Life is unpredictable, but your family's financial future doesn't have to be. Term insurance is one of the simplest and most affordable ways to ensure financial stability for your loved ones in case of your untimely demise. It offers a high coverage amount at a relatively low premium, making it an essential part of financial planning.

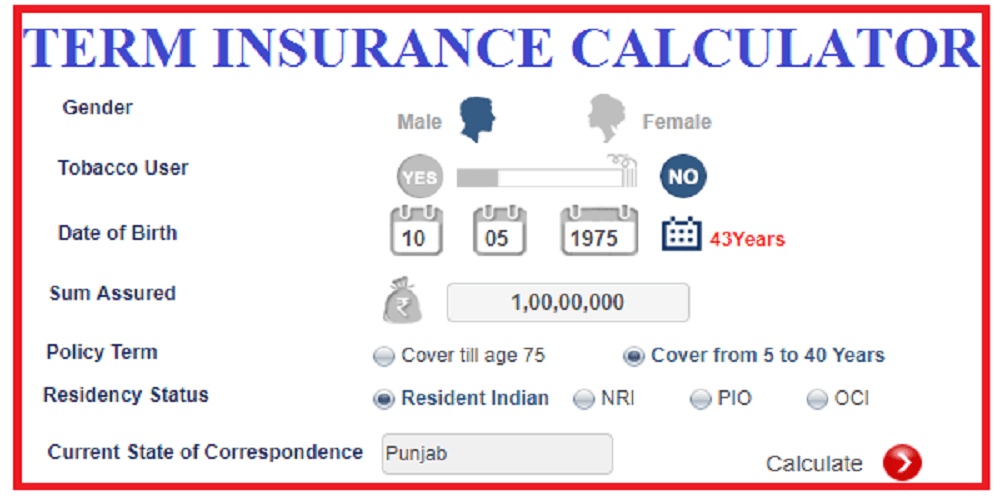

One of the most trusted names in India's insurance industry is SBI Life Insurance, a joint venture between State Bank of India and BNP Paribas Cardif. To simplify the decision-making process for potential policyholders, SBI offers a Term Insurance Calculator, an online tool that helps you estimate the premium for the required sum assured and policy term.

In this comprehensive guide, we will explore how the SBI term insurance calculator works, its features, benefits, and how you can use it to make an informed decision about securing your family's future.

What Is a Term Insurance Calculator?

A term insurance calculator is an online tool that helps individuals estimate the premium they will need to pay for a specific sum assured, tenure, and other related parameters. It is designed to make the process of choosing a term plan faster, more transparent, and hassle-free.

The SBI Term Insurance Calculator specifically helps customers interested in SBI Life’s term insurance products to:

- Compare different premium rates

- Estimate the sum assured suitable for their financial goals

- Customize their policy term and premium payment term

- Decide on riders (additional benefits) and coverage options

Features of SBI Term Insurance Calculator

1. User-Friendly Interface

The calculator is designed to be easy to use even for someone without any prior experience with insurance tools.

2. Customization Options

You can enter various parameters such as your age, income, smoking habits, desired sum assured, and policy tenure to receive an accurate premium quote.

3. Quick Estimates

It takes less than a minute to generate premium quotes once all necessary information is entered.

4. Rider Addition

You can include riders like Accidental Death Benefit, Critical Illness Cover, and Waiver of Premium to see how they impact your premium.

5. No Need for Personal Information

The tool doesn’t always require personal contact details to show the estimate, which makes it privacy-friendly.

Benefits of Using the SBI Term Insurance Calculator

1. Saves Time

Instead of manually comparing different plans or contacting agents, the calculator gives you instant results based on your inputs.

2. Financial Planning

Knowing the exact premium helps in planning your monthly or yearly budget more effectively.

3. Transparency

You get a clear view of what you're paying for, the breakdown of premiums, and the cost of add-on riders.

4. Comparison of Plans

You can easily compare multiple coverage options and find the plan that best suits your needs.

5. Accessibility

Being an online tool, the calculator is available 24/7 and accessible from any device with internet connectivity.

Step-by-Step Guide to Using the SBI Term Insurance Calculator

Using the SBI term insurance calculator is simple and straightforward. Here’s how you can do it:

Step 1: Visit the SBI Life Official Website

Navigate to www.sbilife.co.in and look for the term insurance calculator under the “Tools and Calculators” section.

Step 2: Input Basic Information

You’ll be asked to provide:

- Age

- Gender

- Smoking status (smoker/non-smoker)

- Annual income

- Desired sum assured

- Policy term (in years)

- Premium payment term (same as policy term or limited period)

Step 3: Choose Additional Riders

You can select riders to enhance your policy, such as:

- Accidental Death Benefit Rider

- Critical Illness Rider

- Waiver of Premium Rider

Step 4: View and Compare Premiums

Based on your inputs, the calculator will display the premium amount. You can adjust your inputs and recalculate as many times as needed to find the right balance.

Step 5: Proceed to Buy

Once satisfied, you can proceed to apply for the term insurance plan online. You may be asked to fill in more details and complete the KYC and medical requirements before the policy is issued.

Key Factors That Affect SBI Term Insurance Premium

1. Age

The younger you are, the lower your premium. Age is the most significant factor in determining term insurance cost.

2. Lifestyle Habits

If you are a smoker or consume alcohol, your premiums will generally be higher due to the increased risk.

3. Sum Assured

A higher sum assured will lead to a higher premium, but it also means greater protection for your family.

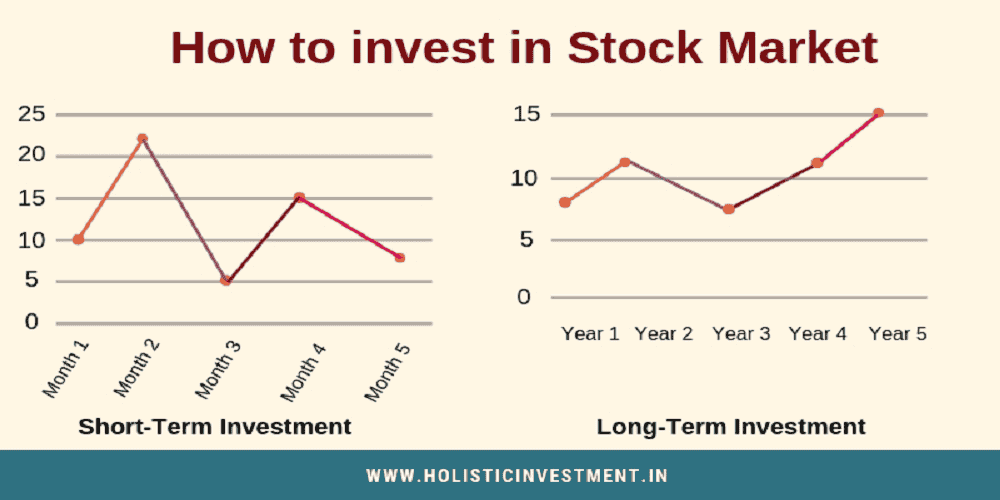

4. Policy Tenure

Longer policy durations attract higher premiums, though the per-year cost may be more cost-effective in the long run.

5. Health History

Pre-existing illnesses or a family history of hereditary diseases may increase your premium or lead to policy exclusions.

Types of SBI Term Insurance Plans Available

Although the calculator is typically used for SBI Life’s flagship term insurance plans, here's an overview of some major plans compatible with it:

1. SBI Life eShield Next

- Pure term insurance

- Comes with multiple benefit structures

- Online-only plan

2. SBI Life Smart Shield

- Customizable term plan

- Option to choose different sum assured options

- Optional riders available

3. SBI Life Saral Jeevan Bima

- Standardized term insurance plan

- Affordable and easy to understand

- Suitable for first-time buyers

Who Should Use the SBI Term Insurance Calculator?

1. First-Time Insurance Buyers

Helps them understand premiums without needing to talk to agents.

2. Young Professionals

Assists in early financial planning and budget allocation.

3. Working Parents

Ensures that the financial future of children and dependents is secured.

4. Business Owners

Allows flexible customization based on fluctuating income patterns.

Common Mistakes to Avoid When Using the Calculator

1. Underestimating the Sum Assured

Always consider your family’s future expenses, children’s education, loans, and lifestyle.

2. Not Factoring in Inflation

Rs. 1 crore today may not hold the same value 20 years from now.

3. Ignoring Riders

Riders can provide extra protection at a minimal additional cost.

4. Providing Incorrect Information

False data may lead to incorrect premium estimates or even claim rejection.

Real-Life Example

Let’s say Rohit, a 30-year-old non-smoker with an annual income of ₹10 lakhs, wants a sum assured of ₹1 crore for a term of 30 years. He uses the SBI Term Insurance Calculator and finds:

- Base premium: ₹9,000 annually

- With Accidental Death Benefit: ₹11,500 annually

- With Critical Illness Cover: ₹14,000 annually

This gives him a clear understanding of what he needs to pay based on the level of coverage he desires.

When and Why to Recalculate

It’s a good idea to revisit the calculator when:

- Your income increases

- You get married or have children

- You take a significant loan

- You develop a health condition

- You approach a major life milestone like retirement

Each time, you may need to adjust your sum assured or tenure accordingly.

SBI Term Insurance Calculator vs Manual Calculation

Manual calculation requires:

- Understanding of actuarial tables

- Estimating mortality risk

- Considering GST, rider charges, etc.

This process is time-consuming and complex. The SBI calculator simplifies this by automating the entire process using smart algorithms and up-to-date pricing.

Security and Privacy

SBI Life's calculator is hosted on a secure website (https) and does not store your personal details unless you proceed to apply for a policy. This ensures that your data is protected and used only for premium estimation.

Tips to Lower Your Term Insurance Premium

- Buy early, preferably in your 20s or early 30s

- Maintain a healthy lifestyle

- Go for online plans (they’re usually cheaper)

- Choose annual payments (instead of monthly or quarterly)

- Avoid unnecessary riders if you don’t need them

Why Choose SBI for Term Insurance?

- Strong brand trust due to the backing of State Bank of India

- Comprehensive product offerings

- Competitive premium rates

- High claim settlement ratio

- Robust customer support

Conclusion

SBI Term Insurance Calculator is a must-use tool for anyone planning to buy term insurance from SBI Life. It saves time, ensures transparency, and helps you make an informed choice about your policy. Whether you’re buying insurance for the first time or upgrading your coverage, this tool is designed to make your journey smooth and effective.

By using the SBI term insurance calculator, you take the first step towards securing your family’s financial future with confidence and clarity.

Frequently Asked Questions (FAQs)

Q1. Is the SBI term insurance calculator free to use?

Yes, the SBI term insurance calculator is completely free and accessible to anyone online.

Q2. Can I use the calculator without entering personal details?

Yes, most estimates can be generated without entering sensitive personal information.

Q3. Does the premium shown in the calculator include taxes?

Usually, the premium shown includes GST, but it's best to check the final premium during the purchase process.

Q4. Can I buy the policy directly after using the calculator?

Yes, you can proceed to buy the policy online after checking your premium estimate.

Q5. What if I enter incorrect information in the calculator?

If the information is incorrect, the premium estimate will also be inaccurate. Always ensure correct data is entered.

Q6. Can I change my inputs and recalculate?

Yes, you can modify your inputs as many times as you like and recalculate accordingly.

Q7. Does the calculator account for riders and additional benefits?

Yes, you can add riders to your base plan and see how they impact the premium.

Q8. Are the premium rates shown fixed?

The rates shown are indicative. The final premium may change after underwriting and medical examination.

Q9. Can I use the calculator on my mobile phone?

Yes, the calculator is mobile-friendly and can be accessed from any device with internet.

Q10. What documents are needed after calculation to proceed with the purchase?

You'll typically need ID proof, address proof, income proof, and medical test results (depending on the sum assured).

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Leave A Comment

0 Comment