When it comes to investing in Initial Public Offerings (IPOs), retail and institutional investors in India often look at the Grey Market Premium (GMP) as an indicator of potential listing performance. One IPO that grabbed a lot of attention was the Star Health and Allied Insurance IPO, backed by Rakesh Jhunjhunwala and other marquee investors.

The IPO attracted interest not only because it was one of the largest in the insurance sector but also due to the company’s unique position in the standalone health insurance market. In this comprehensive guide, we will explore everything about Star Health Insurance IPO GMP, its background, company fundamentals, grey market activity, investor sentiments, and what lessons can be drawn for future IPO investors.

Introduction to Star Health Insurance

Founded in 2006, Star Health and Allied Insurance Company Limited is one of India’s largest standalone health insurance providers. Unlike general insurance companies that cover a wide range of products such as motor, fire, and travel insurance, Star Health focuses primarily on health insurance policies. This specialization allowed it to capture a strong market share and build trust among customers.

Some key highlights of Star Health include:

- India’s largest standalone health insurer by gross written premium.

- A wide distribution network with agents, brokers, and digital channels.

- Strong backing from investors like Rakesh Jhunjhunwala, Safecrop Investments, and WestBridge Capital.

- More than 12,000 employees and a presence in over 500 locations across the country.

With the increasing importance of health insurance in India, particularly post-COVID-19, Star Health was seen as a strong contender to tap the capital markets.

What is IPO GMP?

Before diving deeper into Star Health’s IPO, let’s clarify the concept of IPO Grey Market Premium (GMP).

The Grey Market is an unofficial market where IPO shares are traded before they are officially listed on the stock exchanges. The GMP represents the premium at which IPO shares are being traded in this grey market. For example, if the issue price of an IPO is ₹500 and the grey market price is ₹550, the GMP is ₹50.

Investors and analysts often track GMP to gauge demand and market sentiment for a company’s shares. However, it is important to note that GMP is not an official indicator and can fluctuate significantly before the listing date.

Star Health Insurance IPO – Overview

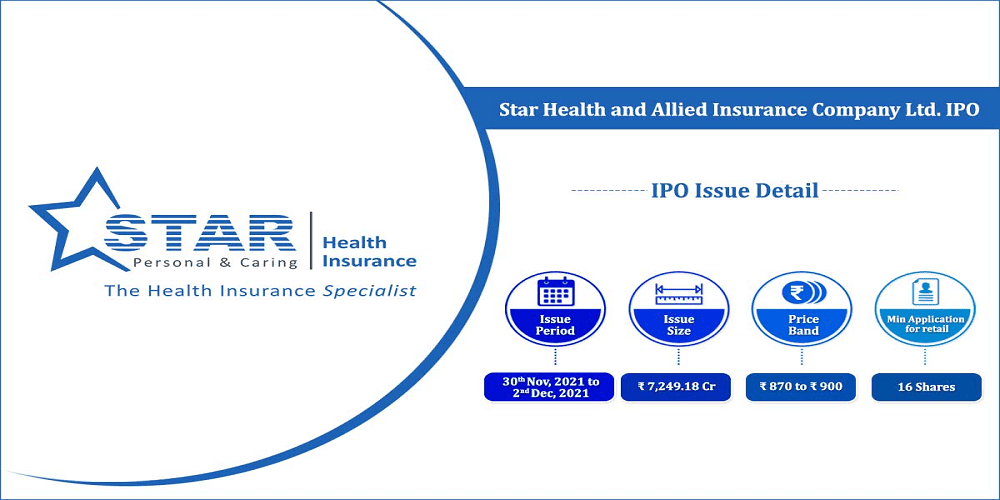

The Star Health IPO was launched in November 2021. Here are some quick details:

- IPO Size: Around ₹7,249 crore

- Price Band: ₹870 to ₹900 per share

- Issue Type: Book Built Issue

- Face Value: ₹10 per share

- Market Lot: 16 shares

The IPO consisted of a fresh issue of ₹2,000 crore and an offer for sale (OFS) worth ₹5,249 crore by existing shareholders. The objective of the issue was to augment the company’s capital base and maintain solvency margins, apart from providing an exit opportunity to some investors.

GMP Trends for Star Health Insurance IPO

The grey market activity around Star Health’s IPO was closely watched. Typically, a strong GMP indicates robust demand and expectations of listing gains. However, in the case of Star Health, the GMP fluctuated significantly.

Initially, when the IPO opened, there was optimism due to the company’s strong market position and the involvement of big investors like Rakesh Jhunjhunwala. Analysts expected the IPO to see good demand. However, as the subscription numbers came in, enthusiasm started to wane.

Reports suggested that the GMP for Star Health IPO was weak, with trading indicating little to no premium over the issue price. In some cases, it was even at a discount, signaling muted demand in the grey market.

Reasons Behind Weak GMP

Several factors contributed to the weak GMP for Star Health’s IPO:

1. High Valuation

The IPO was priced at a Price-to-Earnings (P/E) ratio that many analysts felt was on the higher side compared to peers in the insurance industry. This deterred value-conscious investors.

2. Market Conditions

At the time of the IPO, Indian equity markets were experiencing volatility due to global cues, inflation concerns, and policy uncertainties. Weak market sentiment directly impacted investor appetite.

3. Underwhelming Subscription

While IPOs of popular companies are often oversubscribed multiple times, Star Health’s IPO saw a tepid response. Retail and institutional participation was lower than expected, signaling a lack of enthusiasm.

4. Competition and Profitability Concerns

Though Star Health was a leader in standalone health insurance, concerns were raised about competition from general insurers and long-term profitability challenges in the highly regulated health insurance sector.

Star Health IPO Subscription Details

The IPO opened for subscription from November 30, 2021 to December 2, 2021. Unlike other big IPOs that often witness strong oversubscription, Star Health’s issue was subscribed only 79% overall.

Breakdown of subscriptions:

- Qualified Institutional Buyers (QIBs): Subscribed 1.03 times

- Non-Institutional Investors (NIIs): Subscribed 0.19 times

- Retail Individual Investors (RIIs): Subscribed 1.10 times

This under-subscription was one of the primary reasons why the GMP remained weak.

Listing Day Performance

On December 10, 2021, Star Health Insurance made its debut on the stock exchanges. The IPO price was ₹900 per share, but the listing price was significantly lower at around ₹848.90 on NSE, marking a discount of nearly 6%.

This confirmed what the GMP had been signaling: muted demand and no major listing gains. The listing was disappointing for investors who were hoping for a strong debut.

Lessons for Investors from Star Health IPO GMP

The story of Star Health’s IPO provides important takeaways for retail and institutional investors:

- Do Not Rely Solely on GMP – Grey market activity can provide insights into sentiment but should never be the only deciding factor. Official fundamentals must always take precedence.

- Analyze Valuation Carefully – Even companies with strong brands can fail to attract investors if their valuations are perceived as too expensive.

- Market Conditions Matter – IPO performance is heavily influenced by overall stock market sentiment. Launching during volatile periods can affect demand.

- Subscription Trends are Important – Tracking institutional investor participation often gives clues about how the IPO may perform post-listing.

- Long-Term Perspective is Crucial – While IPO listing gains attract attention, the real value lies in holding fundamentally strong companies for the long term.

Star Health Performance Post-IPO

After the initial listing, Star Health Insurance shares continued to experience volatility. Over time, however, the company stabilized as it continued to grow in the health insurance sector.

Long-term investors who stayed put recognized the underlying strength of the business model, driven by:

- Increasing awareness of health insurance post-pandemic.

- Strong distribution network with more than 5 lakh agents.

- A diversified product portfolio catering to individuals, families, and corporate clients.

- The trust factor associated with Rakesh Jhunjhunwala’s investment.

Though the IPO journey began with weak GMP and disappointing listing, Star Health remained a relevant player in the insurance sector.

Factors That Can Influence IPO GMP in Future

To understand IPO GMP movements better, here are some factors that influence it:

- Subscription Demand – Higher subscription numbers generally lead to higher GMP.

- Valuation Gap – If investors believe the issue is priced attractively compared to peers, GMP tends to rise.

- Anchor Investor Participation – Strong participation from reputed anchor investors boosts confidence.

- Market Mood – Bullish market phases usually lead to higher GMPs across IPOs.

- Sectoral Outlook – Companies in high-growth sectors like fintech, digital, and EVs often see higher GMP than traditional businesses.

Why Investors Still Watch GMP Closely

Despite being unofficial and unregulated, GMP remains popular because it provides a real-time sense of demand and supply before the official listing. For retail investors, it acts as an additional data point, though experts caution against overreliance.

In the case of Star Health, the weak GMP accurately predicted the lackluster listing, but it also discouraged some investors from applying, even though the company had strong fundamentals for the long run.

Conclusion

The Star Health Insurance IPO GMP highlighted how grey market trends can sometimes serve as a reflection of broader investor sentiment. The IPO’s high valuation, weak subscription, and volatile markets resulted in subdued GMP and eventual listing at a discount.

However, the long-term growth story of Star Health as India’s leading standalone health insurer remains intact. Investors must remember that IPO GMP is just one part of the puzzle. A balanced approach that combines grey market indicators, company fundamentals, sector outlook, and valuation is the best way to make informed investment decisions.

For those analyzing IPOs in the future, the Star Health case serves as a reminder to avoid chasing short-term listing gains blindly and instead focus on sustainable long-term wealth creation.

FAQs on Star Health Insurance IPO GMP

Q1. What was the GMP of Star Health Insurance IPO?

The GMP for Star Health Insurance IPO was weak and in some instances traded at a discount, indicating muted demand in the grey market.

Q2. Why did Star Health IPO GMP remain low?

The GMP remained low due to high valuations, weak subscription demand, market volatility, and concerns about competition in the insurance sector.

Q3. How did Star Health Insurance IPO perform on listing day?

Star Health shares listed at around ₹848.90 against the issue price of ₹900, marking a discount of nearly 6%.

Q4. Should investors rely on GMP while applying for IPOs?

No, GMP should only be used as an indicator of market sentiment. Investors should primarily evaluate fundamentals, valuations, and long-term prospects.

Q5. What lessons can be learned from the Star Health IPO GMP?

The key lessons include not relying solely on GMP, understanding valuations, tracking subscription demand, and focusing on long-term investment potential instead of short-term listing gains.

Q6. Is Star Health Insurance still a good company to invest in?

Yes, despite a weak IPO debut, Star Health remains a market leader in standalone health insurance, backed by strong fundamentals and rising demand for health coverage in India.

.jpg)

.png)

.jpg)

.jpg)

Leave A Comment

0 Comment