Cycling is more than just a hobby — for many, it’s a lifestyle, a means of commuting, a sport, and a symbol of freedom. With the increasing value of bicycles, especially high-end models and e-bikes, the risk of theft, damage, or accidental injury has also risen. That’s where bicycle insurance steps in.

In this detailed guide, you will learn everything you need to know about bicycle insurance, including its benefits, types, coverage options, cost factors, how to choose the best plan, and answers to the most frequently asked questions.

What is Bicycle Insurance?

Bicycle insurance is a type of insurance policy designed to protect your bicycle against various risks such as theft, accidental damage, vandalism, and sometimes third-party liabilities. Think of it as similar to car or motorbike insurance — but specifically crafted for bicycles.

As bicycles get more expensive and urban cycling increases, dedicated insurance has become an essential financial safety net for many cyclists.

Why Do You Need Bicycle Insurance?

While some might think insurance is unnecessary for bicycles, consider these facts:

- High-end bicycles can cost anywhere from a few hundred to several thousand dollars.

- Urban areas and campuses report high bicycle theft rates.

- Road accidents involving bicycles are common.

- Repairs and replacement costs can be significant.

A good bicycle insurance policy ensures that if your bike is stolen, damaged, or involved in an accident, you won’t bear the full financial burden alone.

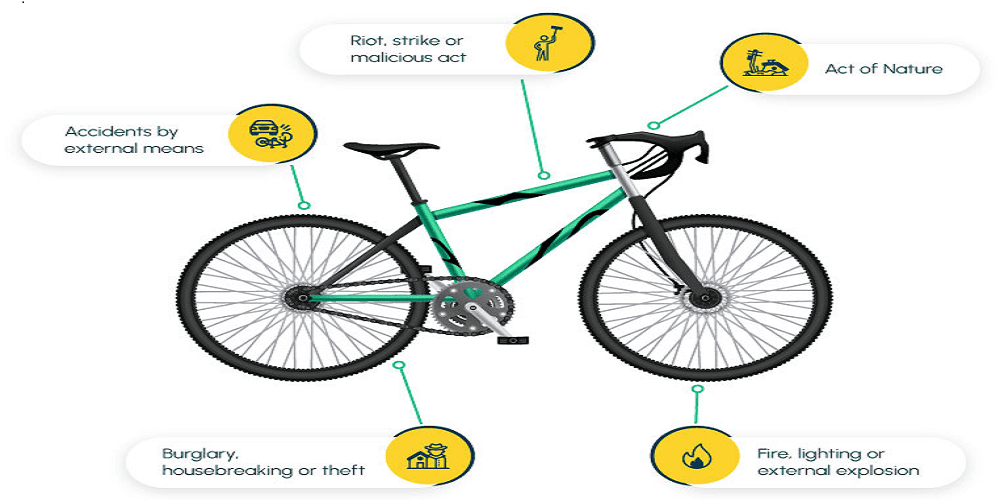

Types of Bicycle Insurance Coverage

Bicycle insurance policies come with various coverage options. Here are the most common ones:

1. Theft Coverage

This covers the cost of your bicycle if it is stolen. Some policies include partial theft coverage too — for example, if only parts like wheels or saddles are stolen.

2. Accidental Damage

If you accidentally damage your bike — say, in a crash or while transporting it — this coverage pays for repairs or replacement.

3. Vandalism

Some policies cover damages caused intentionally by others, such as vandalism while your bike is parked.

4. Third-Party Liability

If you accidentally injure someone or damage their property while riding, liability coverage protects you from the resulting legal or medical costs.

5. Personal Accident

This covers medical expenses if you’re injured while riding your insured bicycle.

6. Worldwide Coverage

For those who travel with their bike, some insurers offer worldwide coverage, so you’re protected abroad too.

What is Typically Not Covered?

Bicycle insurance policies have exclusions. Here are common ones:

- Normal wear and tear

- Damage due to poor maintenance

- Damage from racing or professional competitions (unless specifically covered)

- Theft if the bike was left unlocked or not properly secured

- Intentional damage by the owner

Always read your policy documents carefully to know the fine print.

How Much Does Bicycle Insurance Cost?

The premium for bicycle insurance depends on multiple factors:

- Value of the Bicycle: More expensive bikes cost more to insure.

- Type of Coverage: Comprehensive policies cost more than basic theft-only policies.

- Location: Urban areas with higher theft rates may lead to higher premiums.

- Security Measures: Insurers may offer discounts if you use approved locks, store your bike indoors, or register it with local databases.

- Usage: How often and where you ride (city commuting vs. mountain biking) can affect premiums.

On average, annual premiums might range from 1% to 10% of the bike’s value.

How to Choose the Right Bicycle Insurance

Choosing the best insurance plan requires careful consideration. Here’s a step-by-step guide:

1. Assess Your Bike’s Value

Determine the current market value of your bicycle, including upgrades or accessories.

2. Identify Your Risks

Are you riding daily in the city? Do you race competitively? Do you travel abroad with your bike? Your risks should guide your coverage.

3. Compare Providers

Shop around. Compare multiple insurers, looking at their reputation, claim settlement ratio, customer service, and reviews.

4. Check the Fine Print

Pay close attention to exclusions, deductibles, claim limits, and conditions for theft claims (such as lock requirements).

5. Consider Add-Ons

Some insurers offer optional add-ons like accessories cover, roadside assistance, or racing cover.

How to Make a Claim

Filing a claim for bicycle insurance typically involves these steps:

- Inform the Insurer Immediately: Notify your insurer as soon as the incident occurs.

- File a Police Report: For theft or vandalism, a police report is usually mandatory.

- Provide Proof of Ownership: Receipts, photos, or registration documents help support your claim.

- Submit Supporting Documents: Repair estimates, photographs of damage, or medical bills (for personal accident claims).

- Follow Up: Stay in touch with your insurer until the claim is settled.

Timely and accurate documentation is key to hassle-free claim approval.

Tips to Protect Your Bicycle

While insurance helps you financially, prevention is always better. Here are practical tips:

- Use a high-quality, insurer-approved lock.

- Lock your bike to a secure, immovable object.

- Park in well-lit, populated areas.

- Register your bicycle with local or national bike registration databases.

- Keep purchase receipts and take clear photos of your bike and accessories.

Bicycle Insurance vs. Homeowners or Renters Insurance

Some people rely on their homeowners or renters insurance to cover their bike. While this can work, it often has limitations:

- Coverage might be limited to theft at home, not in public.

- Claiming for a stolen bike might increase your home insurance premium.

- The deductible on home insurance might be higher than the cost of the bike.

Dedicated bicycle insurance is usually more comprehensive and specialized.

E-Bike Insurance: A Growing Need

With the boom in electric bicycles (e-bikes), specialized e-bike insurance is increasingly important. E-bikes often cost significantly more than regular bicycles and may have additional risks due to battery or motor issues.

Some insurers offer specific e-bike insurance covering:

- Battery damage

- Motor malfunction

- Higher third-party liability due to increased speeds

If you own an e-bike, ensure your policy explicitly covers electric models.

How to Reduce Your Premium

To save on bicycle insurance, consider these tips:

- Use Approved Locks: Many insurers provide discounts for using locks from an approved list.

- Store Safely: Secure indoor storage or garages can lower premiums.

- Bundle Policies: Some insurers offer discounts if you buy bicycle insurance along with home or auto insurance.

- No-Claim Discounts: Renewing your policy without claims can earn you a discount.

Popular Bicycle Insurance Providers

While providers vary by country, here are a few popular names globally known for bicycle insurance:

- Velosurance: A US-based specialist bicycle insurer.

- Yellow Jersey: A UK provider focused on cycle insurance.

- Laka: Offers community-powered insurance for cyclists.

- Markel: Offers bike-specific cover with optional add-ons.

Always check if they operate in your region and compare their features.

Common Myths About Bicycle Insurance

Let’s debunk some misconceptions:

Myth 1: “It’s not worth it for cheap bikes.”

Truth: Even a modest bike can be costly to replace, and liability protection is valuable regardless of your bike’s price.

Myth 2: “Home insurance is enough.”

Truth: Home insurance may not cover theft outside your home or accidental damage during rides.

Myth 3: “Claims are never approved.”

Truth: If you follow the policy conditions (like using an approved lock), reputable insurers settle valid claims promptly.

The Future of Bicycle Insurance

The bicycle insurance market is evolving with the rise in e-bikes, smart locks, GPS tracking, and app-based policy management. Many insurers now use technology for:

- Instant policy purchase via apps.

- Real-time claim tracking.

- GPS tracking integration for stolen bikes.

- Usage-based insurance where premiums depend on how much and where you ride.

This tech-driven approach makes modern bicycle insurance more convenient and efficient.

Final Thoughts

Bicycle insurance offers peace of mind to cyclists — whether you ride to work, for fitness, or for adventure. It’s an affordable way to protect your investment and your financial security in case of mishaps.

Before you hit the road, ask yourself: If my bike were stolen or badly damaged today, could I easily afford a replacement? If the answer is no, then bicycle insurance is a smart, practical decision.

Frequently Asked Questions (FAQs)

1. Is bicycle insurance mandatory?

No, unlike car insurance, bicycle insurance is not mandatory in most countries. However, it is strongly recommended, especially for expensive bikes or regular commuters.

2. Can I insure multiple bikes under one policy?

Many insurers allow you to cover multiple bicycles under a single policy. Some offer discounts for insuring more than one bike.

3. Does bicycle insurance cover accessories?

Some policies include or offer optional coverage for accessories such as helmets, lights, panniers, or GPS devices. Check your policy details.

4. Can I get insurance if I build my own bike?

Yes, but you will need proof of value — receipts for components, or a valuation from a professional bike shop.

5. What should I do if my claim is rejected?

First, review the reason for rejection and your policy terms. If you believe the rejection is unfair, escalate it with your insurer’s grievance cell or insurance ombudsman.

Conclusion

In 2025, with cycling booming as a healthy, eco-friendly, and cost-effective mode of transport, protecting your bicycle with dedicated insurance is wise. It shields you from unexpected costs and gives you confidence every time you take your bike on the road.

Whether you ride an entry-level commuter bike, a carbon-frame road racer, or an electric mountain bike, the right insurance policy keeps you covered, so you can focus on enjoying the ride.

.jpg)

Leave A Comment

0 Comment