When it comes to insuring your two-wheeler, PolicyBazaar has emerged as a popular platform for comparing and purchasing insurance policies. Two-wheeler insurance is mandatory in India and several other countries, but the right insurance policy doesn’t just fulfill a legal requirement—it also provides critical financial protection in case of accidents, theft, or damage. Here’s what you need to know about purchasing two-wheeler insurance on PolicyBazaar.

1. Why Choose PolicyBazaar for Two-Wheeler Insurance?

PolicyBazaar is one of India’s leading insurance comparison platforms, known for its simplicity, transparency, and variety of choices. By providing a one-stop solution for comparing policies from top insurers, PolicyBazaar makes it easy for consumers to find the best coverage at the best price.

- Ease of Use: PolicyBazaar’s platform is user-friendly and intuitive. Within a few clicks, you can compare different insurers, evaluate policy features, and finalize your purchase.

- Transparency: One of the biggest advantages of PolicyBazaar is its transparency. It allows you to view policy terms, premium details, and coverage options without hidden fees or last-minute surprises.

- Tailored Plans: Whether you’re looking for a basic third-party liability cover or comprehensive insurance with extra features like theft protection and personal accident cover, PolicyBazaar provides a wide range of options tailored to your needs.

2. Types of Two-Wheeler Insurance Offered on PolicyBazaar

When you shop for two-wheeler insurance on PolicyBazaar, you’ll generally come across two main types of policies:

- Third-Party Liability Insurance: This is the minimum legal requirement for two-wheelers in most regions. It covers damage or injury to a third party caused by your vehicle but does not cover damage to your own bike.

- Comprehensive Insurance: This provides broader coverage, including third-party liability and protection against damage to your own vehicle from accidents, theft, natural disasters, and more.

3. Key Features of PolicyBazaar’s Two-Wheeler Insurance Plans

The two-wheeler insurance policies available on PolicyBazaar come with a host of features, including:

- Cashless Claims: Many policies offer a network of garages where you can avail cashless repairs, making the claims process hassle-free.

- No Claim Bonus (NCB): If you have not made any claims during the policy period, you may be eligible for a no-claim bonus, which can significantly reduce your renewal premium.

- Add-On Covers: Policyholders can opt for add-ons like engine protection, zero depreciation cover, roadside assistance, and more.

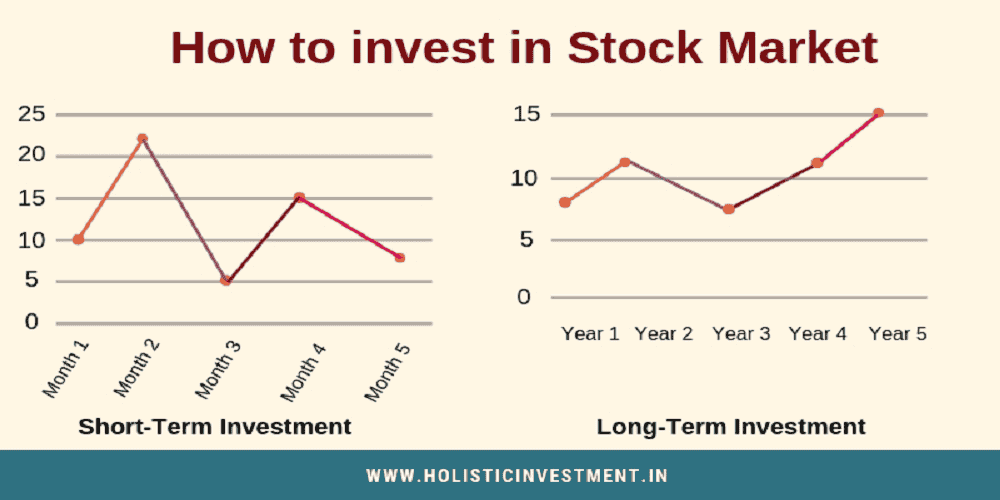

4. How to Choose the Best Two-Wheeler Insurance on PolicyBazaar?

With the variety of options available, it can be challenging to choose the right policy. Here’s how to make an informed decision:

- Compare Premiums: Use PolicyBazaar’s premium comparison tool to see the price differences between insurers. Be mindful of what the policy covers instead of just choosing the cheapest option.

- Review Coverage: Ensure that the coverage suits your needs. If you live in an area prone to theft, comprehensive insurance with theft protection may be essential.

- Check for Add-Ons: Consider add-ons based on your riding habits and the value of your two-wheeler. If you have a newer model, features like zero depreciation cover can be worth the extra cost.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Leave A Comment

0 Comment