₹ 1 crore life cover starting from ₹473/month*

Term Insurance

Term insurance is a type of life insurance that provides coverage for a specific period, known as the "term." If the insured person dies during this term, the policy pays out a death benefit to the beneficiaries. It's temporary, affordable, and doesn't have a savings or investment component. It's ideal for young families, covering debts, and fulfilling temporary financial needs.

Term insurance offers coverage for a set period, typically 10, 20, or 30 years. It's straightforward and affordable, with premiums usually lower than other types of life insurance. Unlike permanent life insurance, it doesn't accumulate cash value over time. It's a good choice for those with temporary financial responsibilities like raising children or paying off a mortgage.

1 Crore

Life Cover

@Starting from 16/day*

75 Lakh

Life Cover

@Starting from 12/day*

50 Lakh

Life Cover

@Starting from 8/day*

Why you should buy term insurance plan?

- Affordable Coverage: Term insurance offers substantial coverage at a lower cost compared to other types of life insurance.

- Financial Protection: It ensures that your loved ones are financially protected if something happens to you during the term of the policy.

- Temporary Needs: It's great for covering temporary financial obligations like mortgages, loans, or providing for your children's education.

- Flexible Options: You can choose the term length based on your needs, whether it's 10, 20, or 30 years.

- Ease of Understanding: Term insurance is straightforward – you pay premiums for a specified period, and if you pass away during that time, your beneficiaries receive a lump sum payout.

- Peace of Mind: Knowing that your family will be taken care of financially can provide peace of mind, especially during life's uncertainties.

- Renewability: Some policies offer the option to renew at the end of the term, allowing you to extend coverage if needed, although premiums may increase.

- No Cash Value: Unlike other types of life insurance, term insurance doesn't accumulate cash value over time, keeping it simple and focused on protection.

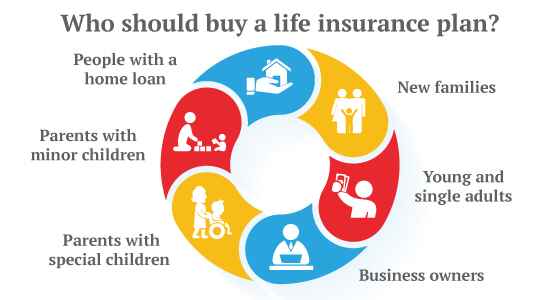

Who should buy term insurance plan?

- Young Families: If you have a family to support, especially if you're the primary breadwinner, term insurance ensures they're financially protected if something happens to you.

- Parents with Dependents: Term insurance is crucial for parents with young children or other dependents who rely on their income for living expenses.

- People with Debts: If you have outstanding debts like a mortgage, car loan, or student loans, term insurance can help ensure that your loved ones won't be burdened with debt if you pass away.

- Sole Providers: If you're the sole provider for your family, term insurance provides a safety net, ensuring your loved ones can maintain their lifestyle and meet financial obligations if you're no longer there.

- Business Owners: Term insurance can also be valuable for business owners to protect their business interests and provide financial security to their partners or key employees.

What is term life policy features?

Term life insurance provides temporary coverage at affordable premiums, with a straightforward structure focused solely on providing financial protection to beneficiaries in the event of the insured person's death.

- Temporary Coverage: Term life insurance provides coverage for a specific period, known as the "term." Common term lengths are 10, 20, or 30 years.

- Affordable Premiums: Term life insurance typically has lower premiums compared to permanent life insurance policies like whole life or universal life. This makes it more accessible for many people.

- Death Benefit: If the insured person dies during the term of the policy, the beneficiaries receive a tax-free lump sum payment, known as the death benefit.

- No Cash Value: Unlike permanent life insurance policies, term life insurance does not accumulate cash value over time. It's purely for protection, with no savings or investment component.

- Renewability and Convertibility: Some term life policies offer the option to renew the coverage at the end of the term or convert it into a permanent life insurance policy. However, this may come with increased premiums.

- Flexibility: Term life insurance policies are flexible, allowing you to choose the coverage amount and term length based on your needs and budget.

- Straightforward: Term life insurance is straightforward and easy to understand. You pay premiums for the duration of the term, and if the insured person passes away during that time, the beneficiaries receive the death benefit.

Documents required to buy term insurance plan

- Identification Proof: Such as a copy of your Aadhar card, passport, or driver's license.

- Address Proof: This could be a utility bill, rental agreement, or voter ID card.

- Income Proof: Salary slips, income tax returns, or bank statements to verify your income.

- Medical History: You may need to provide details about your health history and undergo a medical examination.

- Age Proof: Birth certificate or any other document that verifies your age.

- Occupation Details: Information about your occupation and any associated risks.

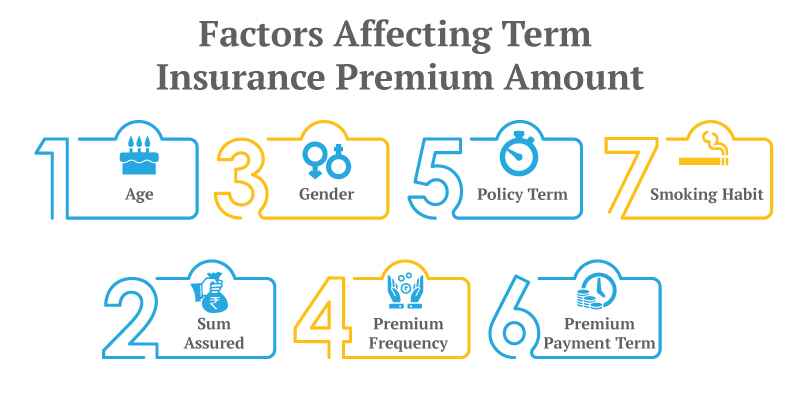

What are the factors that can affect term insurance premiums?

Factors That Can Affect Term Insurance Premiums:

- Age: Younger individuals generally pay lower premiums since they are considered lower risk.

- Health: Your health condition and medical history can impact premiums. Healthier individuals may get lower premiums.

- Smoking Status: Smokers often pay higher premiums due to increased health risks.

- Term Length: Longer terms usually have higher premiums compared to shorter terms.

- Coverage Amount: Higher coverage amounts result in higher premiums.

- Occupation and Hobbies: Risky occupations or hobbies (like skydiving) can lead to higher premiums.

- Gender: In some cases, gender can impact premiums, with females typically paying lower rates.

- Family Medical History: If your family has a history of certain health conditions, it may affect your premiums.

- Driving Record: A poor driving record could increase premiums due to the higher risk associated with accidents.

- Insurance Company: Different insurance companies have varying underwriting criteria and pricing, so premiums can differ.

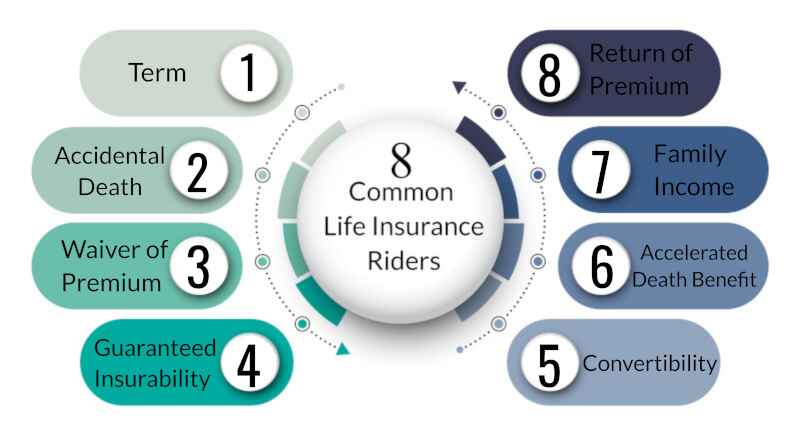

What is a term insurance rider?

- Definition: A term insurance rider is an optional add-on feature that provides additional benefits to your base term life insurance policy.

- Customization: Riders allow you to customize your policy to better suit your needs by adding extra protection or benefits.

- Flexibility: You can choose from a variety of riders to enhance your coverage, tailoring it to your specific circumstances.

- Examples of Riders: Common term insurance riders include:

- **Accidental Death Benefit Rider:** Provides an additional payout if the insured dies due to an accident.

- **Waiver of Premium Rider:** Waives future premium payments if the insured becomes disabled or unable to work due to injury or illness.

- **Child Term Rider:** Provides coverage for the insured's children in case of their death.

- **Critical Illness Rider:** Offers a lump sum payment if the insured is diagnosed with a specified critical illness.

- Cost: Adding riders typically increases the cost of your term insurance policy, but they can provide valuable additional protection.

- Considerations: Before adding riders, consider your specific needs, budget, and whether the extra benefits justify the additional cost.

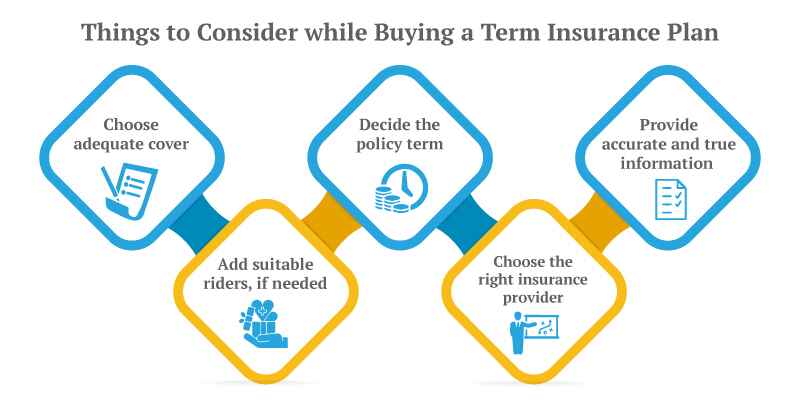

What factors need to be considered before buying the best term insurance plan in india?

Factors to Consider Before Buying the Best Term Insurance Plan in India:

- Coverage Amount: Determine the amount of coverage you need based on your financial obligations, such as loans, education expenses, and family's future needs.

- Term Length: Choose a term length that aligns with your financial goals and the time frame during which your dependents will need financial support.

- Premium Affordability: Compare premium rates from different insurers and ensure that the premiums fit within your budget over the long term.

- Claim Settlement Ratio: Check the claim settlement ratio of the insurance company to ensure they have a good track record of honoring claims promptly.

- Riders: Consider any additional riders available, such as accidental death benefit or critical illness rider, to enhance your coverage based on your specific needs.

- Company Reputation: Research the reputation and financial stability of the insurance company to ensure they will be able to fulfill their obligations in the future.

- Medical Underwriting: Understand the medical underwriting process and disclose all relevant information about your health to avoid claim rejection later.

- Customer Service: Evaluate the quality of customer service provided by the insurance company, including ease of communication and responsiveness.

- Exclusions: Pay attention to policy exclusions and limitations to understand what circumstances are not covered by the policy.

- Reviews and Recommendations: Read reviews and seek recommendations from friends, family, or financial advisors to gather insights and make an informed decision.

Eligibility criteria to buy term insurance plan?

- Age: Typically, individuals between 18 to 65 years old are eligible to buy term insurance. However, the age limit may vary depending on the insurance company.

- Income: Most insurers require applicants to have a stable source of income to pay the premiums.

- Health: Applicants are usually required to disclose their health status and medical history. While some health conditions may not disqualify you from getting coverage, they may affect your premiums.

- Smoking Status: Smoking habits can impact eligibility and premiums. Smokers typically pay higher premiums due to increased health risks.

- Residency: You may need to be a resident of India to be eligible for term insurance plans offered by Indian insurance companies.

- Documentation: Applicants need to provide valid identification proof, address proof, income proof, and other relevant documents as required by the insurance company.

- Occupation: Some insurers may have restrictions or additional requirements for individuals in high-risk occupations or hazardous professions.

- Underwriting: Your eligibility may also depend on the insurer's underwriting guidelines, which assess the risk associated with insuring you.

- Insurability: Insurers may assess your overall insurability based on factors such as age, health, lifestyle, and occupation.

What are the documents required for term life insurance claim process?

- Original Policy Document: The original policy document is usually required to initiate the claim process. Make sure to keep it safe and accessible.

- Death Certificate: A certified copy of the death certificate issued by the relevant authorities is essential to validate the claim.

- Claim Form: Fill out the claim form provided by the insurance company accurately and completely. This form typically includes details about the policyholder, the insured, and the cause of death.

- Medical Records: In cases of natural death, medical records, including hospital admission and treatment documents, may be required to verify the cause of death.

- Police FIR or Post-Mortem Report: If the death occurred under suspicious circumstances or due to unnatural causes, a police First Information Report (FIR) or post-mortem report may be necessary.

- Identity and Address Proof: Provide identity and address proof of the claimant(s), such as Aadhar card, passport, or driver's license, for verification purposes.

- Beneficiary Details: Details of the beneficiary(s) who will receive the claim amount, including their identification and bank account information, need to be provided.

- Legal Documents (if applicable): In cases involving legal heirs or disputes, legal documents such as succession certificate or court orders may be required.

- Assignment of Policy: If the policy has been assigned to someone else, the assignment document needs to be submitted.

- Any Additional Documents: Depending on the circumstances of the death and the terms of the policy, additional documents or information may be requested by the insurance company.