When it comes to protecting your family’s financial future, term insurance stands out as one of the most cost-effective and reliable options. In India, a ₹1 crore term insurance plan has become increasingly popular among salaried professionals, entrepreneurs, and young families seeking adequate coverage at affordable premiums.

This comprehensive guide will help you understand what a 1 crore term insurance plan is, why it matters, which are the best options available in 2025, and how to choose the most suitable one for your needs.

What Is a Term Insurance Plan?

A term insurance plan is a pure protection life insurance policy that provides financial security to your dependents in case of your untimely demise during the policy tenure. The insurer pays the sum assured (in this case ₹1 crore) to the nominee if the policyholder dies during the term.

Unlike other life insurance products such as endowment or ULIPs, term plans do not offer any maturity benefit. This simplicity makes them more affordable and ideal for individuals who want high coverage at low premiums.

For example, a 30-year-old non-smoker can get a ₹1 crore cover for as low as ₹600–₹800 per month, depending on the insurer and policy term.

Why Choose a ₹1 Crore Term Insurance Plan?

A ₹1 crore term insurance plan offers a substantial financial cushion that can cover:

- Family’s living expenses: It ensures that your family can maintain their lifestyle and daily needs even after your demise.

- Children’s education: The payout can fund higher education or marriage expenses.

- Outstanding debts: It helps pay off home loans, car loans, or other financial liabilities.

- Inflation protection: With rising costs, ₹1 crore coverage ensures future needs are met without compromise.

- Peace of mind: Knowing that your family’s financial future is secure brings immense relief.

Who Should Buy a ₹1 Crore Term Insurance Plan?

A ₹1 crore term insurance policy is suitable for:

- Salaried professionals with dependents and loans.

- Self-employed individuals with business liabilities.

- Parents who want to secure their children’s future.

- Young earners looking for affordable long-term protection.

- Individuals with multiple financial dependents.

Factors to Consider Before Choosing the Best ₹1 Crore Term Insurance Plan

Selecting the right term insurance plan requires careful evaluation of various aspects.

1. Claim Settlement Ratio (CSR)

The claim settlement ratio reflects how many claims an insurer has settled successfully out of the total received. A higher CSR (above 95%) indicates reliability and trustworthiness.

2. Premium Affordability

Premiums vary based on age, health, lifestyle, and policy term. Compare premiums across multiple insurers to get the best value without compromising on coverage.

3. Policy Tenure

Choose a policy term that covers you until at least retirement age (60–65 years). Some insurers also offer coverage up to 80 or 85 years of age.

4. Riders and Add-ons

Enhance your base policy with riders such as:

- Accidental death benefit

- Critical illness cover

- Waiver of premium

- Income benefit rider

These options provide broader protection against unforeseen events.

5. Insurer Reputation

Choose a company known for prompt claim processing, transparent policy terms, and strong customer service.

6. Online vs Offline Purchase

Buying term insurance online is usually cheaper due to reduced agent commissions and simplified processing.

Top 10 Best Term Insurance Plans for ₹1 Crore in 2025

Here are some of the leading term insurance policies in India that offer ₹1 crore coverage:

1. HDFC Life Click 2 Protect Super

- Flexible premium payment options.

- Coverage till age 85.

- Riders for accidental and critical illness benefits.

- High claim settlement ratio above 98%.

2. LIC Tech Term Plan

- Offered by India’s most trusted insurer.

- Online policy with lower premiums than offline options.

- Coverage up to 80 years.

- Simple claim process and reliability.

3. ICICI Prudential iProtect Smart

- Covers 34 critical illnesses.

- Option for income payout instead of lump sum.

- Claim settlement ratio over 97%.

- Specal discounts for female and non-smoking policyholders.

4. Max Life Smart Secure Plus

- Offers return of premium option.

- Critical illness and accident riders available.

- Long policy term up to 85 years.

- Claim settlement ratio of 99.5%.

5. Tata AIA Sampoorna Raksha Supreme

- Life cover till 100 years of age.

- Options for regular, limited, or single pay.

- Additional benefits for women and non-smokers.

- Flexible payout modes (lump sum or monthly).

6. SBI Life eShield Next

- Increasing cover option available.

- Comprehensive rider protection.

- Strong CSR of 97.05%.

- Suitable for both salaried and self-employed individuals.

7. Bajaj Allianz Life eTouch Term

- Provides comprehensive coverage at competitive rates.

- Includes accidental and critical illness riders.

- Flexible premium payment options.

- User-friendly claim process.

8. Aditya Birla Sun Life DigiShield Plan

- 10 plan options with income replacement features.

- Joint life coverage available.

- Suitable for those seeking customization.

- Claim settlement ratio above 98%.

9. PNB MetLife Mera Term Plan Plus

- Life stage benefits with increasing cover.

- Option to cover spouse under same plan.

- Add-ons for terminal illness and disability.

- Affordable premiums.

10. Kotak e-Term Plan

- Pure protection at a low cost.

- Covers up to age 75.

- Add-on benefits available.

- Simple online purchase process.

Benefits of a ₹1 Crore Term Insurance Plan

1. High Coverage at Low Cost

Term insurance is the most economical way to get ₹1 crore coverage for just a few hundred rupees per month.

2. Financial Security

It guarantees your family’s financial independence in case of your untimely death.

3. Tax Benefits

Premiums paid are eligible for deduction under Section 80C, and the death benefit is tax-free under Section 10(10D) of the Income Tax Act.

4. Flexible Payment Options

Choose between monthly, quarterly, yearly, or limited-pay premium modes.

5. Rider Flexibility

Add riders to enhance protection based on your financial goals and family requirements.

6. Return of Premium Option

Some insurers offer a return of premium feature, refunding total paid premiums if the policyholder survives the term.

How to Choose the Right ₹1 Crore Term Insurance Plan

Follow these steps to make an informed choice:

- Evaluate your financial needs: Consider dependents, existing loans, and future expenses.

- Determine ideal tenure: Choose coverage until at least retirement or until major financial obligations are settled.

- Compare multiple plans: Use online comparison portals for accurate premium and feature analysis

- Check insurer credibility: Review claim settlement history and customer feedback.

- Disclose accurate information: Always provide truthful details about health, income, and habits to avoid claim rejection.

- Review add-ons carefully: Include riders that match your lifestyle and risk exposure.

Tips for Getting Affordable Premiums

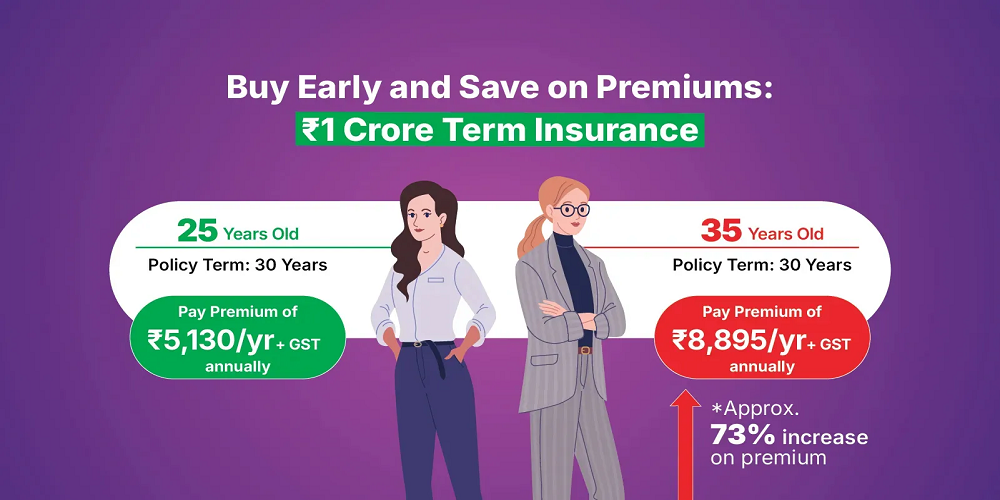

- Buy early: Younger buyers enjoy lower premiums due to lower risk.

- Choose online purchase: Online plans are 10–20% cheaper than offline ones.

- Maintain a healthy lifestyle: Non-smokers and fit individuals get better rates.

- Select annual payments: Yearly payments often come with small discounts.

- Avoid unnecessary riders: Only add essential ones to keep the premium manageable.

Common Mistakes to Avoid While Buying Term Insurance

- Underinsuring: Choosing inadequate coverage that won’t meet your family’s needs.

- Ignoring riders: Skipping critical illness or accident riders that could provide extra protection.

- Not updating policy details: Forgetting to change nominee or personal details over time.

- Lapsing on premium payments: Missing premiums can lead to policy termination.

- Not comparing policies: Choosing the first available plan without research.

How to Buy a ₹1 Crore Term Insurance Plan Online

The online process is quick and transparent:

- Visit the insurer’s official website or a trusted aggregator portal.

- Enter personal details (age, gender, income, lifestyle habits).

- Cmpare premiums and coverage options.

- Select a suitable plan and add riders if needed.

- Fill in the proposal form accurately.

- Complete the payment and medical test if required.

- Receive the policy document via email.

Best Term Insurance Plan for ₹1 Crore: Final Verdict

If you are looking for a balance between affordability, reliability, and flexibility, consider these top options in 2025:

- HDFC Life Click 2 Protect Super – for long-term coverage and strong reputation.

- Max Life Smart Secure Plus – for high claim settlement and return of premium benefit.

- ICICI Prudential iProtect Smart – for comprehensive critical illness cover.

- LIC Tech Term – for traditional trust and wide acceptance.

- Tata AIA Sampoorna Raksha Supreme – for lifetime protection options.

The “best” plan depends on your age, income, financial responsibilities, and family’s future goals.

Frequently Asked Questions (FAQs)

1. What is the minimum premium for a ₹1 crore term insurance plan?

Premiums start from around ₹600 per month for a 25–30-year-old non-smoker with a 30-year term. Rates vary depending on age, lifestyle, and medical history.

2. Can I get a ₹1 crore term insurance plan without a medical test?

Some insurers offer limited coverage without medical tests, but for ₹1 crore or higher, most require a basic health examination to ensure transparency and claim validity.

3. Is it possible to increase the sum assured later?

Yes, some plans offer life-stage benefits that let you increase coverage after major milestones such as marriage or childbirth.

4. Will the premium remain the same throughout the policy term?

Yes, once the premium is fixed at the time of purchase, it generally remains constant for the entire term unless you modify the policy.

5. What happens if I survive the policy term?

In a pure term plan, no maturity benefit is paid. However, some plans offer a return of premium (ROP) feature, where you get back all premiums paid.

6. Can NRIs buy a ₹1 crore term insurance plan in India?

Yes, NRIs and even PIOs (Persons of Indian Origin) can buy term insurance from Indian insurers, subject to medical and documentation requirements.

7. How to ensure smooth claim settlement for my family?

Provide accurate details, pay premiums on time, and inform your nominee about the policy details, insurer’s contact, and claim process.

8. Are there tax benefits available?

Yes. Premiums qualify for tax deduction under Section 80C, and the death benefit is tax-exempt under Section 10(10D).

9. Is ₹1 crore cover enough for my family?

That depends on your income and financial obligations. Ideally, your sum assured should be 10–15 times your annual income to ensure complete security.

10. Can I cancel my term insurance plan later?

Yes, you can cancel during the free-look period (usually 15–30 days) and get a refund of your premium after deduction of minimal administrative charges.

Conclusion

A ₹1 crore term insurance plan is one of the smartest financial decisions you can make to safeguard your family’s future. It provides peace of mind, high coverage at a nominal cost, and helps your loved ones maintain financial stability in your absence.

Before finalizing, compare multiple plans, check the insurer’s claim settlement ratio, read the fine print, and choose a policy that aligns with your long-term financial goals.

The best term plan is not just about the lowest premium—it’s about trust, claim reliability, and comprehensive protection for those who depend on you the most.

Leave A Comment

Fatal error: Uncaught mysqli_sql_exception: Illegal mix of collations (latin1_swedish_ci,IMPLICIT) and (utf8mb4_0900_ai_ci,COERCIBLE) for operation '=' in C:\inetpub\wwwroot\easybima\details.php:374 Stack trace: #0 C:\inetpub\wwwroot\easybima\details.php(374): mysqli_query() #1 {main} thrown in C:\inetpub\wwwroot\easybima\details.php on line 374