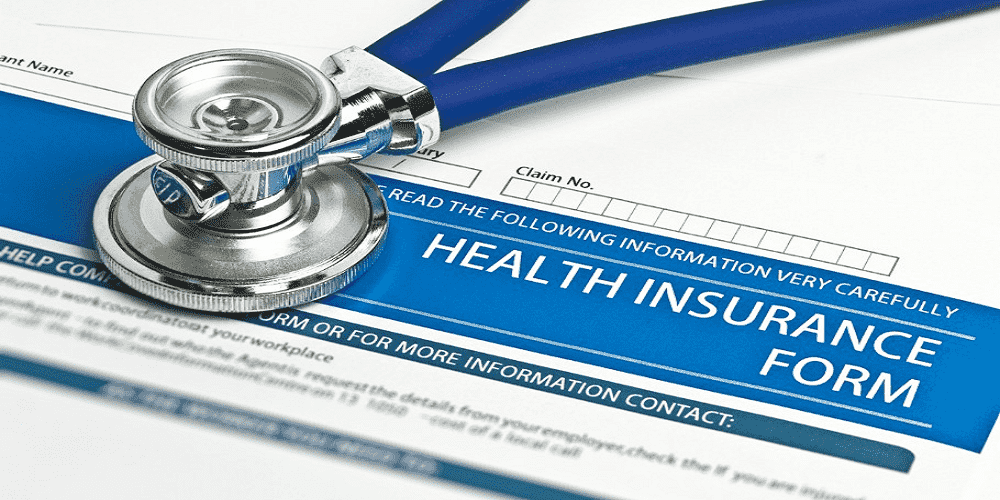

Navigating health insurance options can be daunting, but comparing plans online makes it easier than ever. Here’s a guide on how to compare health insurance plans online effectively.

Identify Your Healthcare Needs

Before diving into comparisons, assess your healthcare needs. Consider factors like frequency of doctor visits, prescription medications, and any ongoing treatments. Understanding these needs will help you find plans that fit well.

Use Comparison Websites

Utilize reputable comparison websites that aggregate various health insurance plans. These platforms allow you to filter options based on coverage types, premiums, deductibles, and provider networks, making it easier to find suitable choices.

Check the Provider Network

When comparing health insurance plans online, pay close attention to the provider network associated with each plan. Ensure that your preferred doctors and hospitals are included in the network to avoid unexpected out-of-pocket costs.

Evaluate Coverage Options

Different plans offer varying levels of coverage. Look closely at what each plan covers—such as preventive care, specialist visits, and emergency services—and ensure it aligns with your healthcare needs.

Consider Costs Beyond Premiums

While premiums are important, consider other costs like deductibles, copayments, and out-of-pocket maximums when comparing plans. A plan with a lower premium might have higher out-of-pocket costs that could outweigh initial savings.

Read Reviews and Ratings

Research reviews and ratings of health insurance providers to gauge customer satisfaction and claims processing efficiency. This information can provide insight into how well a company handles its policyholders' needs.

Look for Additional Benefits

Some health insurance plans offer additional perks such as wellness programs, telehealth services, or discounts on gym memberships. These benefits can add value beyond standard coverage and contribute to overall well-being.

Seek Assistance if Needed

If you're feeling overwhelmed by the options available while trying to compare health insurance plans online, consider seeking assistance from an insurance broker or advisor who can provide personalized guidance based on your situation.

Conclusion

By following these steps on how to compare health insurance plans online, you can make informed decisions that best suit your healthcare needs and budget. Take the time to research thoroughly and choose wisely for optimal health coverage.

.jpg)

.png)

.jpg)

.jpg)

Leave A Comment

0 Comment