Life is full of uncertainties, and planning for the future often means thinking about how to protect your loved ones financially. One of the most effective ways to do this is through life insurance. While term life insurance is popular for its affordability and temporary coverage, a permanent life insurance policy offers lifelong protection along with the added advantage of building cash value over time.

If you’re considering permanent life insurance, you might feel overwhelmed by the choices, terminology, and features. This detailed guide will help you understand what permanent life insurance policies are, how they work, their benefits, drawbacks, and whether they are right for you.

What Is a Permanent Life Insurance Policy?

A permanent life insurance policy is a type of life insurance that provides coverage for the entire lifetime of the insured, as long as the premiums are paid. Unlike term life insurance, which lasts for a specific number of years (e.g., 10, 20, or 30 years), permanent life insurance does not expire. It ensures that whenever the insured passes away, the beneficiaries receive a death benefit.

Additionally, permanent life insurance includes a savings component called cash value. A portion of your premium goes into building this cash value, which grows over time on a tax-deferred basis. This cash value can be borrowed against, withdrawn, or even used to pay premiums.

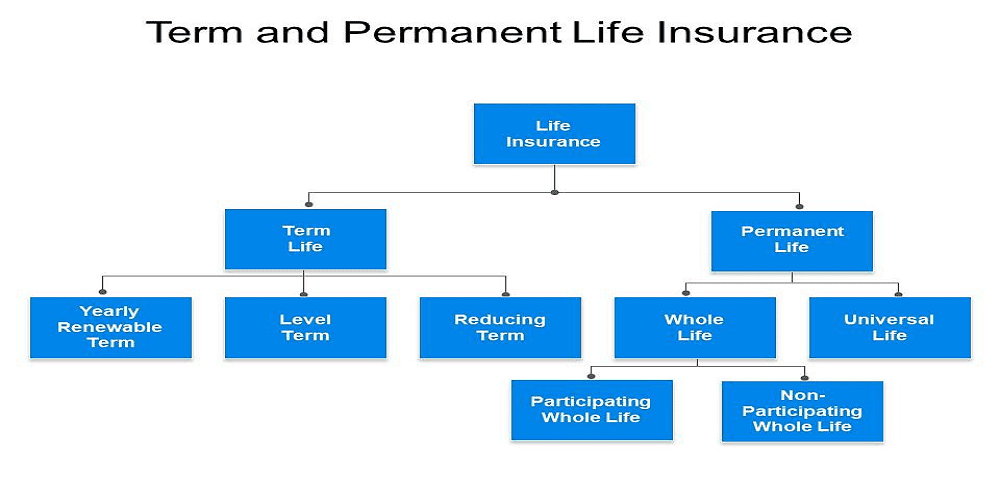

Types of Permanent Life Insurance Policies

Not all permanent life insurance policies are the same. There are several types, each with its own features and benefits.

1. Whole Life Insurance

Whole life insurance is the most traditional form of permanent life insurance. It offers:

- Guaranteed death benefit.

- Fixed premiums that never increase.

- Cash value growth at a guaranteed rate.

It’s often viewed as a stable, predictable option for individuals who want lifelong coverage with minimal complexity.

2. Universal Life Insurance

Universal life insurance offers more flexibility than whole life. Policyholders can adjust their premiums and death benefits within certain limits. Its cash value grows based on interest rates or market indexes, depending on the policy type.

3. Variable Life Insurance

Variable life insurance allows you to invest the cash value in sub-accounts similar to mutual funds. This means your cash value and death benefit can grow significantly, but they are also subject to market risks.

4. Indexed Universal Life Insurance (IUL)

IUL policies link the cash value growth to a stock market index, such as the S&P 500. They typically offer a guaranteed minimum interest rate, protecting you from total loss, while still allowing some growth potential.

5. Variable Universal Life Insurance (VUL)

This combines the flexible features of universal life with the investment opportunities of variable life. It carries higher risks but can also provide higher rewards if your investments perform well.

How Does a Permanent Life Insurance Policy Work?

A permanent life insurance policy functions in two main ways:

- Death Benefit Protection

The primary purpose of life insurance is to provide financial support to your beneficiaries upon your death. Permanent life insurance guarantees a payout regardless of when you pass away, as long as the policy is active. - Cash Value Accumulation

A portion of your premiums is allocated toward building cash value. Over time, this cash value grows, often at a guaranteed or market-linked rate. You can use this cash value in several ways:

- Borrow against it through policy loans.

- Withdraw a portion for expenses.

- Use it to cover premiums if needed.

It’s important to remember that loans or withdrawals can reduce the death benefit if not repaid.

Benefits of Permanent Life Insurance

Permanent life insurance offers unique advantages that term policies cannot match.

1. Lifetime Coverage

You never have to worry about coverage expiring as long as premiums are paid. This makes permanent life insurance especially valuable for those who want long-term financial protection.

2. Cash Value Growth

The cash value acts as a financial safety net. It can be tapped into for emergencies, retirement, education expenses, or other financial needs.

3. Fixed Premiums (Whole Life)

With whole life insurance, your premiums remain level throughout the policy’s duration, which provides stability in long-term financial planning.

4. Estate Planning Tool

Permanent life insurance is often used in estate planning to transfer wealth, cover estate taxes, or leave a guaranteed inheritance.

5. Tax Advantages

- Death benefits are typically tax-free for beneficiaries.

- Cash value grows on a tax-deferred basis.

- Policy loans are generally not taxable.

Drawbacks of Permanent Life Insurance

While permanent life insurance has many benefits, it also comes with some disadvantages.

1. Higher Premiums

Permanent life insurance is significantly more expensive than term life insurance. This is because of the lifetime coverage and cash value component.

2. Complexity

Some types of permanent life insurance, such as variable or universal policies, can be complex and require ongoing management.

3. Lower Returns

The cash value growth in whole life policies is conservative compared to other investments like stocks or mutual funds.

4. Reduced Death Benefit (if loans aren’t repaid)

Borrowing against the cash value can reduce the death benefit if the loan isn’t repaid in full.

Who Should Consider a Permanent Life Insurance Policy?

A permanent life insurance policy isn’t right for everyone. It tends to be more suitable for individuals with specific financial goals.

- High-income earners looking for tax-advantaged savings and wealth transfer.

- People with lifelong dependents, such as children with special needs, who require guaranteed lifelong coverage.

- Individuals focused on estate planning and wealth preservation.

- Those who want to combine insurance with investment and are willing to pay higher premiums for these benefits.

If you only need temporary coverage (e.g., until children are grown or a mortgage is paid off), a term life insurance policy might be more cost-effective.

Permanent Life Insurance vs. Term Life Insurance

Many people struggle to decide between permanent and term life insurance. Here’s how they differ conceptually:

- Coverage Period: Term is temporary; permanent is lifelong.

- Cost: Term is cheaper; permanent is more expensive.

- Cash Value: Term has none; permanent builds savings.

- Flexibility: Permanent can allow loans, withdrawals, and investment options.

The right choice depends on your budget, goals, and how long you want coverage.

How to Choose the Right Permanent Life Insurance Policy

When selecting a permanent life insurance policy, consider the following factors:

- Budget: Can you afford higher premiums over the long term?

- Goals: Do you want guaranteed stability (whole life) or growth potential (variable or indexed universal life)?

- Risk Tolerance: Are you comfortable with investment risks in exchange for potentially higher returns?

- Flexibility: Do you want the ability to adjust premiums and death benefits?

- Company Reputation: Choose a reputable insurer with strong financial ratings.

It may also help to consult a financial advisor or insurance professional to align the policy with your overall financial plan.

The Role of Cash Value in Financial Planning

One of the most attractive features of permanent life insurance is its cash value. Beyond serving as a financial backup, it can play a key role in your financial strategy.

- Retirement Supplement: You can use cash value to supplement retirement income.

- Emergency Fund: Access funds without going through banks or credit checks.

- Education Funding: Borrow against it to pay for children’s college expenses.

- Debt Management: Use it strategically for major expenses.

However, withdrawals and loans should be carefully managed to avoid diminishing your policy’s benefits.

Common Misconceptions About Permanent Life Insurance

- “It’s the best investment.”

Permanent life insurance is not primarily an investment. It’s first and foremost insurance with a savings feature. - “Cash value grows quickly.”

In reality, cash value grows slowly in the initial years, and significant accumulation may take decades. - “Everyone needs permanent life insurance.”

Not true. For many families, term life insurance is sufficient and more affordable. - “You lose money if you don’t use the cash value.”

Even if you don’t use the cash value, your beneficiaries still receive the death benefit, making the policy valuable.

Steps to Buy a Permanent Life Insurance Policy

- Assess Your Needs

Understand why you need permanent coverage—estate planning, lifelong dependents, or wealth building. - Compare Policy Types

Decide between whole life, universal life, variable life, or indexed options. - Get Quotes

Compare premium rates, benefits, and features from multiple insurers. - Review Financial Strength

Check insurer ratings from agencies like A.M. Best or Moody’s. - Consult a Professional

A financial advisor can explain complex policies and help you select the most suitable one.

FAQs About Permanent Life Insurance Policy

Q1. What is the main difference between term life and permanent life insurance?

Term life insurance provides coverage for a specific period, while permanent life insurance offers lifetime coverage with a cash value component.

Q2. Can I borrow money from my permanent life insurance policy?

Yes, you can borrow against the cash value of your policy. However, unpaid loans reduce the death benefit.

Q3. Is permanent life insurance worth the higher cost?

It depends on your financial goals. If you want lifelong coverage and the benefits of cash value, it may be worth it. If you only need temporary coverage, term life may be better.

Q4. How long does it take for cash value to build up?

Cash value typically takes several years to accumulate significantly. Growth is slow in the early years but increases over time.

Q5. Can I switch from a term life insurance policy to a permanent policy?

Yes, many insurers offer conversion options that allow you to switch from term to permanent coverage without undergoing another medical exam.

Final Thoughts

A permanent life insurance policy is more than just protection—it’s a financial tool that can help you build wealth, provide peace of mind, and ensure your loved ones are financially secure no matter when you pass away. While it comes with higher costs and complexities, its lifelong benefits and cash value component make it an attractive option for many people, especially those with long-term financial goals.

Before making a decision, carefully consider your needs, budget, and long-term plans. Permanent life insurance can be an excellent addition to a well-rounded financial strategy when chosen wisely.

.jpg)

.png)

.jpg)

.jpg)

Leave A Comment

0 Comment