Term insurance is an affordable and effective way to secure your family's financial future. In today’s fast-paced world, purchasing term insurance online has become an easy and popular option. In this guide, we will walk you through the process of buying term insurance online, what to look for, and how to ensure you’re getting the best coverage.

What is Term Insurance?

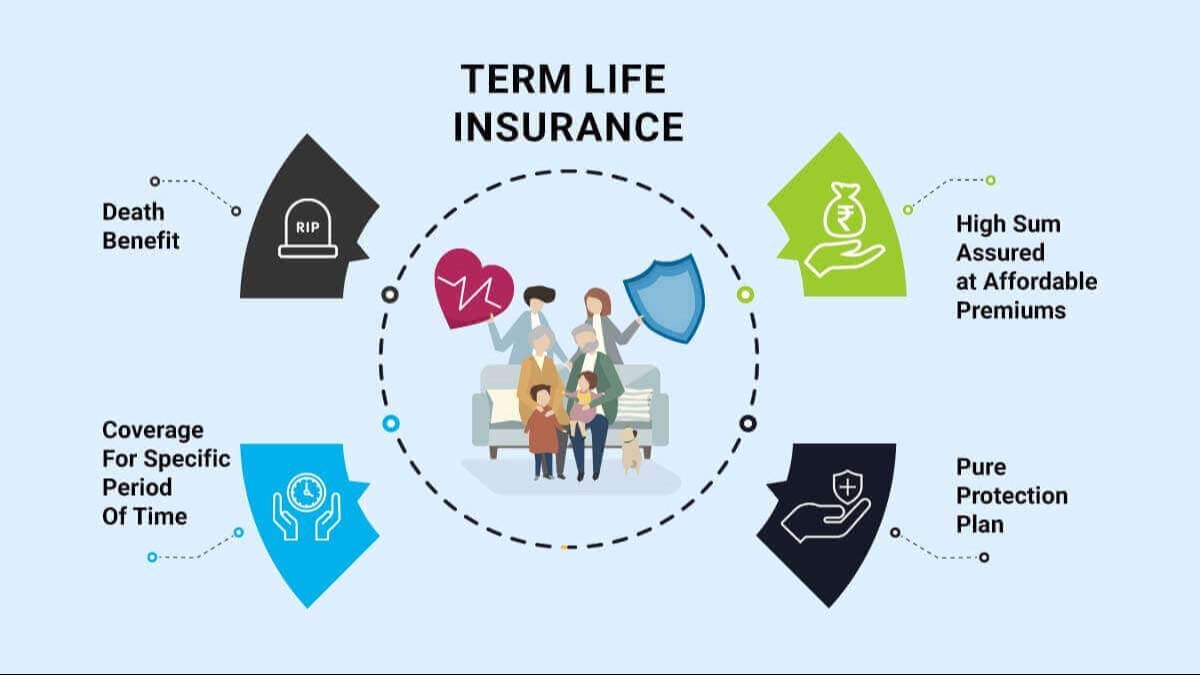

Term insurance is a type of life insurance that provides coverage for a specific period, or "term." If the policyholder passes away during this term, the insurer pays a death benefit to the designated beneficiaries. Term insurance is generally more affordable than whole life policies because it offers no cash value component and only provides a death benefit.

Why Buy Term Insurance Online?

- Convenience: The entire process can be completed from home. No need to meet with agents or go through long paperwork.

- Transparency: When you buy term insurance online, you have full access to the policy details, terms, and premium breakdowns. This allows for more informed decision-making.

- Lower Premiums: Without the need for intermediaries, online term insurance often comes with reduced premiums. This means you can get the same coverage for a lower price compared to buying offline.

- Faster Processing: Online applications are processed more quickly, meaning you can have your policy activated sooner.

Steps to Buy Term Insurance Online

- Assess Your Insurance Needs:

Consider your family's financial needs, your debts, and future obligations before deciding on the coverage amount. - Choose the Right Term:

The duration of your term insurance is important. You may want to choose a policy that lasts until your retirement or until your children are financially independent. - Compare Policies:

Many websites offer tools to compare different term insurance policies from leading insurers. This is a crucial step to ensure you're getting the best coverage at the most affordable price. - Check for Riders:

Riders are add-ons that provide additional coverage for specific events, like accidental death or critical illness. Review the available riders and consider if any are applicable to your situation. - Submit Documents and Pay Online:

Once you've chosen the right policy, you can complete the application by uploading necessary documents like identity proof and income details. Payment is also made online, and once completed, you will receive your policy documents via email.

Benefits of Term Insurance

- Affordable Premiums: Term insurance provides a high sum assured at a relatively low premium.

- Financial Security: It ensures that your loved ones are financially secure in case something happens to you.

- Flexibility: You can choose the policy term and the coverage amount based on your financial situation.

Buying term insurance online is a smart, convenient, and efficient way to secure your family's financial future. Take advantage of the transparency, lower premiums, and flexibility offered by online platforms, and protect your loved ones without hassle.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Leave A Comment

0 Comment