If you’re planning to buy a motorcycle, one of the essential costs to consider is how much is motorcycle insurance. The price varies based on multiple factors, including your location, bike type, and riding history. In this guide, we’ll break down the cost and help you understand what affects your insurance premium.

Factors That Affect Motorcycle Insurance Costs

- Your Location

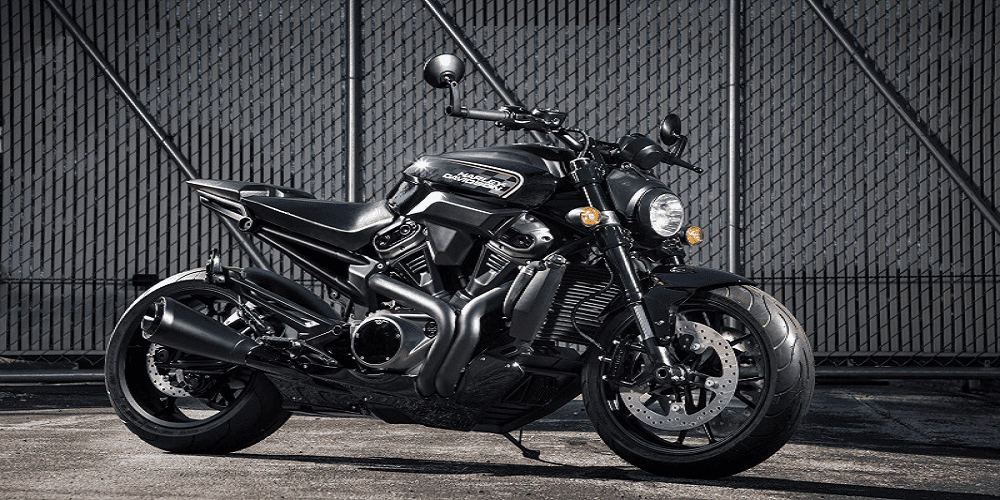

Insurance rates vary by state and city. Urban areas generally have higher premiums due to increased accident risks. - Type of Motorcycle

A high-performance sports bike will cost more to insure than a standard commuter bike. - Riding Experience & Driving History

New riders or those with a history of accidents may pay higher premiums. - Coverage Options

Comprehensive insurance costs more than basic liability coverage.

Average Cost of Motorcycle Insurance

On average, motorcycle insurance costs range from $200 to $500 per year for liability coverage and $600 to $2,000 per year for full coverage, depending on the factors mentioned above.

Tips to Lower Motorcycle Insurance Costs

- Take a motorcycle safety course.

- Choose a bike with a smaller engine.

- Maintain a clean driving record.

- Bundle your insurance with other policies.

FAQs

1. Can I get motorcycle insurance for a month?

Yes, some insurers offer short-term policies, but they might be expensive.

2. Does my credit score affect my motorcycle insurance?

Yes, in many states, a higher credit score can lower your premium.

3. Is motorcycle insurance cheaper than car insurance?

Generally, yes, but it depends on the bike and coverage type.

.jpg)

Leave A Comment

0 Comment