Your car insurance premium is calculated using several factors, and mileage is one of them. But what happens if your policy reflects the wrong mileage on the clock? Let’s dive into the potential consequences and solutions.

Why Mileage Matters

Mileage gives insurance providers insight into your driving habits. High mileage indicates greater risk exposure, while low mileage suggests less time on the road. Incorrect mileage can lead to:

- Higher Premiums: If overstated, you may pay more than necessary.

- Claim Denials: Discrepancies during a claim may cause complications.

Steps to Correct Wrong Mileage

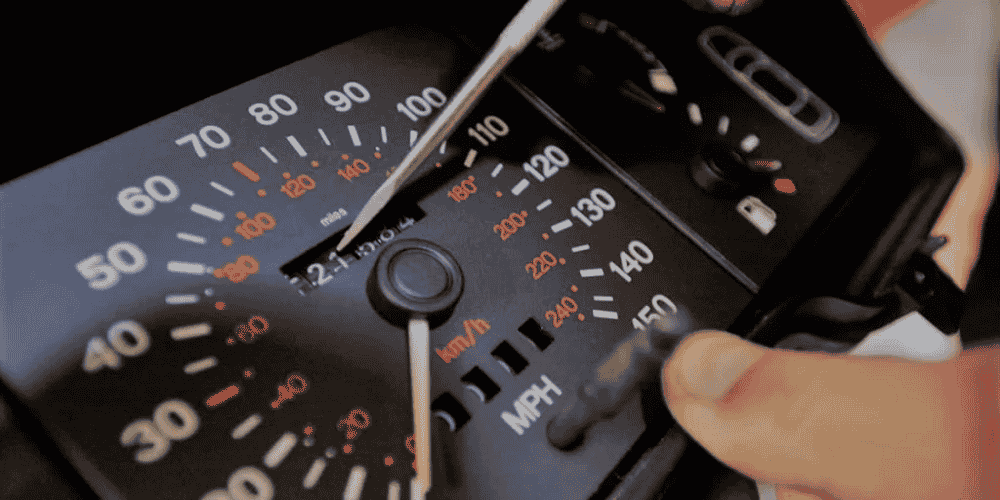

- Verify Your Odometer Reading: Check your vehicle to confirm the actual mileage.

- Contact Your Insurance Provider: Inform them about the error and provide accurate details.

- Update Your Policy: Request a revised document to avoid future issues.

Preventing Future Mistakes

Provide accurate information when purchasing or renewing insurance. Double-check all policy details, especially when switching companies or making changes.

FAQs

Q: Can wrong mileage affect my insurance claims?

A: Yes, incorrect mileage could lead to claim delays or rejections. Always keep your policy updated.

Q: Do insurance companies verify mileage?

A: Some may request odometer readings, especially during claims or policy renewals.

.jpg)

Leave A Comment

0 Comment