When it comes to protecting your family’s financial future, few tools are as effective and affordable as term insurance. If you're unfamiliar with the term or wondering what makes it so popular, this detailed guide will walk you through everything you need to know—from its basic definition to how it works, the benefits, features, and common questions people ask about it.

Let’s dive into the complete meaning and significance of term insurance.

What is Term Insurance?

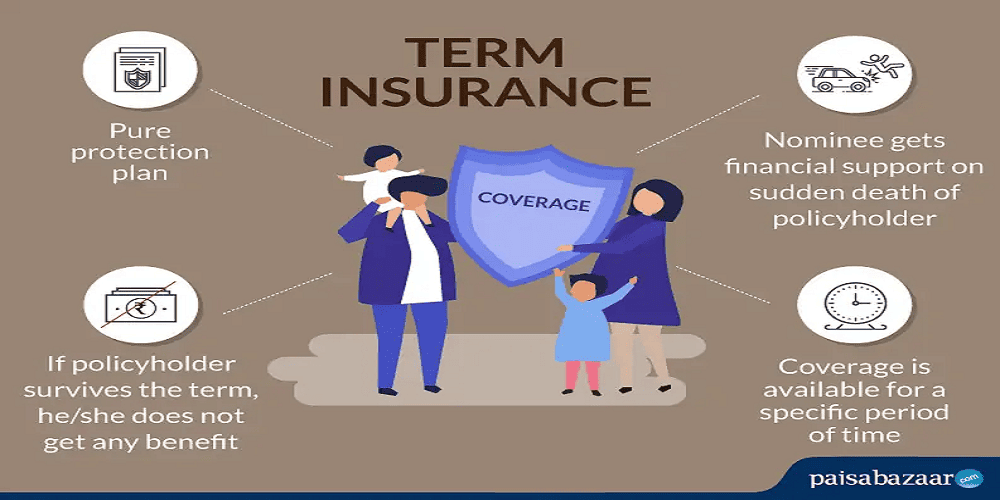

Term insurance is a type of life insurance policy that offers coverage for a specific period. If the policyholder dies during the policy term, the insurance company pays a pre-decided sum to the nominee. This amount is known as the death benefit.

However, if the person survives the term, no payout is made. That’s why term insurance is called “pure life cover.” It focuses solely on protection, not on returns or savings.

How Term Insurance Works

The concept is simple:

- You decide how long you want the coverage (for example, 10, 20, or 30 years).

- You choose how much coverage you need (the sum assured).

- You pay a regular premium (monthly, quarterly, or yearly).

- If you pass away within the term, your nominee gets the sum assured.

- If you survive the term, no payout is made unless you selected a return of premium plan.

Why Term Insurance Matters

Life is unpredictable. If something happens to the earning member of the family, the financial burden can fall heavily on the dependents. Term insurance ensures your loved ones are protected and can maintain their lifestyle even in your absence.

Key reasons why term insurance is important:

- Replaces lost income

- Helps pay off loans and debts

- Covers children’s education costs

- Provides peace of mind

- Supports long-term financial planning

Main Features of Term Insurance

Let’s look at some key features that define term insurance:

1. Fixed Term Coverage

You buy the policy for a fixed number of years. If you die during this period, your family gets the benefit.

2. Low Premiums

Among all life insurance products, term plans offer the most affordable premiums for large coverage amounts.

3. High Sum Assured

You can choose a very high coverage amount at a relatively low premium. This ensures your family gets adequate financial support.

4. No Maturity Benefit

If you survive the policy term, there is no payout—unless you opt for a specific type of plan that offers a return of premiums.

5. Tax Benefits

Premiums paid are eligible for deductions under Section 80C. The death benefit is also tax-free under Section 10(10D).

6. Rider Options

You can enhance your plan with optional riders like critical illness cover, accidental death benefit, and waiver of premium.

Types of Term Insurance Policies

There are various term insurance plans available to suit different life stages and financial goals:

Level Term Plan

The most basic form where the sum assured stays the same throughout the policy.

Increasing Term Plan

The sum assured increases each year to account for inflation and rising financial needs.

Decreasing Term Plan

Here, the sum assured reduces every year. Useful when you want to cover decreasing liabilities like home loans.

Return of Premium Plan

If you survive the policy term, all the premiums paid are returned to you.

Convertible Term Plan

Allows you to convert the term plan into a whole life or endowment plan later, without undergoing medical tests again.

Term Plan with Riders

These are plans that come with additional protective covers like critical illness, disability, or accidental death.

Who Should Buy Term Insurance?

Term insurance is suitable for anyone who has dependents or financial responsibilities. Some examples include:

- Young individuals who have just started working

- Married couples with children

- People with home loans or car loans

- Parents planning for their children’s future

- Business owners or self-employed individuals

If your absence would create financial problems for your family, you need term insurance.

When Should You Buy Term Insurance?

The earlier you buy, the better. Premiums are lower when you are young and healthy. Delaying purchase can lead to:

- Higher premiums

- Difficulty in getting coverage due to health issues

- Limited plan options

It’s ideal to buy term insurance in your 20s or early 30s when the premium is the lowest.

How Much Term Insurance Coverage Do You Need?

A common rule of thumb is to have coverage that’s 15 to 20 times your annual income. But you should also consider:

- Existing loans

- Family expenses

- Children’s education

- Healthcare costs

- Inflation

Use online term insurance calculators to estimate the right coverage based on your needs.

Benefits of Term Insurance

1. Financial Protection for Family

The biggest advantage is that your family won’t face financial hardship if you’re not around.

2. Affordable Premiums

Compared to other life insurance products, term plans are significantly cheaper.

3. Customizable Coverage

You can add riders to cover more risks, such as critical illness, accidental death, or disability.

4. Simple to Understand

Unlike complex insurance plans with investments, term insurance is easy to understand and manage.

5. Tax Savings

You can claim deductions for premiums paid and also enjoy tax-free death benefits.

Factors That Affect Term Insurance Premium

Several things impact how much you pay for a term plan:

- Age: Younger applicants pay lower premiums.

- Gender: Premiums are usually lower for women.

- Health: Pre-existing conditions can increase premiums.

- Smoking/Tobacco: Smokers pay higher premiums.

- Coverage Amount: Higher coverage means higher premium.

- Policy Term: Longer terms may increase the premium.

Steps to Buy Term Insurance

Here’s how to get started:

- Assess Your Needs: Decide on the sum assured and policy duration.

- Compare Plans: Use online tools to compare different policies and premiums.

- Fill Out the Proposal Form: Provide accurate personal and health details.

- Medical Check-up: Some insurers may require a health check-up.

- Pay the Premium: Choose your payment mode and make the first premium payment.

- Get the Policy: If approved, you’ll receive the policy document digitally or by post.

Digital Term Insurance

Today, buying term insurance online is easy, quick, and convenient. Some benefits of online plans include:

- Lower premiums due to fewer overheads

- Instant policy issuance

- Easy comparison of features and prices

- No need for agents or physical visits

Most insurers have user-friendly websites or mobile apps for the entire process—from buying to claim settlement.

Common Mistakes to Avoid

While buying term insurance, steer clear of these common errors:

1. Buying Low Coverage

Trying to save on premium by choosing low coverage can leave your family underinsured.

2. Hiding Health Details

Not disclosing medical history or smoking habits may lead to claim rejection later.

3. Delaying Purchase

Postponing the decision only increases your cost and may limit your choices.

4. Not Reviewing the Plan

As your income and responsibilities grow, you may need to increase your coverage.

5. Ignoring Claim Settlement Ratio

Always check the insurer’s track record in settling claims before purchasing.

Claim Settlement Process

In case of the policyholder’s death, the nominee needs to:

- Inform the Insurer: Submit the claim intimation at the earliest.

- Submit Documents: Death certificate, ID proof, policy document, and other required papers.

- Verification: The insurer will verify all the information.

- Claim Disbursement: If everything is in order, the claim will be paid to the nominee.

Most insurers today settle claims within a few weeks if all documents are submitted properly.

Difference Between Term Insurance and Other Life Insurance Plans

Term insurance focuses purely on protection. Other life insurance plans like endowment, whole life, and ULIPs have an investment or savings element.

Here’s how they differ:

- Term Insurance: Pure protection, no savings, affordable premium

- Endowment Plan: Protection + guaranteed savings, higher premium

- ULIP: Protection + market-linked investment, risk of returns

If your goal is just to protect your family financially, term insurance is the best choice.

Frequently Asked Questions (FAQs)

Q1. What does term insurance mean?

Term insurance is a type of life insurance that offers financial protection to your family if you pass away during the policy term.

Q2. Is term insurance better than other insurance plans?

If your primary goal is life cover at a low cost, term insurance is the best option. Other plans are costlier due to investment components.

Q3. Can I get money back with term insurance?

Not usually. But if you choose a return of premium plan, the premiums you paid will be refunded if you survive the term.

Q4. Do I need medical tests to buy term insurance?

Many insurers require medical tests for higher coverage or older applicants. For low coverage or young buyers, some plans skip this step.

Q5. Is the premium fixed for the entire term?

Yes, once the policy is issued, the premium stays fixed throughout the policy term.

Q6. What happens if I stop paying the premium?

The policy will lapse after the grace period, and your coverage will end. You may have to restart the process or pay a penalty to reinstate it.

Q7. Can I increase the coverage later?

Some insurers allow increasing your coverage during major life events like marriage, childbirth, or home purchase.

Q8. Is the claim amount taxable?

No, the death benefit received by the nominee is tax-free under Section 10(10D).

Q9. How long should the term be?

Ideally, the policy term should cover you till your retirement age or until your major financial responsibilities are over.

Q10. Can NRIs buy term insurance in India?

Yes, most Indian insurers allow NRIs to purchase term plans, although they may need to complete certain documentation and health checks.

Conclusion

Term insurance is one of the most important tools in your financial planning journey. It offers unmatched benefits at an affordable cost. Though it doesn’t offer survival returns, the peace of mind and protection it provides are priceless.

Understanding the term insurance meaning is your first step toward protecting what matters most—your loved ones. Don’t wait for the perfect time. The right time to buy term insurance is now.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Leave A Comment

0 Comment