Grow Savings Consistently with Recurring Deposits

Recurring Deposit

A recurring deposit (RD) is a type of term deposit offered by banks and financial institutions. It allows individuals to save and invest a fixed amount of money regularly over a predetermined period. Unlike a fixed deposit (FD), where a lump sum amount is deposited upfront, in an RD, the depositor makes fixed monthly deposits of a specified amount for the entire tenure of the deposit.

RDs are suitable for individuals who want to build a savings habit and earn interest on their deposits while meeting their financial goals. They offer flexibility in terms of deposit amount, tenure, and frequency of deposits. Depositors can choose the monthly deposit amount based on their financial capability and investment goals.

RDs earn interest on the deposited amount at the prevailing rate offered by the bank or financial institution. The interest is compounded quarterly or at regular intervals and added to the RD account. RDs have a fixed tenure, usually ranging from six months to ten years, during which the deposits are made regularly.

While premature withdrawal of RDs may be allowed by some banks, it may attract penalties or lower interest rates. Therefore, it's advisable to continue the RD until maturity to maximize returns. Upon maturity, RDs may be automatically renewed for another tenure at prevailing interest rates, providing continuity of investment and interest earnings.

Recurring deposits are ideal for individuals looking to save and accumulate funds over time for specific financial goals such as education, marriage, home purchase, or retirement. They offer a disciplined approach to saving and earning interest on regular deposits, making them a popular choice among investors.

What are the types of recurring deposit?

Types of Recurring Deposits (RD):

Recurring deposits (RDs) come in various types, catering to different investment needs and preferences. While the basic structure of RDs remains the same, there may be variations in terms of features, tenure, and interest rates. Here are some common types of recurring deposits:

Regular Recurring Deposits: Regular RDs are the most common type, where individuals make fixed monthly deposits of a specified amount for a predetermined period. The interest rate is fixed at the time of opening the RD and remains constant throughout the tenure.

Senior Citizen Recurring Deposits: Senior citizen RDs are specifically designed for individuals above a certain age (typically 60 years or older). These RDs may offer higher interest rates compared to regular RDs to provide additional income for senior citizens during retirement.

Tax-Saving Recurring Deposits: Tax-saving RDs, also known as tax-saving RDs, allow individuals to claim tax benefits under Section 80C of the Income Tax Act, 1961. Depositors can invest a certain amount of money in these RDs for a fixed tenure (usually five years) and claim deductions from taxable income.

Flexi Recurring Deposits: Flexi RDs offer flexibility in terms of deposit amount and frequency. Depositors can vary the monthly deposit amount within a certain range or skip deposits altogether without incurring penalties. These RDs are suitable for individuals with irregular income or fluctuating financial commitments.

Special Purpose Recurring Deposits: Some banks may offer special-purpose RDs tailored to specific needs such as education, marriage, or retirement planning. These RDs may come with customized features, tenure options, and preferential interest rates to help individuals achieve their financial goals.

Each type of recurring deposit has its own features, benefits, and suitability for different investors. Individuals should choose the type of RD that aligns with their investment objectives, risk tolerance, and financial needs.

What are the features and benefits of recurring deposit?

Features and Benefits of Recurring Deposit (RD):

- Regular Savings: RDs encourage regular savings by allowing individuals to deposit a fixed amount of money every month for a predetermined period. This helps inculcate a savings discipline and ensures consistent accumulation of funds over time.

- Flexible Tenure: RDs offer flexibility in terms of tenure, allowing depositors to choose the duration of the deposit according to their financial goals and investment horizon. Tenure options typically range from six months to ten years, providing investors with the flexibility to align their investments with their specific needs.

- Fixed Interest Rate: RDs offer a fixed rate of interest throughout the tenure of the deposit, providing certainty and predictability of returns to investors. The interest rate is determined at the time of opening the RD and remains unchanged, regardless of fluctuations in market interest rates.

- Compounded Interest: The interest earned on RDs is compounded at regular intervals (usually quarterly) and added to the principal amount. This results in the gradual growth of the investment over time, as the interest is calculated on the cumulative deposit amount.

- Low Risk: RDs are considered low-risk investments as they are backed by the issuing bank or financial institution. The principal amount invested in the RD is generally protected, and depositors are assured of receiving the predetermined interest income at maturity.

- Tax Benefits: While RDs do not offer tax benefits similar to tax-saving investments, the interest earned on RDs is taxable as per the individual's income tax slab rates. However, individuals can plan their RD investments strategically to minimize tax liability and optimize returns.

How does a rd works?

How Does a Recurring Deposit (RD) Work?

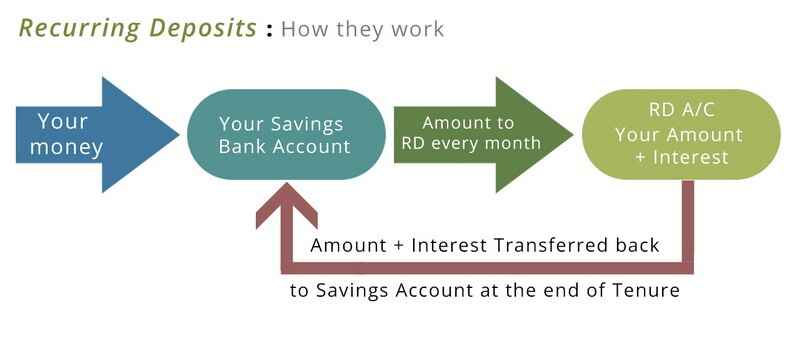

A recurring deposit (RD) operates on the principle of regular savings and cumulative interest earnings. It allows individuals to deposit a fixed amount of money at regular intervals, typically monthly, over a predetermined period, known as the tenure. Here's how the process of opening and operating an RD typically works:

- Opening an RD: To open an RD, the depositor needs to visit a bank or financial institution and fill out an application form. The form requires details such as the deposit amount, tenure, and frequency of deposits (usually monthly). The depositor may need to provide identification documents such as PAN card, Aadhaar card, passport, or driving license for KYC (Know Your Customer) verification.

- Depositing Funds: Once the RD account is opened, the depositor starts depositing a fixed amount of money at regular intervals, usually monthly, into the RD account. The amount deposited remains constant throughout the tenure of the RD.

- Earning Interest: The deposited amount earns interest at the prevailing rate offered by the bank or financial institution. The interest is compounded at regular intervals (usually quarterly) and added to the principal amount. As a result, the interest is calculated on the cumulative deposit amount, leading to the gradual growth of the investment over time.

- Fixed Tenure: RDs have a fixed tenure, typically ranging from six months to ten years, during which the deposits are made regularly. At the end of the tenure, the RD matures, and the depositor receives the maturity amount, which includes the principal amount along with accumulated interest.

- Withdrawal or Renewal: Upon maturity, the depositor has the option to withdraw the maturity amount or renew the RD for another tenure. If the depositor chooses to withdraw the amount, they receive the maturity proceeds either in cash or credited to their bank account. Alternatively, they can opt for automatic renewal of the RD for another tenure at prevailing interest rates.

Overall, recurring deposits provide a convenient and disciplined way for individuals to save and earn interest on their deposits while working towards their financial goals. They offer stability, regular savings, and cumulative interest earnings, making them a popular choice among investors seeking steady returns.

Who is eligible for rd?

Eligibility for Recurring Deposit (RD):

Recurring deposits (RDs) are a popular savings option offered by banks and financial institutions, and they are available to a wide range of individuals. Here's a look at who is eligible to open an RD:

- Resident Individuals: Resident individuals, both salaried and self-employed, are eligible to open RDs with banks or financial institutions. They can open RD accounts in their own name or jointly with another individual.

- Minors: Minors, under the guardianship of their parents or legal guardians, can also invest in RDs. The RD account can be opened in the name of the minor, with the parent or guardian acting as the signatory.

- Senior Citizens: Senior citizens, typically aged 60 years or older, are eligible to open RD accounts with banks. Some banks offer special RD schemes with higher interest rates for senior citizens to provide additional income during retirement.

- Hindu Undivided Families (HUFs): HUFs, which consist of members of a family bound together by bloodline and commonality of property, can also invest in RDs.

- Trusts, Partnerships, and Corporates: Trusts, partnerships, companies, and other corporate entities are eligible to open RD accounts for investment purposes. They may have separate procedures and documentation requirements for opening RD accounts.

It's important to note that eligibility criteria may vary depending on the bank or financial institution's policies and regulations governing RDs. Additionally, individuals may need to fulfill KYC (Know Your Customer) requirements and provide identification documents such as PAN card, Aadhaar card, passport, or driving license to open an RD account.

What are the taxation on rd earnings?

Taxation on Recurring Deposit (RD) Earnings:

The interest earned on recurring deposits (RDs) is subject to taxation as per the income tax laws of the country. In India, the interest earned on RDs is treated as income and is taxable under the Income Tax Act, 1961. Here are the key points regarding taxation on RD earnings:

- TDS (Tax Deducted at Source): Banks and financial institutions are required to deduct Tax Deducted at Source (TDS) on the interest earned on RDs if the interest income exceeds a certain threshold. The current threshold for TDS on RD interest is ₹40,000 for individuals below 60 years of age and ₹50,000 for senior citizens aged 60 years and above.

- Income Tax Slabs: The interest income earned on RDs is added to the individual's total income for the financial year and taxed as per the applicable income tax slab rates. The income tax slabs determine the rate at which the interest income is taxed based on the individual's total income.

- Taxation for Senior Citizens: Senior citizens (individuals aged 60 years and above) may avail of higher exemption limits on RD interest income. They can claim tax benefits under Section 80TTB of the Income Tax Act, which allows for a deduction of up to ₹50,000 on interest income earned from deposits with banks, post offices, and cooperative banks.

- Tax-Saving RDs: Unlike tax-saving fixed deposits, there are no specific RDs that offer tax benefits under Section 80C of the Income Tax Act. The interest earned on RDs is fully taxable as per the individual's income tax slab rates.

- Taxation on Premature Withdrawal: In the case of premature withdrawal of RDs before the completion of the tenure, the interest earned may be subject to penalty and taxation at the individual's applicable income tax slab rates.

It's important for investors to understand the taxation implications of RD earnings and plan their investments accordingly. Consulting with a tax advisor or financial planner can help individuals optimize their tax liabilities and maximize their returns from recurring deposits.

What are the Documents required for RD

Documents Required for Recurring Deposit (RD):

Opening a recurring deposit (RD) typically requires minimal documentation, but certain documents are necessary to comply with Know Your Customer (KYC) regulations and verify the depositor's identity and address. Here are the commonly required documents:

- Identity Proof: Valid government-issued identification documents such as Aadhaar card, PAN card, passport, voter ID card, or driver's license are required to verify the depositor's identity. These documents contain personal details such as name, photograph, and unique identification number.

- Address Proof: Documents that serve as proof of address are necessary to verify the residential address of the depositor. Accepted address proof documents include Aadhaar card, passport, utility bills (electricity, water, gas), bank statements, rent agreement, or any government-issued document containing the residential address.

- Photographs: Recent passport-size photographs of the depositor may be required for identification purposes and record-keeping by the bank or financial institution.

- PAN Card: The Permanent Account Number (PAN) card is mandatory for individuals opening recurring deposits exceeding ₹50,000 in a financial year. It is used for tax reporting and compliance purposes and helps track high-value transactions.

- Other KYC Documents: Additional KYC documents may be required as per the bank's policies and regulatory requirements. These may include declaration forms, nominee details, signature specimens, and any other documents deemed necessary by the bank or financial institution.

It's important for depositors to provide accurate and up-to-date documentation to comply with KYC norms and ensure smooth processing of their RD applications. Banks and financial institutions may have specific requirements, so individuals should inquire about the documents needed before opening an RD.