The State Bank of India (SBI) is one of the largest and most trusted public sector banks in India. Among its various deposit schemes, the Recurring Deposit (RD) stands out as a popular choice for individuals seeking a disciplined and risk-free investment avenue. In 2021, SBI offered competitive interest rates on its RD schemes, catering to both general and senior citizen customers. This article delves into the specifics of SBI's RD interest rates for 2021, providing a detailed analysis of the rates, features, and frequently asked questions.

Understanding SBI Recurring Deposit

A Recurring Deposit is a financial product that allows individuals to invest a fixed amount of money every month for a predetermined tenure. The primary objective of this scheme is to encourage regular savings among individuals, especially those with a steady income. The key features of SBI's RD scheme include:

- Minimum Deposit: ₹100 per month, with subsequent deposits in multiples of ₹10.

- Tenure: Ranges from 12 months to 120 months (1 year to 10 years).

- Interest Rates: Vary based on the tenure and the depositor's age.

- Premature Withdrawal: Allowed with a penalty, which varies based on the tenure and amount.

- Taxation: Interest earned is subject to tax as per the individual's income tax slab.

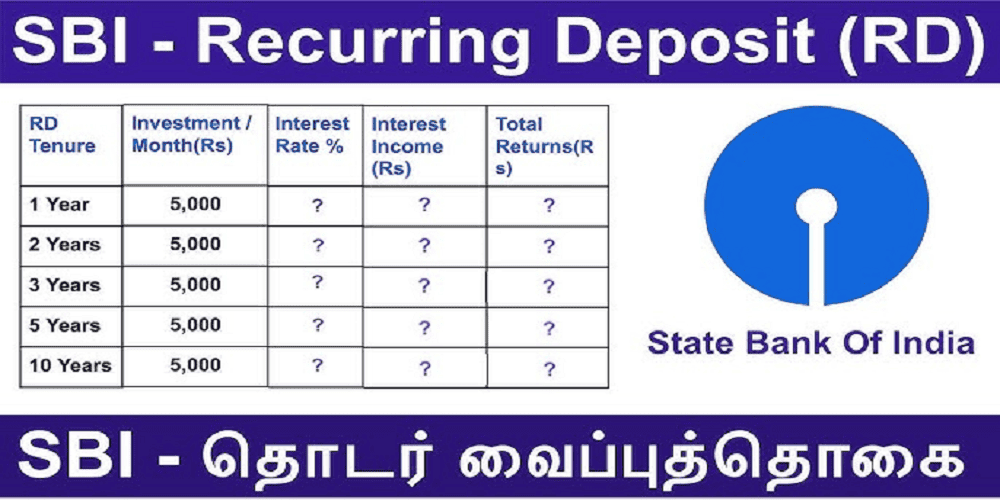

SBI RD Interest Rates for 2021

As of January 8, 2021, SBI revised its RD interest rates. The rates were structured based on the tenure of the deposit and the age of the depositor. Here's a breakdown of the interest rates:

For General Public

- 1 year to less than 2 years: 4.90%

- 2 years to less than 3 years: 5.10%

- 3 years to less than 5 years: 5.30%

- 5 years and up to 10 years: 5.40%

For Senior Citizens

Senior citizens typically receive an additional 0.50% interest over the standard rates. Therefore, the rates for senior citizens in 2021 were:

- 1 year to less than 2 years: 5.40%

- 2 years to less than 3 years: 5.60%

- 3 years to less than 5 years: 5.80%

- 5 years and up to 10 years: 5.90%

These rates were effective across all SBI branches and were applicable to both new and existing RD accounts.

Key Features of SBI RD Scheme

- Flexible Deposit Amount: Investors can start with a minimum of ₹100 per month, making it accessible for a wide range of individuals.

- Long Tenure: The option to invest for up to 10 years allows for long-term financial planning.

- Loan Facility: After 3 months, depositors can avail of a loan against their RD, up to 90% of the deposit amount.

- Tax Deduction: RDs are not eligible for tax deductions under Section 80C, but the interest earned is subject to TDS if it exceeds ₹40,000 (₹50,000 for senior citizens) in a financial year.

- Online Facility: SBI provides the convenience of opening and managing RD accounts online through its internet banking portal.

Benefits of Investing in SBI RD

- Risk-Free Investment: Being a government-backed entity, SBI offers a secure investment environment.

- Regular Income: The monthly deposits inculcate a habit of saving and provide a structured financial plan.

- Compound Interest: Interest is compounded quarterly, enhancing the overall returns.

- Loan Against RD: The facility to avail of a loan against the RD provides liquidity in times of need.

Premature Withdrawal and Penalty

While SBI allows premature withdrawal of RD accounts, it comes with certain conditions:

- Penalty: A penalty of 1% is levied on the interest rate applicable to the period the deposit remained with the bank.

- Interest Calculation: The interest paid on premature withdrawal may be less than the contracted rate or the applicable rate for the period till which the deposit was made with the bank.

- Eligibility: Premature withdrawal is permissible after a minimum of 3 months from the date of deposit.

Tax Implications

The interest earned on SBI RD is subject to tax as per the individual's income tax slab. Additionally, if the total interest earned exceeds ₹40,000 in a financial year (₹50,000 for senior citizens), Tax Deducted at Source (TDS) is applicable. The TDS rate is 10%, provided the PAN details are furnished. In the absence of PAN, the TDS rate is 20%.

Frequently Asked Questions (FAQs)

Q1: Can I open an SBI RD account online?

Yes, SBI provides the facility to open and manage RD accounts online through its internet banking portal.

Q2: What is the minimum amount required to open an RD account?

The minimum monthly deposit amount is ₹100, with subsequent deposits in multiples of ₹10.

Q3: Can I change the monthly deposit amount after opening the RD account?

No, the monthly deposit amount cannot be altered once the RD account is opened.

Q4: Is there any penalty for missing a monthly deposit?

Yes, if a monthly deposit is missed, the account becomes 'defaulted,' and a penalty is levied. The account will continue to earn interest at the applicable rate, but the defaulted month will not be considered for interest calculation.

Q5: Can I transfer my RD account to another branch?

Yes, RD accounts can be transferred to another branch of SBI by submitting a request at the current branch.

Q6: What happens if I do not claim my RD maturity amount?

If the maturity amount is not claimed within a specified period, it will be treated as an unclaimed deposit and will attract applicable interest rates.

Q7: Are there any special schemes for senior citizens?

Yes, senior citizens are offered an additional 0.50% interest over the standard RD rates.

Q8: Can I avail of a loan against my RD?

Yes, after 3 months, you can avail of a loan against your RD, up to 90% of the deposit amount.

Conclusion

SBI's Recurring Deposit scheme in 2021 offered a secure and structured investment option for individuals looking to build their savings over time. With competitive interest rates, the flexibility of tenure, and the added benefits for senior citizens, it catered to a wide range of investors. While the interest rates were relatively modest, the safety and reliability of SBI made it a preferred choice for many. As with any financial product, it's essential to assess your financial goals and consult with a financial advisor to determine if an RD aligns with your investment strategy.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Leave A Comment

0 Comment