Life is unpredictable, and ensuring your loved ones are financially protected is one of the most important decisions you can make. Life insurance provides peace of mind by covering expenses, debts, or even future financial needs when you are no longer around. But with so many companies offering different plans, riders, and benefits, choosing the best life insurance company can feel overwhelming.

This guide will walk you through everything you need to know about life insurance providers, factors that make a company reliable, types of policies, and a list of companies that are often considered among the top choices.

Why Choosing the Best Life Insurance Company Matters

Life insurance is not just another financial product—it’s a long-term contract where you trust a company to support your family when they need it most. Picking the wrong company could mean delayed claims, inadequate coverage, or expensive premiums. Here are a few reasons why choosing the right insurer matters:

- Financial Security for Your Family – The main reason to buy life insurance is to ensure your dependents are financially secure after your death.

- Claim Settlement Ratio – A good company processes claims efficiently, ensuring your family is not burdened with delays.

- Long-Term Trust – Since policies often last decades, you need an insurer with a strong reputation and financial stability.

- Affordable Premiums – Different companies offer varying rates; finding the right balance between cost and coverage is essential.

- Additional Benefits – The best life insurers provide riders such as critical illness cover, accidental death benefits, or waiver of premium options.

Factors to Consider Before Selecting a Life Insurance Company

When comparing life insurance companies, here are the key factors you should evaluate:

1. Financial Strength

Insurance is a promise for the future. To fulfill that promise, the company must have strong financial backing. Look for ratings from agencies like AM Best, Moody’s, or Standard & Poor’s.

2. Claim Settlement Ratio

This percentage shows how many claims an insurer approves compared to the number received. The higher the ratio, the better.

3. Customer Service

An insurer with a responsive support team can save your family time and stress during difficult moments.

4. Range of Products

The best companies offer term insurance, whole life insurance, universal life, and other options to suit different needs.

5. Premium Affordability

Premiums should fit your budget without compromising on the coverage amount.

6. Flexibility in Riders

Customizable riders such as disability income, critical illness, or accidental death can enhance the value of your policy.

Types of Life Insurance Policies

Before exploring the top companies, it’s important to understand the main types of life insurance they usually offer:

1. Term Life Insurance

The simplest and most affordable option. It provides coverage for a set period (10, 20, or 30 years). If you pass away during the term, your family receives the benefit.

2. Whole Life Insurance

Covers you for your entire life and builds cash value over time. Premiums are higher but fixed.

3. Universal Life Insurance

Offers lifetime coverage with flexible premiums and investment opportunities.

4. Variable Life Insurance

Combines life insurance with investment funds. The cash value can grow depending on market performance.

5. Final Expense Insurance

A smaller coverage plan designed to pay for funeral costs and minor debts.

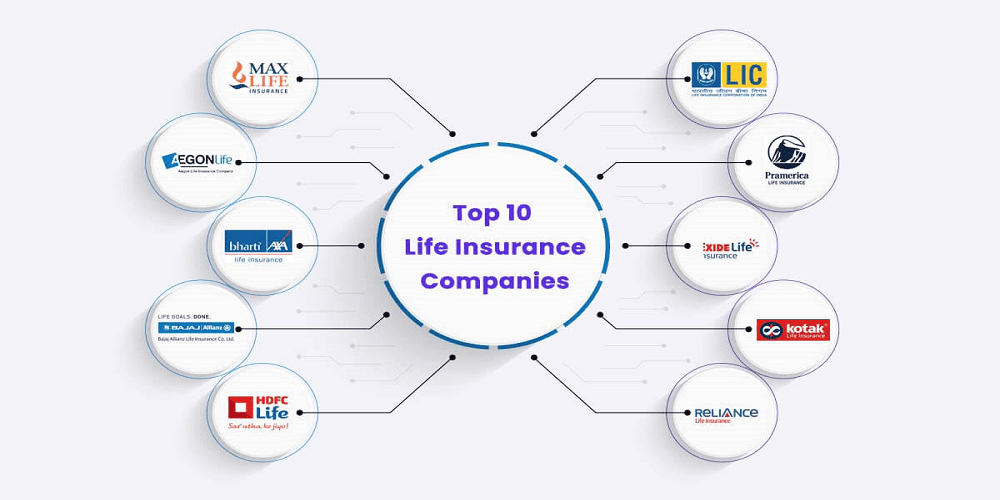

Best Life Insurance Companies: Detailed Overview

Here is a comprehensive look at companies often regarded as leaders in the life insurance industry. These companies are recognized for strong financial stability, high claim settlement ratios, and customer satisfaction.

1. Northwestern Mutual

- Known for strong financial strength and high customer satisfaction.

- Offers whole life, term life, and universal life policies.

- Strong dividend-paying record.

2. New York Life

- One of the oldest insurers in the U.S.

- Offers term, whole life, and variable universal life insurance.

- High financial ratings and long-standing trust.

3. MassMutual

- Known for affordable premiums and diverse policy options.

- Offers term, whole, universal, and variable life insurance.

- Strong claim settlement history.

4. Prudential

- Offers a wide range of life insurance options including indexed universal life.

- Well-suited for people looking for flexible policies with riders.

- Known for accommodating applicants with health conditions.

5. State Farm Life Insurance

- Popular for customer service and wide network of agents.

- Offers term, whole, and universal life.

- Affordable options with good financial strength.

6. Guardian Life

- Offers life insurance with strong disability insurance add-ons.

- Excellent for those wanting financial protection plus investment options.

- Good claim settlement reputation.

7. Lincoln Financial Group

- Offers flexible universal life policies.

- Focus on comprehensive coverage and riders.

- Good choice for high-income earners seeking estate planning.

8. Pacific Life

- Known for affordable term life insurance.

- Strong investment-focused universal life policies.

- Financially stable with excellent ratings.

9. Mutual of Omaha

- Trusted for more than a century.

- Offers whole life, term life, and children’s policies.

- Competitive pricing with strong customer care.

10. AIG (American International Group)

- Wide range of policies including guaranteed issue whole life.

- Great for people who may not qualify elsewhere.

- Flexible premium structures.

How to Choose the Right Company for You

Here are steps to ensure you pick the best life insurance company for your needs:

- Assess Your Needs – Decide how much coverage you need based on debts, income replacement, and future goals.

- Compare Quotes – Use online tools or consult agents to compare premiums.

- Check Financial Ratings – Ensure the company is financially stable for the long term.

- Read Policy Details – Understand exclusions, riders, and premium payment terms.

- Check Claim Settlement Ratio – This is the most important indicator of reliability.

- Seek Recommendations – Ask family or financial advisors for their experience with companies.

Benefits of Choosing the Best Life Insurance Company

- Peace of Mind – Knowing your family is protected.

- Tax Benefits – Many life insurance plans come with tax deductions.

- Flexible Planning – Choose policies that align with financial goals.

- Affordable Premiums – Top companies balance coverage with cost.

- Long-Term Security – Your family will not face financial hardship in your absence.

Common Mistakes to Avoid When Selecting a Life Insurance Company

- Choosing Solely on Price – Cheap premiums may mean limited benefits.

- Not Checking Claim Settlement Ratio – This can be a costly oversight.

- Ignoring Riders – Riders add value to your base policy.

- Delaying Purchase – Premiums increase with age and health risks.

- Not Reviewing Policy Annually – Life circumstances change, so your coverage should too.

Final Thoughts

Life insurance is not just about buying a policy—it’s about choosing a company that will stand by your loved ones when they need it most. The best life insurance companies combine financial strength, customer satisfaction, affordable premiums, and high claim settlement ratios. Whether you choose Northwestern Mutual, New York Life, Prudential, or another trusted brand, the goal is to find the policy that fits your unique needs.

Your decision today can protect your family’s tomorrow.

FAQs About Best Life Insurance Companies

Q1. What is the best life insurance company overall?

The best life insurance company depends on your personal needs. Northwestern Mutual, New York Life, and Prudential are often rated highly due to their financial stability and variety of plans.

Q2. How do I compare life insurance companies?

Compare companies based on claim settlement ratios, financial ratings, premium affordability, customer service, and available riders.

Q3. Is term life insurance better than whole life insurance?

Term life is cheaper and ideal for temporary needs, while whole life provides lifelong coverage plus cash value but at higher premiums.

Q4. Can I buy life insurance if I have health issues?

Yes, many companies like AIG and Prudential offer policies for individuals with pre-existing health conditions, though premiums may be higher.

Q5. How much life insurance coverage should I buy?

A common rule is to buy coverage equal to 10–15 times your annual income, plus enough to cover debts, mortgages, and future expenses like children’s education.

.jpg)

.png)

.jpg)

.jpg)

Leave A Comment

0 Comment