A term insurance plan with return of premium has become one of the most preferred life insurance options among modern buyers. It promises the essential benefit of financial protection for your family, along with the assurance of receiving all premiums back if you survive the policy tenure. This unique blend of risk coverage and savings makes it appealing for people who want security without losing their hard-earned money. In this comprehensive guide, we will explore what a term insurance plan with return of premium truly means, why it is gaining popularity, its features, benefits, eligibility, riders, buying tips, and much more. Whether you are a first-time insurance buyer or someone comparing different life insurance options, this in-depth article will help you make a confident decision.

What Is a Term Insurance Plan With Return of Premium?

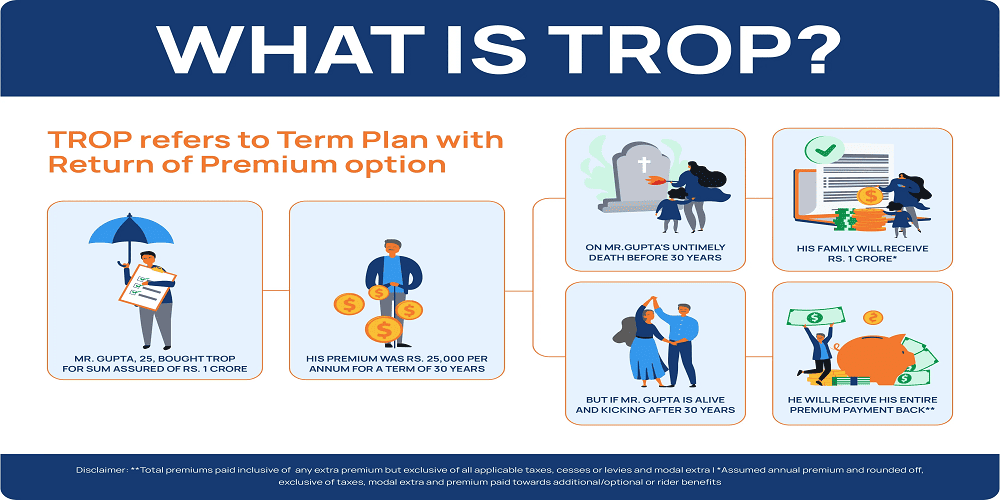

A term insurance plan with return of premium, commonly known as TROP, is a special type of term life insurance policy where the policyholder receives back all the premiums paid during the policy period if they survive the entire tenure. While a regular term plan only provides a death benefit and does not offer any maturity payout, TROP ensures that the premiums are refunded, making it a low-risk and value-adding product for individuals who want protection alongside savings.

With TROP, you enjoy two major advantages. First, your family stays secure with a substantial life cover in case of an unexpected event. Second, if you outlive the policy period, the insurance company refunds all premiums paid, excluding certain charges like GST or rider premiums. This makes the plan ideal for people who hesitate to buy a simple term plan because they worry that they might not get anything back.

How Does a Term Insurance Plan With Return of Premium Work?

Understanding how a TROP works is simple. When you buy the plan, you choose sum assured, policy period, and premium payment mode. You pay the premiums regularly, yearly, half-yearly, quarterly, or monthly, based on your preference. If something unfortunate happens to you during the policy period, your nominee receives the death benefit, which is the sum assured. However, if you survive the tenure, instead of the plan ending without any returns, the insurer refunds all the premiums that you paid during the policy period. This return acts as a financial reward for maintaining long-term coverage.

For example, if your policy premium is 20,000 per year for 30 years, and you survive the period, the insurance company refunds around 6,00,000 (excluding taxes). This amount can act as a savings corpus for post-retirement or future needs.

Why Should You Consider a Term Insurance Plan With Return of Premium?

A term insurance plan with return of premium bridges the gap between traditional term plans and savings plans. People who find it hard to accept that they will not receive any money from a regular term policy love the concept of premium return. It allows you to enjoy peace of mind knowing that your family is protected and your money is safe.

The return of premium feature makes the plan suitable for those who prefer guaranteed returns. Unlike market-linked investments, the maturity benefit under TROP is assured. Therefore, it is a good option for individuals looking for a safe financial product that offers both protection and savings.

Benefits of Term Insurance Plan With Return of Premium

1. Dual Benefit of Protection and Savings

The first and most significant benefit of a TROP is the dual advantage it offers. You get comprehensive financial protection for your family in case of your untimely demise. However, if you survive the policy period, you receive your entire premium back. This ensures your money does not go to waste.

2. Guaranteed Maturity Benefits

One of the biggest attractions of TROP is its guaranteed maturity benefit. Unlike market-linked policies, the returns are fixed and risk-free. This makes it ideal for risk-averse individuals.

3. Financial Protection for Family

A term insurance plan ensures that your family will not face financial hardship in your absence. Your nominee receives a tax-free lump sum amount, which can be used to maintain lifestyle, manage debts, pay for future expenses like children’s education, and more.

4. Tax Benefits

Term insurance plans with return of premium offer tax benefits under prevailing tax laws. Premiums paid may be eligible for deduction under Section 80C, and the maturity benefit received is generally exempt under Section 10(10D) subject to certain conditions.

5. Peace of Mind

Knowing that your loved ones will remain financially secure while you get your money back at maturity provides immense peace of mind. This emotional benefit cannot be overstated, especially for primary earners.

6. Encourages Long-Term Financial Discipline

TROP is designed as a long-term commitment, encouraging individuals to maintain regular premium payments. This discipline helps build financial stability and long-term planning habits.

7. Option of Riders

You can enhance your policy with riders such as accidental death benefits, critical illness cover, premium waiver benefits, and more. This makes your policy more comprehensive.

Features of Term Insurance Plan With Return of Premium

1. Return of Total Premiums Paid

All basic premiums paid are returned at policy maturity, making it a no-loss insurance plan.

2. Flexible Premium Payment Options

You can choose from regular pay, limited pay, or single premium options depending on your cash flow.

3. Various Policy Tenures

TROP policies come with a wide range of policy terms such as 10, 20, 30, or 40 years. You can pick a duration that aligns with your financial goals.

4. High Sum Assured at Affordable Premiums

Even though a TROP costs more than a regular term plan, it still provides a high sum assured relative to the premium.

5. Survival and Death Benefits

Your family gets the sum assured if you die during the tenure. If you survive, you get your money back.

6. Loan Facilities

Some TROP plans may provide the option to avail a loan against the policy, depending on terms and conditions.

Who Should Buy a Term Insurance Plan With Return of Premium?

A TROP is ideal for the following individuals:

1. People Who Want the Security of Getting Money Back

If you are someone who dislikes the idea of losing money on a pure protection plan, TROP is for you.

2. Risk-Averse Individuals

Those who prefer guaranteed returns and avoid market-linked products should consider this plan.

3. First-Time Insurance Buyers

New buyers often hesitate to buy regular term insurance. TROP is a perfect starting point as it offers both protection and savings.

4. People Who Want Long-Term Commitment

If you want a systematic way to secure your future while building savings, TROP works well.

5. Family-Oriented Individuals

People with dependents find TROP especially helpful because it ensures two layers of security: life cover and survival benefit.

Return of Premium vs Regular Term Plan

A regular term plan offers the same life protection as TROP at a significantly lower premium, but does not provide maturity benefits. TROP, on the other hand, returns your entire premium amount if you survive. This key difference makes many buyers choose TROP over a normal term plan. However, the premium for TROP is typically higher, often 2 to 3 times that of a pure term plan. So the decision depends on your risk profile, financial planning, and preference for returns.

Cost of Term Insurance Plan With Return of Premium

A key factor to understand is that TROP premiums are higher. The premium difference exists because the insurer needs to return your investment at the end of the tenure. However, the peace of mind and assured maturity benefits justify the higher cost for many individuals.

To decide whether the premium is worth it, evaluate your financial goals. If guaranteed returns matter more than low premiums, TROP is the right choice.

How to Choose the Right Term Insurance Plan With Return of Premium

Choosing the best TROP can be confusing due to the number of options in the market. Here are essential points to consider:

1. Claim Settlement Ratio

Choose an insurer with a high claim settlement ratio. This ensures your family will not face issues in claim processing.

2. Premium Amount

Compare the premium across insurers. A higher premium does not always mean better benefits.

3. Maturity Benefits

Understand how much you will receive at maturity. Some policies may exclude certain charges.

4. Riders

Check available riders and choose the ones that suit your needs.

5. Policy Term

Select a term that aligns with your financial goals or the age until you want coverage.

6. Flexibility in Payment

Choose a plan offering multiple premium payment options such as limited pay or regular pay.

7. Reviews and Ratings

Read customer reviews and check industry ratings before buying.

Riders Available With Term Insurance Plan With Return of Premium

While riders vary by insurer, the most common ones include:

1. Accidental Death Rider

Provides an additional payout if the policyholder dies due to an accident.

2. Critical Illness Rider

Offers financial support in case the policyholder is diagnosed with a covered critical illness.

3. Premium Waiver Rider

Ensures future premiums are waived off in case of disability or critical illness.

4. Accidental Disability Rider

Provides compensation if the policyholder suffers a permanent disability due to an accident.

Adding these riders enhances your coverage and provides a comprehensive shield against multiple risks.

Eligibility Criteria

Eligibility differs slightly across insurance companies, but generally includes:

- Minimum entry age between 18 to 21 years

- Maximum entry age around 55 to 60 years

- Maximum maturity age up to 75 or 85 years

- Medical evaluation may be required depending on age and health

Documents Required for TROP

When buying a TROP policy, you will typically need:

- Identity proof

- Address proof

- Income proof

- Medical reports

- Photographs

- Bank details

Why TROP Is Popular in India

Term insurance with return of premium is especially popular in India due to the preference for guaranteed returns. Many people hesitate to buy a term plan without returns, considering it an expense rather than an investment. TROP solves this concern and provides the best of both worlds: safety and returns. The maturity payout appeals to individuals who want to secure their family without losing their money.

Tips for Buying a TROP Policy

- Compare multiple insurers before finalising.

- Choose a longer tenure to get better coverage.

- Assess whether your financial goals align with the maturity returns.

- Ensure accurate medical and financial disclosure to avoid claim issues.

- Do not over-buy coverage; choose an affordable plan that meets your needs.

Common Misconceptions About TROP

Many believe that the premium refund is like earning interest. This is incorrect. The amount returned is simply the premium you paid, not an investment return. Another misconception is that TROP is better than a regular term plan in all situations. People with limited budgets may still benefit more from a standard term plan with lower premiums.

Conclusion

A term insurance plan with return of premium is an ideal solution for people seeking both protection and guaranteed returns. It is a perfect blend of security, savings, and mental peace. With TROP, you ensure that your family stays financially protected while you receive all your premiums back if you survive the policy tenure. This makes it a smart choice for individuals who do not want their money to go to waste and prefer assurance along with coverage.

By evaluating factors such as premium, claim settlement ratio, riders, policy terms, and financial goals, you can choose the right TROP plan that suits your requirements. It offers disciplined financial planning, long-term savings, and a solid foundation for your family's future.

FAQs

1. What is a term insurance plan with return of premium?

It is a type of term plan where you get your premiums back at maturity if you survive the policy period.

2. Is TROP better than regular term insurance?

TROP is suitable for people who want guaranteed returns, while regular term plans are more affordable but do not offer maturity benefits.

3. Are the premiums higher in TROP?

Yes, premiums for TROP are generally higher because the insurer refunds the premium amount at maturity.

4. Is the maturity benefit taxable?

Maturity benefits are generally exempt under Section 10(10D), subject to policy terms and tax rules.

5. Can I add riders to TROP?

Yes, most insurers offer riders such as critical illness, accidental death, and premium waiver riders.

6. What happens if I miss premium payments?

Missing payments may lead to policy lapse. Some insurers offer a grace period to make payments.

7. How much sum assured should I choose?

It depends on your income, liabilities, and family expenses. A general rule is 10 to 15 times your annual income.

8. Do I need medical tests for TROP?

Medical tests may be required depending on the age, health condition, and sum assured.

9. Can I surrender a TROP policy?

Some TROP policies may offer surrender value, but it is generally lower than premiums paid.

10. Who should buy a TROP plan?

Anyone who wants life protection along with guaranteed maturity benefits can consider buying a TROP.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Leave A Comment

0 Comment