Understanding the various car insurance coverage options is essential for making informed decisions about protecting yourself and your vehicle. Here’s a breakdown of common types of coverage available in most policies.

Liability Coverage

Liability coverage is mandatory in most states and protects you financially if you're responsible for an accident that causes injury or property damage to others. It consists of two components:

- Bodily Injury Liability: Covers medical expenses and lost wages for injured parties.

- Property Damage Liability: Pays for repairs to other vehicles or property damaged in an accident.

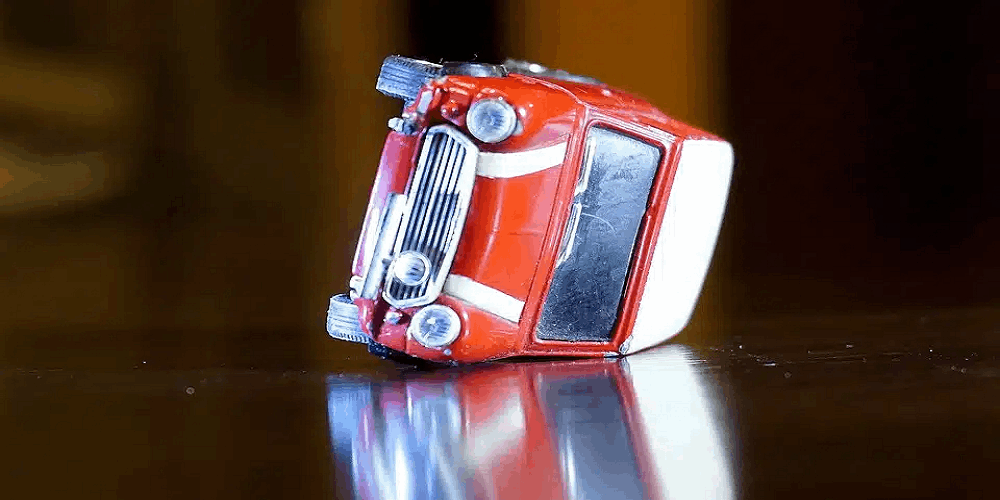

Collision Coverage

This type of coverage pays for damages to your own vehicle resulting from a collision with another car or object, regardless of fault. It’s particularly useful if you have a newer or more valuable vehicle.

Comprehensive Coverage

Comprehensive coverage protects against non-collision-related incidents such as theft, vandalism, fire, or natural disasters. This is especially important if you live in an area prone to such risks.

Personal Injury Protection (PIP)

PIP covers medical expenses for you and your passengers after an accident, regardless of fault. It may also cover lost wages and other related costs, making it a valuable addition if medical bills could be substantial.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you're involved in an accident with someone who lacks sufficient insurance or is completely uninsured. It ensures that you're not left bearing the financial burden due to another driver’s lack of coverage.

Gap Insurance

If you're financing or leasing a vehicle, gap insurance covers the difference between what you owe on the car and its current market value in case of a total loss. This is particularly relevant as new cars depreciate quickly.

Additional Options

Many insurers offer optional add-ons such as roadside assistance, rental reimbursement, and custom parts coverage. Evaluate these based on your specific needs and driving habits.

By understanding these car insurance coverage options, you can tailor a policy that best fits your lifestyle while ensuring adequate protection on the road.

.jpg)

Leave A Comment

0 Comment