Florida is known for its sunshine, beautiful coastlines, and vibrant cities. But if you're a driver in the Sunshine State, there's another reality you can't ignore: car insurance. Florida ranks among the most expensive states in the U.S. for auto insurance. Whether you’re a new driver, a recent transplant, or just looking to save money, understanding car insurance in Florida is essential. In this guide, we’ll walk you through everything from state requirements to cost-saving tips and common pitfalls.

Why Is Car Insurance So Expensive in Florida?

Florida's high insurance rates are due to a combination of factors:

- No-Fault System: Florida follows a no-fault insurance model, which means your insurance pays for your injuries regardless of who caused the accident. This leads to higher claim frequency.

- High Fraud Rates: Florida experiences a significant amount of insurance fraud, especially related to personal injury protection (PIP) claims.

- Extreme Weather: Hurricanes and flooding are common, which raises comprehensive insurance rates.

- Dense Traffic and Tourism: More drivers—especially tourists unfamiliar with local roads—lead to more accidents.

Minimum Car Insurance Requirements in Florida

Florida law requires all drivers to carry at least the following insurance coverage:

- Personal Injury Protection (PIP): $10,000 minimum

- Property Damage Liability (PDL): $10,000 minimum

Florida does not require Bodily Injury Liability (BIL) insurance unless you've been in certain types of accidents or have specific driving offenses on your record.

However, these minimums may not provide sufficient coverage. Medical bills and car repairs can easily exceed these limits, so many drivers opt for additional coverage.

Types of Car Insurance Coverage Available

Here’s a breakdown of the most common car insurance options in Florida:

1. Personal Injury Protection (PIP)

Covers your medical expenses and lost wages after an accident, regardless of fault. Required by Florida law.

2. Property Damage Liability (PDL)

Covers damage you cause to other people’s property with your car. Also required.

3. Bodily Injury Liability (BIL)

Covers injuries to others if you’re at fault in an accident. Optional in Florida but often recommended.

4. Collision Coverage

Pays for damage to your vehicle in an accident, regardless of who is at fault.

5. Comprehensive Coverage

Covers non-collision events like theft, vandalism, or hurricane damage.

6. Uninsured/Underinsured Motorist (UM/UIM)

Protects you if you're hit by a driver who doesn’t have insurance or has insufficient coverage.

Optional Add-ons Worth Considering

Florida drivers may also consider:

- Roadside Assistance: Towing, flat tire changes, and other emergency services.

- Rental Reimbursement: Covers the cost of a rental car while your vehicle is being repaired.

- Gap Insurance: If you finance or lease your vehicle, this covers the difference between what you owe and the car’s value if it’s totaled.

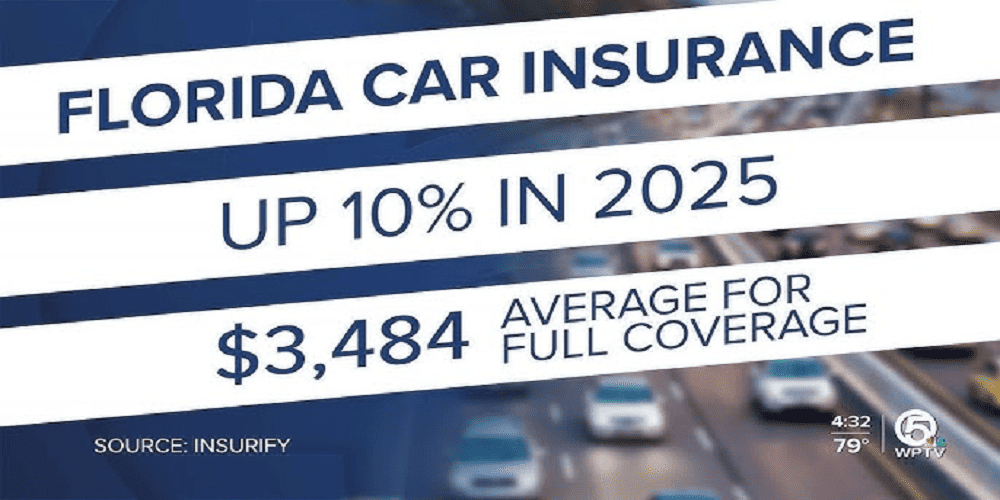

How Much Does Car Insurance Cost in Florida?

On average, Florida drivers pay about $2,400 to $2,800 annually for full coverage. For minimum coverage, costs range from $800 to $1,200 per year. Factors influencing cost include:

- Age and Gender

- Driving History

- ZIP Code

- Vehicle Type

- Credit Score

- Coverage Amounts

Young drivers and those in metropolitan areas like Miami or Orlando often pay higher premiums.

Cheapest Car Insurance Providers in Florida

While rates vary, some companies consistently offer competitive pricing:

- State Farm: Popular for affordable full coverage and customer satisfaction.

- GEICO: Known for low premiums and extensive discounts.

- Progressive: Good for high-risk drivers and those needing flexible coverage.

- Allstate: Offers various bundling discounts.

- USAA: Great for military families, though membership is limited.

How to Save on Car Insurance in Florida

Here are some strategies to reduce your premium:

1. Shop Around

Rates vary by provider. Compare quotes from at least 3–5 insurers.

2. Bundle Policies

Many insurers offer discounts for bundling auto with home, renters, or life insurance.

3. Maintain a Clean Driving Record

Tickets and accidents can increase your rate significantly.

4. Take a Defensive Driving Course

Completing a certified course may qualify you for a discount.

5. Adjust Your Coverage

Opt for higher deductibles or drop unnecessary coverage on older cars.

6. Use Telematics

Many insurers offer discounts if you allow them to track your driving habits via an app.

What Happens If You Drive Without Insurance in Florida?

Driving uninsured in Florida is a serious offense. Penalties may include:

- License suspension

- Vehicle registration suspension

- Fines up to $500

- Reinstatement fees

- Potential jail time for repeat offenses

SR-22 and FR-44 in Florida

If you've had a DUI or certain violations, Florida may require an SR-22 or FR-44:

- SR-22: Proof of minimum liability insurance after a serious offense.

- FR-44: Required after DUI convictions, mandates higher coverage limits.

These forms must be filed by your insurance company directly with the state.

Special Considerations for Snowbirds and Seasonal Residents

Florida is a popular destination for seasonal residents. If you're only living in Florida part of the year:

- You may be required to register your vehicle and obtain Florida insurance if you spend more than 90 days annually in the state.

- Some insurers offer seasonal policies or let you adjust your coverage during off months.

Car Insurance for Teens and New Drivers

Adding a teen to your policy can double your premium. Ways to save include:

- Good student discounts

- Driver’s ed course completion

- Adding them to the family policy instead of getting their own

High-Risk Drivers: What Are Your Options?

If you're considered high-risk due to multiple accidents or violations:

- Look into non-standard insurance providers

- Try usage-based insurance (pay-as-you-go)

- Join the Florida Automobile Joint Underwriting Association (FAJUA) if you can't get standard coverage

Electric Cars and Car Insurance in Florida

Electric vehicles (EVs) often cost more to insure because of expensive parts and repairs. However, some insurers offer green vehicle discounts. Keep in mind:

- EVs may qualify for federal or state incentives

- Charging equipment and battery repairs may affect your coverage needs

Insurance When You Move to Florida

If you're relocating:

- You must update your registration and get Florida insurance within 10 days of establishing residency

- Be aware that rates may be significantly different from your previous state

- Florida's no-fault system may be a big change if you're coming from a tort-based state

Common Mistakes to Avoid

- Underinsuring Your Vehicle: The state minimums often aren't enough.

- Not Disclosing All Drivers: Insurers can deny claims if unlisted drivers are involved in an accident.

- Letting Coverage Lapse: Even a short lapse can lead to higher rates or legal penalties.

- Failing to Update Information: Report address or vehicle changes promptly.

FAQs About Car Insurance in Florida

Q1: Is car insurance mandatory in Florida?

Yes, all registered vehicles must carry a minimum of $10,000 in PIP and $10,000 in PDL.

Q2: Can I use out-of-state insurance in Florida?

No. Once you become a Florida resident or register a vehicle in Florida, you must carry a Florida-based policy.

Q3: Why is Florida a no-fault state?

The no-fault system is designed to streamline claims and reduce lawsuits. However, it also contributes to higher premiums.

Q4: What if the other driver doesn't have insurance?

If you have Uninsured Motorist coverage, your policy will pay for your injuries or damages.

Q5: How long do accidents stay on my record?

Typically 3–5 years, depending on the severity and your insurer's policies.

Q6: Does Florida require insurance for motorcycles?

Yes, but the rules differ. Motorcyclists must have financial responsibility and may need to show proof after a crash.

Q7: Can I get car insurance without a license?

Some insurers offer coverage to unlicensed drivers, often for car owners who don’t drive but want to insure the vehicle.

Q8: How soon do I need to get insurance after buying a car?

Immediately. You can’t register the vehicle without proof of insurance.

Q9: Can I pause my insurance if I'm not driving?

Some insurers allow coverage suspension, but your registration may also be suspended. Check with your insurer.

Q10: What's the penalty for a lapsed policy?

Fines, license suspension, and higher future premiums. It's best to avoid any lapse in coverage.

Final Thoughts

Car insurance in Florida is both a legal necessity and a financial safety net. With high accident rates, severe weather, and legal requirements, it’s crucial to have the right policy in place. Whether you're a lifelong Floridian or a new arrival, understanding your coverage options and responsibilities can save you money—and stress—down the road.

.jpg)

Leave A Comment

0 Comment