In the ever-evolving landscape of investment options, fixed income mutual funds have carved out a steady, reliable niche for investors seeking lower volatility and predictable returns. Whether you're planning for retirement, saving for a major life goal, or simply trying to balance a diversified portfolio, fixed income mutual funds can offer stability amid market turbulence.

This detailed guide will walk you through everything you need to know about fixed income mutual funds — from the basics and benefits to strategies and risks. By the end, you’ll be able to decide whether these funds deserve a place in your investment strategy.

What Are Fixed Income Mutual Funds?

Fixed income mutual funds are investment funds that primarily invest in bonds and other debt instruments. These funds are designed to provide investors with regular income, usually in the form of interest or dividends. Unlike equity funds that invest in stocks, fixed income funds focus on less volatile assets such as:

- Government bonds

- Corporate bonds

- Municipal bonds

- Mortgage-backed securities

- Treasury bills

- Commercial paper

The key objective of a fixed income mutual fund is capital preservation and income generation, not capital appreciation. These funds are considered suitable for conservative investors or those looking to reduce overall portfolio risk.

How Do Fixed Income Mutual Funds Work?

When you invest in a fixed income mutual fund, your money is pooled with that of other investors and used by a professional fund manager to buy a portfolio of debt securities. The returns are generated primarily through interest payments from the underlying bonds and capital gains when bonds are sold at a profit.

The interest income earned is distributed to investors, usually on a monthly or quarterly basis. Since the underlying investments mature at different times, fund managers continuously reinvest in new bonds to maintain returns and manage risk.

The Net Asset Value (NAV) of a fixed income mutual fund fluctuates based on interest rate movements and credit quality of the holdings. However, compared to equity funds, these fluctuations are generally minor.

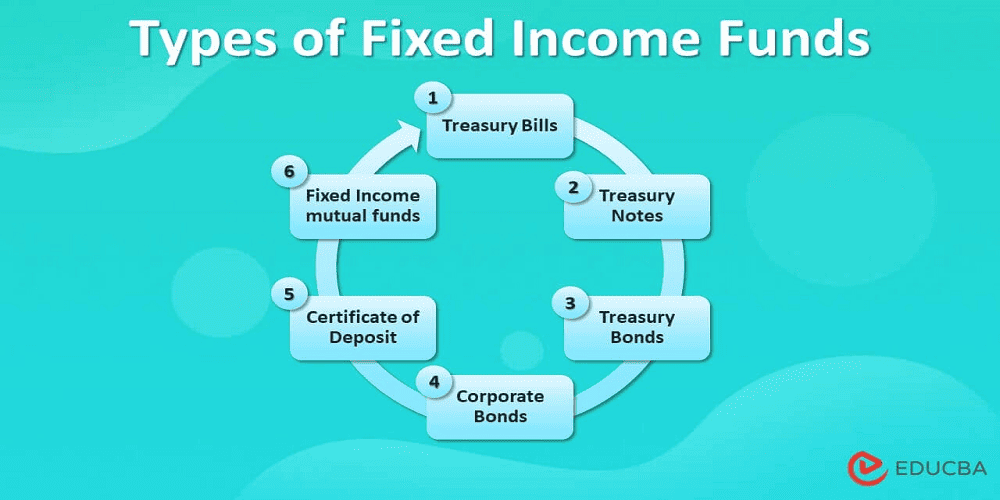

Types of Fixed Income Mutual Funds

Fixed income mutual funds come in many forms, each with varying risk and return characteristics. Some of the most popular types include:

1. Government Bond Funds

These invest in sovereign securities like Treasury bonds or government securities. They are considered very safe but typically offer lower returns.

2. Corporate Bond Funds

These funds invest in bonds issued by companies. They usually offer higher yields than government bonds but come with added credit risk.

3. High-Yield Bond Funds

Also known as junk bond funds, these invest in low-rated corporate bonds. They offer high returns but are riskier.

4. Municipal Bond Funds

These are tax-efficient funds that invest in debt issued by state or local governments. Interest income is often tax-exempt.

5. Short-Term and Long-Term Bond Funds

Short-term bond funds invest in securities with shorter maturities (usually under 3 years), while long-term bond funds invest in instruments with longer durations. Short-term funds are less sensitive to interest rate changes.

6. Floating Rate Funds

These invest in bonds with variable interest rates. They are less sensitive to interest rate changes and offer a cushion against rising rates.

Advantages of Fixed Income Mutual Funds

Fixed income mutual funds offer several benefits that make them attractive for both novice and seasoned investors. Here are some of the key advantages:

1. Regular Income

The primary benefit of fixed income funds is the regular interest income they provide. This is ideal for retirees or investors seeking predictable cash flows.

2. Capital Preservation

These funds are less volatile than equity mutual funds and provide a safer investment avenue for preserving capital.

3. Diversification

Fixed income mutual funds allow investors to diversify across various debt instruments, issuers, and sectors, thereby reducing risk.

4. Professional Management

Experienced fund managers actively manage the portfolio, making decisions based on credit analysis, interest rate outlook, and economic factors.

5. Liquidity

Unlike fixed deposits or bonds that may require lock-ins or secondary market sales, fixed income mutual funds are generally liquid and can be redeemed easily.

6. Tax Efficiency

Some funds like municipal bond funds offer tax-free income, which can be advantageous for investors in higher tax brackets.

Risks Associated with Fixed Income Mutual Funds

While fixed income funds are less risky than equities, they are not risk-free. Understanding the potential downsides is crucial:

1. Interest Rate Risk

When interest rates rise, the price of existing bonds falls. This negatively impacts the NAV of fixed income funds.

2. Credit Risk

If the issuer of a bond defaults, the fund could suffer losses. High-yield funds are particularly exposed to this risk.

3. Inflation Risk

Inflation can erode the real value of interest income and principal, especially in funds that invest in fixed-rate securities.

4. Reinvestment Risk

As bonds mature, fund managers reinvest the proceeds. If interest rates have dropped, reinvestment may yield lower returns.

5. Liquidity Risk

In times of financial stress, it may become difficult to sell certain debt instruments without impacting their price.

Who Should Invest in Fixed Income Mutual Funds?

Fixed income mutual funds are suitable for a wide variety of investors:

- Retirees seeking regular income with low risk.

- Conservative investors who prioritize capital preservation over high returns.

- Young professionals looking to diversify their equity-heavy portfolios.

- High-net-worth individuals who wish to stabilize returns during volatile market cycles.

- Goal-based investors planning for short- to medium-term financial goals.

Factors to Consider Before Investing

Before committing to a fixed income mutual fund, consider the following:

1. Investment Horizon

Choose short-duration funds for goals within 1–3 years and long-duration funds for goals beyond 5 years.

2. Risk Appetite

Evaluate your ability to handle NAV fluctuations due to interest rate or credit risks.

3. Yield vs. Safety

High yields often come with high risk. Strike the right balance based on your comfort level.

4. Fund Manager's Track Record

A seasoned fund manager with a strong track record is more likely to navigate market risks successfully.

5. Expense Ratio

Lower expense ratios mean more of your returns stay with you. Compare fees across similar funds.

Fixed Income Funds vs Fixed Deposits

Many investors compare fixed income mutual funds with traditional bank fixed deposits (FDs). While both offer fixed income, there are notable differences.

Fixed income mutual funds can offer higher returns than FDs, especially when interest rates are falling. However, FDs offer guaranteed returns and are generally safer as they are backed by banks and regulated bodies.

Fixed income funds provide better liquidity, tax efficiency under certain conditions, and diversification, but they also carry market-linked risk unlike the fixed and assured returns of FDs.

Taxation on Fixed Income Mutual Funds

Tax treatment depends on the holding period and the type of income received:

- Dividends are added to your income and taxed as per your slab.

- Capital gains are taxed based on the duration:

- Short-Term Capital Gains (STCG): If held for less than 3 years, gains are taxed as per your income tax slab.

- Long-Term Capital Gains (LTCG): If held for more than 3 years, gains are taxed at 20% with indexation benefit.

Fixed Income Funds in Rising vs Falling Interest Rates

In a Rising Rate Environment

Short-duration funds or floating rate funds perform better as they reinvest at higher yields. Long-duration funds may suffer due to falling bond prices.

In a Falling Rate Environment

Long-duration funds tend to benefit more due to capital appreciation in bond prices. Short-term funds may still deliver steady returns but will be less responsive.

Tips for Investing in Fixed Income Mutual Funds

- Always align your fund choice with your financial goals.

- Avoid chasing returns; assess risk first.

- Monitor credit ratings of the fund's holdings regularly.

- Diversify your debt allocation across fund types.

- Don’t invest your emergency corpus in high-yield bond funds.

- Consult a financial advisor if unsure about fund selection.

Common Myths About Fixed Income Mutual Funds

Myth 1: Fixed income mutual funds are risk-free

Reality: While they are safer than equity funds, they carry interest rate, credit, and liquidity risks.

Myth 2: Only retirees should invest in fixed income funds

Reality: They are suitable for any investor looking for portfolio stability.

Myth 3: Returns are guaranteed

Reality: They are market-linked and returns fluctuate based on economic conditions.

Myth 4: They are the same as fixed deposits

Reality: They are more flexible and can offer better post-tax returns than FDs, though with added risk.

Future of Fixed Income Mutual Funds

As global economic uncertainty and interest rate fluctuations continue, the demand for flexible, professionally managed debt instruments will likely grow. Innovations such as target maturity funds and passive debt ETFs are expanding investor choices.

With growing awareness and the rise of financial planning, fixed income mutual funds are poised to become an even more integral part of diversified portfolios.

Conclusion

Fixed income mutual funds are a powerful tool for anyone looking to generate steady returns, protect capital, and balance a diversified portfolio. While they don’t promise high returns like equity funds, they offer safety, predictability, and professional management.

If you're planning for retirement, saving for a down payment, or just want to mitigate equity risk, fixed income funds can serve as a reliable anchor in your investment strategy. Just remember to assess your goals, evaluate the risks, and choose wisely.

FAQs on Fixed Income Mutual Funds

Q1. Are fixed income mutual funds safe?

Fixed income mutual funds are relatively safer than equity funds but are not entirely risk-free. They carry interest rate risk, credit risk, and liquidity risk. Government bond funds are generally safer than corporate or high-yield bond funds.

Q2. Can I lose money in a fixed income mutual fund?

Yes, it's possible. If interest rates rise, bond prices fall, impacting NAV. If any bond issuer defaults, it can also lead to losses. However, the chances are lower compared to equity investments.

Q3. How long should I stay invested in fixed income funds?

It depends on your goal and the type of fund. For short-term goals, stick to short-duration or ultra-short-term funds. For long-term goals, income funds or long-duration funds may be suitable. Always align investment duration with fund maturity profile.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Leave A Comment

0 Comment