Investing in the stock market requires more than just intuition. Today, data-driven decisions are essential, and one of the most effective tools for traders and investors is stock charts with indicators. These charts provide a visual representation of stock price movements and, when combined with technical indicators, help traders anticipate trends, identify entry and exit points, and manage risk efficiently. For those starting out or trading on a budget, free stock charts with indicators offer a perfect solution to access these powerful tools without spending money.

Understanding Stock Charts

A stock chart is a graphical representation of a stock’s price movement over a certain period. The horizontal axis shows time, while the vertical axis shows price. Charts can display data for minutes, hours, days, months, or even years, depending on the investor’s needs.

There are several types of stock charts:

- Line charts: These are simple charts that connect closing prices over time, giving a basic view of trends.

- Bar charts: These show the opening, high, low, and closing prices for a given period, providing more detail than line charts.

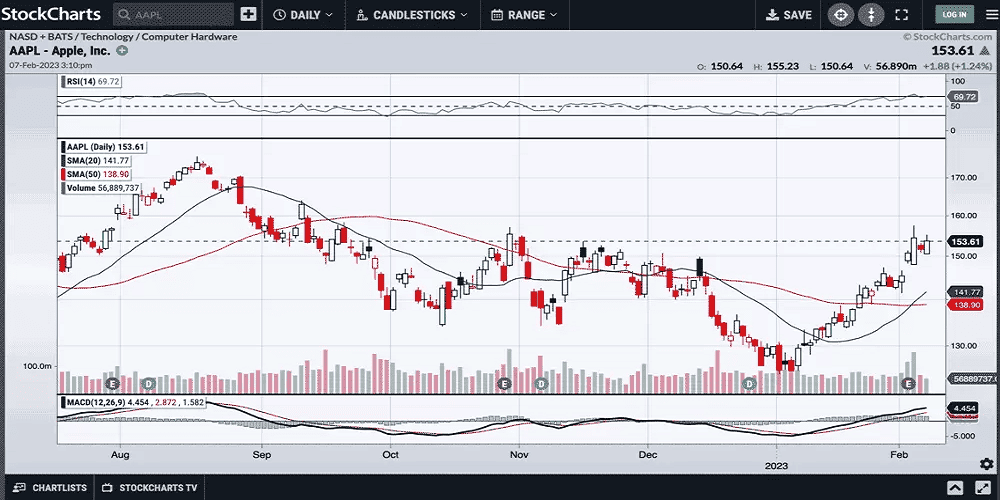

- Candlestick charts: Popular among traders, these use color-coded “candles” to represent price movements, highlighting bullish and bearish trends clearly.

While these charts show historical price data, their real power comes from combining them with technical indicators.

What Are Indicators?

Indicators are mathematical calculations based on a stock’s price and volume. They help traders interpret market conditions and forecast potential price movements. Indicators fall into two main categories:

- Trend indicators: These help identify the direction of the market. Examples include Moving Averages (MA), Moving Average Convergence Divergence (MACD), and Average Directional Index (ADX).

- Momentum indicators: These measure the speed and strength of a price movement. Popular momentum indicators include Relative Strength Index (RSI), Stochastic Oscillator, and Commodity Channel Index (CCI).

By combining charts with these indicators, traders can make informed decisions rather than relying solely on speculation.

Why Use Free Stock Charts with Indicators

While premium charting platforms exist, many traders and investors, especially beginners, prefer free stock charts with indicators. Here’s why:

- Cost-Effective: Free platforms eliminate the need for expensive subscriptions while still offering essential tools for analysis.

- Accessibility: Most free charting tools are web-based and can be accessed from any device with an internet connection.

- Educational Value: Beginners can experiment with different indicators and strategies without financial pressure, helping them learn faster.

- Real-Time Data: Many free platforms provide live price updates, ensuring that decisions are based on current market conditions.

Best Free Platforms for Stock Charts with Indicators

Several platforms provide robust charting tools with indicators for free. Here are some widely used options:

- TradingView: TradingView is one of the most popular platforms for free stock charts with indicators. It offers an intuitive interface, multiple chart types, and hundreds of built-in indicators. Traders can also customize indicators and create alerts based on specific conditions.

- Yahoo Finance: Yahoo Finance provides basic charts with key technical indicators. While not as advanced as TradingView, it is suitable for beginners who want quick analysis of stocks.

- Investing.com: Investing.com offers a range of chart types and more than 100 technical indicators. Its web-based platform is user-friendly, and users can save chart setups for later reference.

- StockCharts.com: StockCharts.com has a free plan that allows users to view charts with essential indicators. While the free version has limitations compared to paid plans, it is still valuable for casual traders.

- MetaTrader 4 (MT4): While MT4 is primarily used for forex trading, it also supports stock charting with indicators. It allows users to add custom indicators and analyze historical data efficiently.

How to Use Stock Charts with Indicators Effectively

Using free stock charts with indicators requires understanding both the charts and the indicators you choose. Here are some tips for effective use:

- Start with Trend Indicators: Begin by identifying the overall market trend using tools like Moving Averages or MACD. Knowing the trend helps prevent trading against the market.

- Add Momentum Indicators: Once the trend is established, use momentum indicators like RSI or Stochastic Oscillator to find entry and exit points. For instance, an RSI above 70 may indicate an overbought condition, suggesting a possible price decline.

- Combine Multiple Indicators: Using more than one indicator can confirm signals and reduce the risk of false alerts. However, avoid overloading charts with too many indicators, as this can create confusion.

- Backtest Strategies: Free platforms often allow you to review historical data. Test your strategies on past price movements to see how well they perform before applying them in live markets.

- Stay Updated with News: Indicators are helpful, but external factors like news and earnings reports can impact stock prices. Combining technical analysis with fundamental analysis can improve decision-making.

Benefits of Using Free Stock Charts with Indicators

- Improved Decision-Making: Visualizing price data alongside indicators helps traders make informed choices.

- Reduced Emotional Trading: Indicators provide objective signals, minimizing impulsive decisions driven by fear or greed.

- Flexible Trading Styles: Free charts accommodate day traders, swing traders, and long-term investors alike.

- Learning Opportunity: Beginners gain hands-on experience with technical analysis without financial risk.

Common Mistakes to Avoid

While free stock charts with indicators are helpful, traders should be aware of potential pitfalls:

- Relying Solely on Indicators: Indicators are not foolproof. Always consider market context and external factors.

- Overcomplicating Charts: Too many indicators can create analysis paralysis. Focus on a few key indicators.

- Ignoring Risk Management: Even if indicators suggest a trade, always use stop-loss orders and position sizing to manage risk.

- Failing to Backtest: Jumping into trades without testing strategies on historical data can lead to losses.

Conclusion

Free stock charts with indicators are indispensable tools for modern traders and investors. They offer a cost-effective way to access professional-grade analysis tools, helping users make informed decisions, reduce risk, and improve trading performance. Platforms like TradingView, Yahoo Finance, and Investing.com provide ample opportunities to analyze stocks using multiple indicators. However, while these tools are powerful, they should be used in combination with market knowledge, fundamental analysis, and disciplined risk management.

By learning how to use free stock charts with indicators effectively, both beginners and experienced traders can enhance their market strategies, increase profitability, and build confidence in their trading journey.

FAQs

1. Can I really trade successfully using only free stock charts with indicators?

Yes, many traders use free charts successfully, especially when starting out. However, success also depends on knowledge, discipline, risk management, and combining technical analysis with market research. Free charts provide the tools, but skill and strategy are key.

2. Which indicators are best for beginners?

For beginners, trend indicators like Moving Averages and MACD, along with momentum indicators like RSI, are most useful. They are easy to understand and help identify clear entry and exit points.

3. Are free stock chart platforms reliable?

Most free platforms provide accurate real-time data and reliable charts. TradingView, Yahoo Finance, and Investing.com are widely trusted. However, for high-frequency trading or advanced features, premium plans may be more suitable.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Leave A Comment

0 Comment