Owning a property comes with risks, and protecting it with property insurance is crucial. But how do you prove that your property is insured? That’s where evidence of property insurance comes in. This document acts as proof that your property is covered under an insurance policy, providing necessary details for lenders, tenants, or other stakeholders.

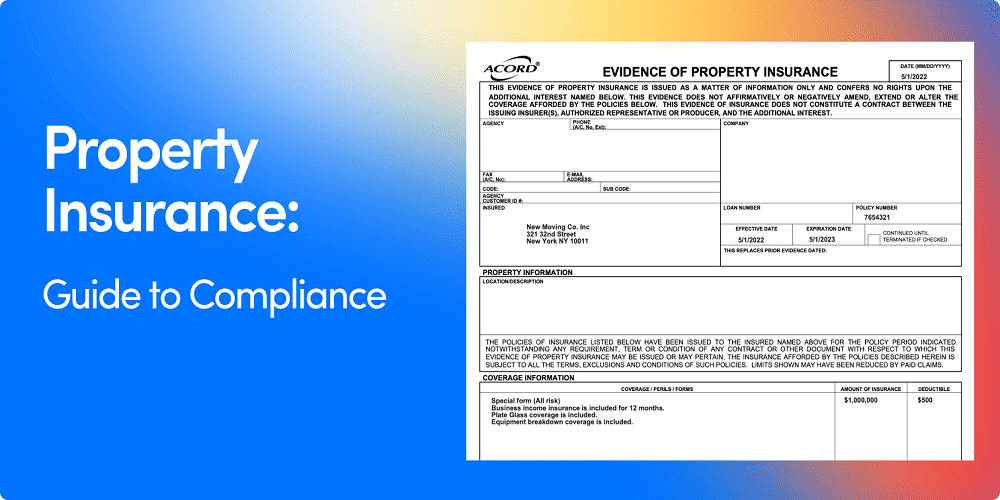

In this guide, we’ll explore everything you need to know about evidence of property insurance, its importance, and how to obtain a fillable evidence of property insurance form. We will also discuss ACORD 27 fillable form, a commonly used document for property insurance proof.

What is Evidence of Property Insurance?

Definition and Purpose

Evidence of property insurance is a document issued by an insurance provider that confirms active coverage for a specific property. It includes essential details such as:

- Policyholder’s name

- Property address

- Coverage details (types of coverage, limits, deductibles)

- Policy number

- Effective and expiration dates

- Insurance provider details

Who Needs It?

Various parties may require evidence of property insurance, including:

- Lenders – Mortgage providers often require proof of insurance before finalizing a loan.

- Landlords and Tenants – Landlords may ask for evidence to ensure tenants have renters’ insurance.

- Homeowners – To protect their property and assets.

- Business Owners – To cover commercial properties from potential risks.

Why is Evidence of Property Insurance Important?

1. Compliance with Lender Requirements

If you have a mortgage, your lender will require you to maintain insurance coverage on your property. Evidence of property insurance ensures you comply with their terms, preventing penalties or forced-placed insurance, which is often more expensive.

2. Proof of Financial Protection

This document confirms that your property is covered against risks such as fire, theft, or natural disasters. Without it, stakeholders may assume your property is uninsured, leading to financial risks.

3. Facilitates Lease Agreements

Landlords often require tenants to show proof of renters' insurance before signing a lease. Providing evidence of property insurance ensures compliance with lease terms.

4. Simplifies Claims Process

Having a valid insurance policy on record makes it easier to file claims in case of damage or loss. It acts as a reference point for both insurers and insured parties.

How to Obtain a Fillable Evidence of Property Insurance Form?

A fillable evidence of property insurance form is an editable document that can be completed online and printed for official use. Most insurance companies provide this upon request.

Steps to Get a Fillable Form:

- Contact Your Insurance Provider – Request a fillable evidence of property insurance form directly from your insurer.

- Download from Official Websites – Some providers offer fillable PDFs on their websites.

- Use an ACORD Form – The ACORD 27 fillable form is widely accepted as a standard format for property insurance evidence.

What is an ACORD 27 Fillable Form?

The ACORD 27 is a standardized form used in the insurance industry to certify property insurance coverage. It provides detailed information about the policy and is often required by lenders and landlords.

Key Features of ACORD 27 Fillable Form:

- Editable fields for easy customization.

- Official format recognized by banks, lenders, and businesses.

- Includes essential details like policyholder information, coverage limits, and insurer contact.

To get an ACORD 27 fillable form, check with your insurer or download it from a reliable insurance documentation website.

How to Fill Out an Evidence of Property Insurance Form?

Step 1: Enter Policyholder Information

Provide the insured party’s name, address, and contact details. Ensure accuracy to avoid discrepancies.

Step 2: Add Property Details

Include the exact address of the insured property. For commercial properties, specify the type of building (e.g., office, retail, warehouse).

Step 3: Insurance Coverage Information

List:

- Coverage type (homeowners, renters, commercial property insurance).

- Policy number for reference.

- Coverage limits (amount insured for damages, liability, etc.).

- Deductibles that apply to the policy.

Step 4: Insurer Information

Provide details of the insurance provider, including their name, contact number, and official address.

Step 5: Signature and Authorization

Most forms require a signature from an authorized representative of the insurance company to confirm the policy's validity.

Common Mistakes to Avoid When Using Evidence of Property Insurance

Even though filling out this form is straightforward, mistakes can lead to delays or policy disputes. Here are some common errors to avoid:

- Providing Incorrect Information – Ensure all details match the official policy records.

- Using an Expired Form – Always verify that the insurance policy is active and up to date.

- Not Notifying Lenders or Landlords – If your coverage changes, update the necessary parties immediately.

- Ignoring Policy Limits – Double-check the coverage amount to ensure it meets lender or lease requirements.

Frequently Asked Questions (FAQs)

1. How Do I Request Evidence of Property Insurance?

You can request it directly from your insurance company via phone, email, or online customer portal.

2. Is Evidence of Property Insurance the Same as an Insurance Policy?

No, it’s a summarized version of your insurance policy that proves active coverage.

3. Can I Use an ACORD 27 Fillable Form for Any Property?

Yes, ACORD 27 is a widely accepted document for residential and commercial properties.

4. What If My Insurance Coverage Changes?

If your policy changes, request an updated evidence of property insurance document and inform relevant parties.

5. Do All Lenders Require Evidence of Property Insurance?

Most lenders require it to ensure the property is adequately insured against risks.

Conclusion: Why You Need Evidence of Property Insurance

Having evidence of property insurance is essential for property owners, tenants, and businesses. Whether you’re securing a mortgage, renting a home, or protecting a commercial building, this document provides peace of mind and ensures compliance with financial institutions and lease agreements.

For those needing a fillable evidence of property insurance form, the ACORD 27 fillable form is a standard choice that simplifies documentation. Always keep an updated copy on hand and share it with necessary stakeholders when required.

.jpg)

.jpg)

.jpg)

Leave A Comment

0 Comment