In the vast universe of mutual funds, fixed income mutual funds hold a unique position. They provide investors with a relatively stable return, making them ideal for conservative investors, retirees, or those seeking portfolio diversification. Whether you're new to investing or looking to balance your equity exposure, understanding fixed income mutual funds can help you make informed decisions.

What Are Fixed Income Mutual Funds?

Fixed income mutual funds are investment vehicles that primarily invest in debt securities like government bonds, corporate bonds, treasury bills, and money market instruments. These funds aim to generate regular income for investors in the form of interest payments, and in some cases, capital appreciation.

Unlike equity mutual funds that depend on market performance, fixed income funds focus on preserving capital and providing consistent returns. The performance of these funds is tied to interest rate movements and the creditworthiness of the issuers of the debt instruments.

Key Characteristics of Fixed Income Mutual Funds

1. Regular Income Generation

These funds are structured to offer periodic income—monthly, quarterly, or semi-annually—through dividends or interest earned from the underlying debt instruments.

2. Lower Risk Profile

Fixed income funds are generally less volatile than equity funds. However, they still carry risks like interest rate risk and credit risk.

3. Preservation of Capital

While not entirely risk-free, fixed income funds prioritize capital preservation over high returns, making them suitable for conservative investors.

4. Liquidity

Most fixed income mutual funds offer decent liquidity, allowing investors to redeem their investments within a short period, often without significant penalties.

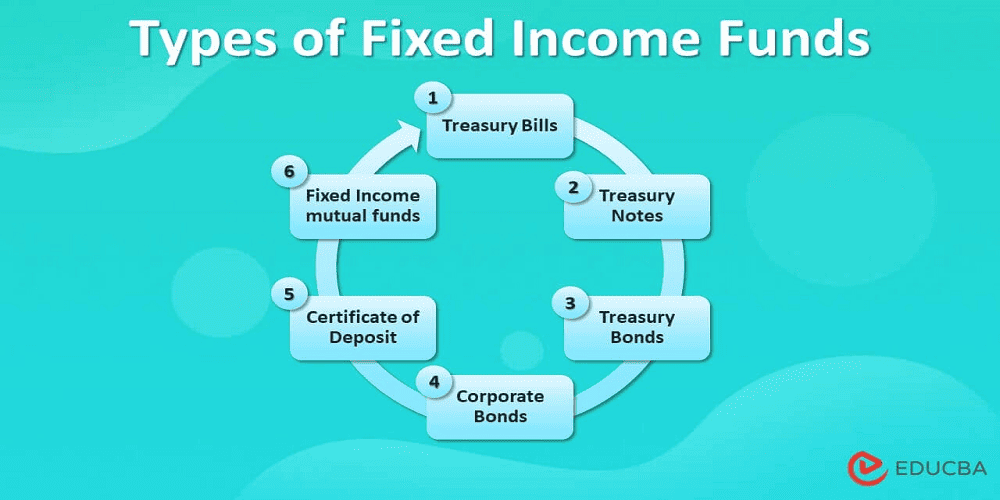

Types of Fixed Income Mutual Funds

Fixed income funds come in various types, each catering to different risk profiles and investment horizons:

1. Government Bond Funds

These invest in sovereign debt issued by the central or state governments. They are considered among the safest because of the backing of the government.

2. Corporate Bond Funds

These funds invest in high-rated corporate debt. They offer higher yields than government bonds but carry more risk due to the potential default of the issuing company.

3. Short-Term Bond Funds

Ideal for those with a 1-3 year investment horizon. They invest in bonds with shorter maturity periods, reducing interest rate risk.

4. Long-Term Bond Funds

These funds invest in debt instruments with longer maturities, suitable for those with a long-term perspective and the ability to tolerate interest rate fluctuations.

5. Money Market Funds

These funds invest in highly liquid, short-term instruments like treasury bills, certificates of deposit, and commercial papers. They are considered low-risk and are ideal for parking funds for a short duration.

6. Dynamic Bond Funds

These funds have no fixed maturity profile. Fund managers actively shift between short- and long-term bonds based on interest rate expectations.

7. Gilt Funds

They invest only in government securities, eliminating credit risk. However, they are sensitive to interest rate changes.

Why Invest in Fixed Income Mutual Funds?

1. Stable Income Stream

The primary attraction of fixed income funds is the stability they offer in the form of interest income.

2. Diversification

They provide a cushion against equity market volatility, helping balance your portfolio.

3. Capital Preservation

Particularly important for investors nearing retirement or those who cannot afford to lose capital.

4. Lower Volatility

Due to their conservative asset allocation, fixed income funds tend to be less volatile than equity-oriented funds.

5. Accessibility

You don’t need to be an expert to invest in these funds. They’re managed by professional fund managers and require no large upfront capital.

How Do Fixed Income Mutual Funds Work?

Fund managers pool money from multiple investors and invest it in a mix of debt instruments. The portfolio is actively managed to ensure risk-adjusted returns. Income from interest is distributed to investors at regular intervals, or it is reinvested, depending on the plan (growth or dividend option) chosen by the investor.

Returns are generated primarily from:

- Interest income

- Capital gains from bond price appreciation

- Coupon payments

Performance Factors to Consider

While investing in fixed income funds, several factors can affect performance:

1. Interest Rates

When interest rates rise, bond prices fall, and vice versa. Funds holding long-duration bonds are more sensitive to these movements.

2. Credit Risk

If the issuer of a bond defaults, the fund suffers a loss. Always check the credit rating of the fund's portfolio.

3. Duration and Maturity

Longer duration funds carry more risk but may offer better returns in a falling interest rate environment.

4. Expense Ratio

A higher expense ratio can eat into returns. Choose funds with a lower cost structure, especially if the returns are modest.

Taxation of Fixed Income Mutual Funds in India

As of FY 2023-24:

- Gains from fixed income mutual funds are taxed as per the investor’s income tax slab since indexation benefits have been removed.

- If you opt for the dividend option, the dividend is also added to your taxable income and taxed accordingly.

This makes it essential to plan redemptions wisely to avoid unnecessary tax burdens.

Ideal Investor Profile for Fixed Income Funds

- Retirees seeking steady income

- First-time investors looking for low-risk options

- Risk-averse individuals

- Investors rebalancing portfolios with too much equity exposure

- Corporate treasuries or HNIs wanting short-term parking with returns better than savings accounts

Top Tips to Choose the Right Fixed Income Fund

- Check Portfolio Quality: Look at the credit rating of the bonds held.

- Assess Duration: Align with your investment horizon and interest rate outlook.

- Compare Historical Performance: Check consistency over different market cycles.

- Review Expense Ratio: Lower is generally better.

- Look for Fund Manager Experience: A seasoned manager can navigate interest rate changes better.

Common Myths About Fixed Income Mutual Funds

Myth 1: They Are Completely Risk-Free

No mutual fund is entirely risk-free. Fixed income funds carry interest rate and credit risks, though less than equities.

Myth 2: Fixed Deposits Are Always Better

FDs may be safer, but they often underperform in a low-interest-rate environment compared to quality fixed income funds.

Myth 3: Only for Old Investors

Anyone looking to diversify, lower risk, or preserve capital can benefit from fixed income funds—not just retirees.

Best Practices for Investing in Fixed Income Funds

- Stay invested for 2-3 years for short-term funds, and longer for long-term bond funds.

- Reinvest dividends if you don’t need income immediately, to benefit from compounding.

- Monitor interest rate trends, as these can impact returns significantly.

- Diversify within debt funds (e.g., a mix of gilt, corporate, and money market funds).

- Avoid chasing returns blindly; focus on quality and consistency.

Conclusion

Fixed income mutual funds are a reliable investment option for those seeking stability, income, and capital preservation. While they may not deliver the explosive returns of equities, they serve a vital role in balancing and safeguarding an investment portfolio. Whether you're a conservative investor or someone looking to park idle funds, fixed income mutual funds can be a worthy addition to your financial plan.

FAQs on Fixed Income Mutual Funds

Q1. Are fixed income mutual funds safe?

They are relatively safer than equity funds but are not risk-free. They carry interest rate and credit risk.

Q2. What is the ideal time horizon for investing in fixed income funds?

For short-term bond funds, 1-3 years is ideal. For long-term funds, at least 3-5 years is recommended.

Q3. Can I lose money in a fixed income mutual fund?

Yes, especially if interest rates rise sharply or if the fund holds low-credit-quality bonds that default.

Q4. How do fixed income funds generate returns?

Returns come from interest payments on bonds, price appreciation of the bonds, and periodic coupons.

Q5. How often do fixed income funds pay income?

It depends on the plan. Dividend plans may pay monthly, quarterly, or annually, while growth plans reinvest earnings.

Q6. What is the tax treatment of these funds?

Gains are added to your income and taxed as per your income tax slab since indexation benefits have been removed.

Q7. How are they different from equity mutual funds?

Fixed income funds invest in debt instruments and focus on income and capital preservation, whereas equity funds invest in stocks aiming for high returns and carry higher risk.

Q8. Should I invest during rising interest rate cycles?

It depends on the type of fund. Short-term and floating-rate bond funds may perform better in rising rate environments.

Q9. Do fixed income mutual funds have lock-in periods?

Most open-ended fixed income funds do not have lock-in periods, but some may have exit loads if redeemed early.

Q10. How do I choose the best fixed income fund?

Look at factors like portfolio quality, fund manager expertise, historical returns, expense ratio, and alignment with your financial goals.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Leave A Comment

0 Comment