When it comes to managing insurance portfolios, having a trusted partner is crucial. Insurance Management Associates (IMA) has built a reputation for providing customized insurance solutions that cater to both individual and corporate clients. But what makes IMA stand out in a crowded market?

Who Are Insurance Management Associates?

Insurance Management Associates is a full-service insurance brokerage firm that provides personalized risk management solutions. Whether you're an individual looking for life insurance or a company in need of group health plans, IMA’s expertise ensures that your needs are met.

Why Work with IMA?

One of the key differentiators of IMA is its approach to understanding client needs. Unlike traditional brokers who simply offer pre-packaged policies, IMA takes the time to analyze your specific risks and needs, then tailors a plan that provides comprehensive protection at an optimal cost.

Areas of Expertise

- Commercial Insurance: Whether you're in construction, healthcare, or retail, IMA offers industry-specific solutions to protect your business from liability, property damage, and other risks.

- Personal Insurance: From auto and home insurance to life and health coverage, IMA works with top insurers to provide you with the best rates and coverage.

- Employee Benefits: IMA specializes in designing employee benefit programs that not only meet regulatory requirements but also keep your employees satisfied and protected.

The IMA Advantage

- Tailored Solutions: No two clients are the same, and IMA’s customized plans ensure that you only pay for what you need.

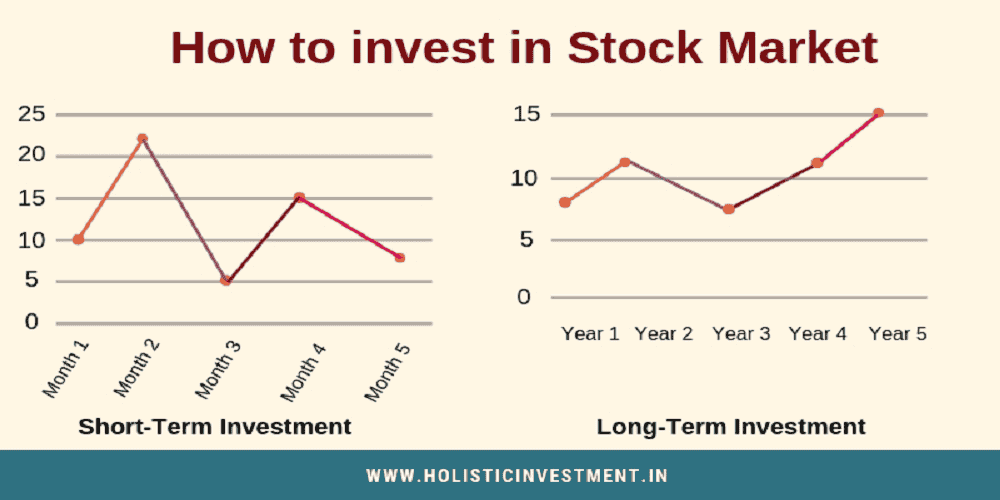

- Risk Management Expertise: With decades of experience, IMA can help you identify potential risks and suggest ways to mitigate them, ensuring long-term savings.

- Superior Customer Service: IMA prides itself on providing unmatched support, with agents available to answer queries and assist with claims at any time.

In conclusion, Insurance Management Associates offer a unique combination of expertise, flexibility, and customer focus, making them an ideal partner for both businesses and individuals looking for reliable insurance management solutions.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Leave A Comment

0 Comment