, it is better to get personalized quotes based on your specific property details. Two similar-looking houses in different locations can have very different property insurance prices.

How Insurers Calculate Property Insurance Price

Insurance companies use a risk assessment process to calculate property insurance price. They analyze data related to property characteristics, location risks, historical claims, and market trends. Advanced models and algorithms help insurers predict the likelihood and cost of future claims.

Insurers also consider external factors such as inflation, construction cost trends, and regulatory changes. These elements can cause property insurance prices to increase over time, even if the property itself remains unchanged.

Ways to Reduce Property Insurance Price

Reducing property insurance price is possible if you take the right steps. Below are some effective strategies.

Compare Multiple Quotes

Always compare insurance quotes from different providers. Each insurer has its own pricing model, so the same coverage can have different property insurance prices across companies.

Improve Property Safety

Installing safety features such as smoke detectors, fire alarms, security systems, and surveillance cameras can lower your property insurance price. Insurers often offer discounts for risk-reducing measures.

Increase Deductible Wisely

Opting for a slightly higher deductible can significantly reduce your property insurance price. However, make sure the deductible amount is affordable in case of a claim.

Bundle Insurance Policies

Many insurers offer discounts if you bundle property insurance with other policies such as auto or health insurance. Bundling can help lower the overall insurance price.

Maintain a Good Claim Record

Avoid making small or unnecessary claims. A clean claim history can help keep your property insurance price stable over the long term.

Common Mistakes That Increase Property Insurance Price

Many property owners unknowingly increase their insurance costs by making avoidable mistakes.

One common mistake is underestimating or overestimating property value. Underinsurance can lead to financial loss, while overinsurance results in a higher property insurance price. Another mistake is ignoring policy exclusions and add-ons, which can create gaps in coverage.

Failing to review and update the policy regularly is also a problem. Property values and risks change over time, and an outdated policy may not offer the best price or protection.

Property Insurance Price for New vs Old Properties

Newly constructed properties often have a lower property insurance price because they meet modern building codes and safety standards. In contrast, older properties may have higher premiums shows due to outdated systems and higher maintenance risks.

However, renovating an old property and upgrading safety features can help reduce its insurance price over time.

Impact of Natural Disasters on Property Insurance Price

Natural disasters significantly affect property insurance price. Areas that experience frequent floods, earthquakes, or storms often see higher premiums. In some cases, insurers may require separate policies for specific risks, which increases the overall cost.

Property owners in high-risk zones should carefully evaluate coverage options and consider preventive measures to manage insurance expenses.

Role of Government Regulations

Government regulations and building codes also influence property insurance price. Stricter safety requirements and zoning laws can reduce risk, leading to lower premiums. On the other hand, regulatory changes can increase compliance costs for insurers, which may be passed on to policyholders.

Long-Term Trends in Property Insurance Price

Over time, property insurance prices tend to increase due to inflation, rising construction costs, and climate-related risks. Understanding these trends can help property owners plan their budgets better and avoid surprises.

Regular policy reviews and market comparisons are essential to keep your insurance price competitive.

Choosing the Right Policy Based on Property Insurance Price

While price is important, it should not be the only factor when choosing insurance. A very low property insurance price may come with limited coverage or high deductibles. Always balance affordability with adequate protection.

Reading policy terms carefully and understanding coverage limits can help you make the right decision.

FAQs on Property Insurance Price

What determines property insurance price the most?

Location, property value, construction type, coverage limits, and risk exposure are the biggest factors that determine property insurance price.

Is property insurance price the same every year?

No, property insurance price can change annually due to inflation, claim history, changes in property value, and updated risk assessments.

Can I reduce property insurance price without reducing coverage?

Yes, you can reduce property insurance price by improving safety features, comparing insurers, bundling policies, and maintaining a good claim record.

Does a higher deductible always mean a lower property insurance price?

Generally, yes. A higher deductible reduces the insurer’s risk, which often lowers the property insurance price. However, you should choose a deductible you can afford.

Is property insurance price higher for rental properties?

In most cases, yes. Rental properties usually have a higher property insurance price because they involve additional risks related to tenants and rental income.

How often should I review my property insurance price?

It is recommended to review your property insurance price at least once a year or whenever there are major changes to your property.

Can renovations affect property insurance price?

Yes, renovations can either increase or decrease property insurance price depending on whether they increase property value or improve safety features.

Is the cheapest property insurance price always the best option?

Not necessarily. The cheapest property insurance price may offer limited coverage. Always compare benefits, exclusions, and claim support before deciding.

Conclusion

Property insurance price is influenced by a wide range of factors, from location and construction type to coverage limits and claim history. By understanding how pricing works, property owners can make smarter decisions, avoid common mistakes, and secure the right coverage at a reasonable cost.

Instead of focusing only on the lowest price, aim for a policy that offers balanced protection and long-term value. Regular reviews, safety improvements, and market comparisons can help you manage property insurance price effectively and protect your valuable assets.

.jpg)

.jpg)

.jpg)

Leave A Comment

0 Comment