Mutual fund can be a best way to grow youy savings

Mutual Fund

A mutual fund is like a big pot of money that lots of people put their savings into. Instead of investing in just one thing, like a single stock or bond, a mutual fund spreads the money out across many different investments. These investments can include stocks (which are pieces of ownership in companies), bonds (which are loans to companies or governments), and other assets.

Think of a mutual fund as a team effort. When you invest in a mutual fund, you're buying shares of that fund. Each share represents a small piece of the entire pot of money. Professional money managers are in charge of deciding where to invest the money in the fund. They study the markets, research companies, and make choices based on what they think will make the most money for the investors.

One of the best things about mutual funds is that they're managed by experts, so you don't have to be a financial genius to invest. Plus, because your money is spread out over many investments, it's less risky than putting all your savings into just one stock or bond. Mutual funds also offer flexibility—you can buy or sell shares at any time, and you can choose from different types of funds to match your financial goals and risk tolerance.

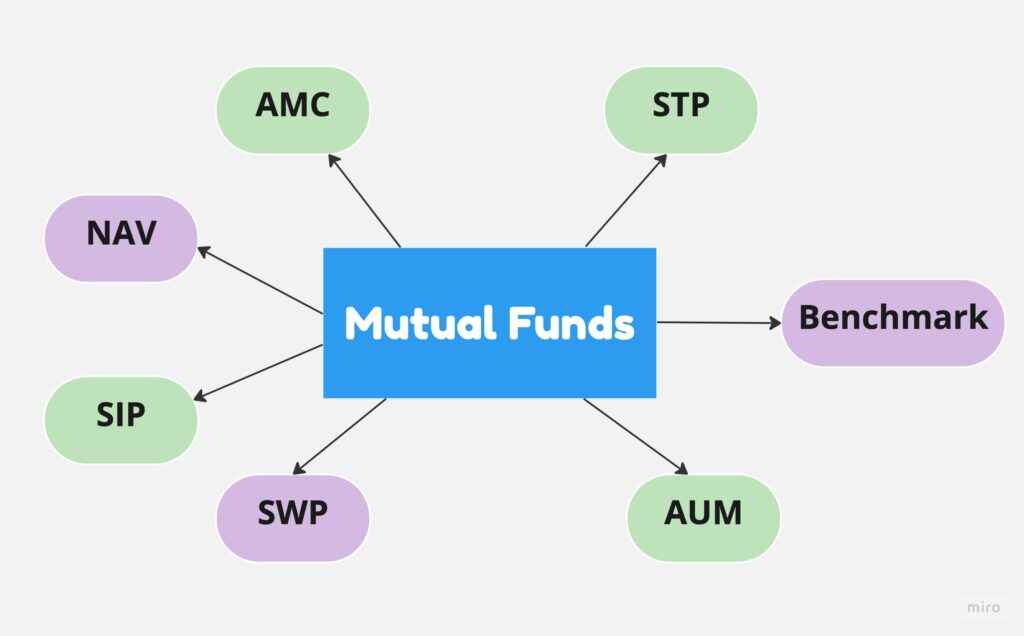

Mutual Fund Terminologies

Common Terminologies of Mutual Funds:

Understanding the language of mutual funds can help investors navigate the world of investing more confidently. Here are some common terminologies you might encounter:

- Net Asset Value (NAV): NAV represents the per-share value of a mutual fund. It's calculated by dividing the total value of all the fund's assets minus liabilities by the number of outstanding shares.

- Expense Ratio: The expense ratio is the percentage of a mutual fund's assets that are used to cover its operating expenses, including management fees, administrative costs, and other expenses. It's deducted from the fund's assets before calculating the NAV.

- Load: A load is a sales charge or commission that investors may pay when buying or selling shares of a mutual fund. Front-end loads are charged at the time of purchase, while back-end loads are charged when selling shares.

- Asset Allocation: Asset allocation refers to the strategy of dividing a mutual fund's investment portfolio among different asset classes, such as stocks, bonds, and cash, to achieve a balance between risk and return.

- Diversification: Diversification is the practice of spreading investments across different securities, industries, sectors, and geographic regions to reduce risk and minimize the impact of poor performance in any single investment.

- Yield: Yield is the income generated by a mutual fund's investments, typically expressed as a percentage of the fund's NAV. It includes dividends from stocks, interest from bonds, and other sources of income.

- Capital Gain: Capital gain is the profit realized from selling a mutual fund investment for a higher price than its purchase price. It can be either short-term (held for one year or less) or long-term (held for more than one year), and it's subject to capital gains tax.

- Risk Profile: The risk profile of a mutual fund reflects its level of risk and volatility. Different funds have different risk profiles based on factors such as asset allocation, investment strategy, and the types of securities held.

- Performance Benchmark: A performance benchmark is a standard or index used to measure the performance of a mutual fund relative to its peers or the broader market. Common benchmarks include stock market indices like the S&P 500 or bond indices like the Bloomberg Barclays Aggregate Bond Index.

These are just a few of the many terms you might encounter when investing in mutual funds. By familiarizing yourself with these terminologies, you can better understand how mutual funds work and make informed investment decisions.

Understanding mutual funds

Understanding Mutual Funds with an Example:

Let's say you want to invest your savings in the stock market, but you're not sure which individual stocks to buy. You've heard about mutual funds as a way to invest in the market without having to pick stocks yourself. Here's how mutual funds work using an example:

Imagine you have $1,000 to invest. Instead of buying individual stocks with that money, you decide to invest in a mutual fund. You choose a mutual fund that focuses on technology companies because you believe the tech sector will perform well in the future.

The mutual fund pools your $1,000 together with money from other investors who have similar investment goals. With this combined pool of money, the mutual fund manager can buy a diversified portfolio of technology stocks on your behalf.

For example, the mutual fund might invest in companies like Apple, Microsoft, Google, and Amazon, among others. By investing in multiple companies, the mutual fund spreads out the risk. If one company's stock performs poorly, it may be offset by gains from other companies in the portfolio.

Now, let's say the value of the stocks in the mutual fund's portfolio increases over time. As a result, the value of your investment also grows. If the mutual fund's portfolio increases in value by 10% over the year, your $1,000 investment would be worth $1,100.

However, it's important to note that mutual funds also come with fees, such as management fees and other expenses. These fees are typically expressed as an expense ratio, which is a percentage of the fund's assets deducted annually to cover operating costs.

Despite the fees, mutual funds offer several advantages, including professional management, diversification, liquidity, and accessibility. They allow investors to participate in the stock market without needing to pick individual stocks or manage their own portfolios.

Overall, mutual funds provide a convenient and accessible way for investors to achieve their financial goals and build wealth over the long term.

What are the types of mutual funds?

Types of Mutual Funds:

Mutual funds come in various types, each designed to meet different investment objectives, risk profiles, and preferences of investors. Here are some common types of mutual funds:

- Equity Funds: Equity funds primarily invest in stocks or shares of companies. They offer the potential for high returns over the long term but come with higher risk due to stock market volatility. Examples include large-cap funds, mid-cap funds, small-cap funds, sector funds, and thematic funds.

- Debt Funds: Debt funds invest in fixed-income securities such as bonds, government securities, corporate bonds, and money market instruments. They provide regular income through interest payments and are considered less risky than equity funds. Examples include liquid funds, income funds, gilt funds, and corporate bond funds.

- Hybrid Funds: Hybrid funds, also known as balanced funds or asset allocation funds, invest in a mix of stocks and bonds to achieve a balance between growth and income. They offer diversification and are suitable for investors seeking a combination of capital appreciation and stability. Examples include balanced funds, dynamic asset allocation funds, and monthly income plans (MIPs).

- Index Funds: Index funds replicate the performance of a specific stock market index, such as the S&P 500 or the Nifty 50, by investing in the same securities in the same proportion as the index. They offer low-cost exposure to broad market indices and are suitable for passive investors seeking market returns with minimal expenses.

- Exchange-Traded Funds (ETFs): ETFs are similar to index funds but trade on stock exchanges like individual stocks. They offer the flexibility of trading throughout the day at market prices and are often used for short-term trading or tactical asset allocation. Examples include equity ETFs, bond ETFs, commodity ETFs, and sector ETFs.

- Money Market Funds: Money market funds invest in short-term, high-quality debt securities with maturities of up to one year. They provide stability of capital and liquidity, making them suitable for investors seeking safety and short-term cash management. Examples include treasury bills, commercial paper, certificates of deposit, and repurchase agreements.

- Specialty Funds: Specialty funds focus on specific investment themes, sectors, or strategies. They may invest in niche areas such as real estate, commodities, infrastructure, healthcare, or socially responsible investing (SRI). Specialty funds offer targeted exposure but may come with higher risk and volatility.

These are just a few examples of the types of mutual funds available to investors. Each type has its own characteristics, risk-return profile, and suitability for different investment goals and preferences. Investors should carefully evaluate their investment objectives, risk tolerance, and time horizon before choosing a mutual fund.

Types of Mutual Funds Based on Asset Class

Mutual funds can also be categorized based on the size of the companies they invest in. These categories include large-cap, mid-cap, and small-cap funds. Here's a closer look at each:

- Large-Cap Funds: Large-cap funds primarily invest in stocks of large, well-established companies with large market capitalizations. These companies typically have a long track record of stable performance and are considered industry leaders. Large-cap funds aim to provide stable returns and are often less volatile than mid-cap and small-cap funds.

- Mid-Cap Funds: Mid-cap funds invest in stocks of medium-sized companies with moderate market capitalizations. These companies are smaller than large-caps but larger than small-caps and are often in a phase of growth and expansion. Mid-cap funds offer potential for higher returns than large-caps but may come with higher volatility and risk.

- Small-Cap Funds: Small-cap funds invest in stocks of small, emerging companies with small market capitalizations. These companies are often in the early stages of development and have the potential for rapid growth but also carry higher risk. Small-cap funds offer the highest potential for returns among the three categories but are also the most volatile.

- Multi-Cap Funds: Multi-cap funds invest in stocks across companies of all sizes, including large-cap, mid-cap, and small-cap stocks. The fund manager has the flexibility to adjust the allocation among different market capitalizations based on market conditions, valuations, and investment opportunities. Multi-cap funds aim to provide diversification across the entire market spectrum and capitalize on the best investment opportunities available at any given time.

Investors can choose mutual funds from these categories based on their investment goals, risk tolerance, and time horizon. Large-cap funds are suitable for investors seeking stability and steady returns, while mid-cap and small-cap funds are better suited for those willing to take on higher risk for the potential of higher returns.

What are the fees and charges of mutual funds?

Fees and Charges in Mutual Funds:

Investing in mutual funds involves various fees and charges that investors should be aware of. These fees are deducted from the fund's assets and impact the overall returns earned by investors. Here are some common fees and charges associated with mutual funds:

- Expense Ratio: The expense ratio is the annual fee charged by the mutual fund to cover its operating expenses, including management fees, administrative costs, marketing expenses, and other operational overheads. It's expressed as a percentage of the fund's average net assets and is deducted from the fund's assets before calculating the net asset value (NAV).

- Front-End Load: A front-end load, also known as a sales load or sales charge, is a fee charged at the time of purchasing mutual fund units. It's expressed as a percentage of the amount invested and is deducted upfront from the investor's investment. Front-end loads are typically used to compensate the sales agent or distributor selling the mutual fund.

- Back-End Load: A back-end load, also known as a deferred sales charge (DSC) or exit load, is a fee charged when redeeming or selling mutual fund units within a specified period, usually one to seven years. The fee gradually decreases over time and may eventually be waived if the investor holds the units for the entire period. Back-end loads are designed to discourage short-term trading and promote long-term investing.

- Transaction Fees: Transaction fees are charges levied by the mutual fund for buying or selling units of the fund. These fees may vary depending on the type of transaction (e.g., purchase, redemption, exchange), the channel used (e.g., online, offline), and the payment method (e.g., electronic transfer, cheque).

- Account Maintenance Fees: Some mutual funds may impose account maintenance fees for maintaining investment accounts, especially for smaller accounts that fall below a certain threshold. These fees are typically charged annually or semi-annually and cover administrative expenses associated with account management.

- Other Charges: In addition to the above fees, mutual funds may also incur other charges, such as custodian fees, trustee fees, legal fees, audit fees, and regulatory fees. These charges are necessary for the operation and compliance of the mutual fund and are borne by the fund's investors.

It's important for investors to understand the fees and charges associated with mutual funds and consider them when evaluating the overall cost and potential returns of their investments. By minimizing fees and expenses, investors can maximize their investment returns and achieve their financial goals more effectively.

What are the key features of mutual fund?

Key Features of Mutual Funds:

Mutual funds offer several features that make them popular investment vehicles among investors. Understanding these key features can help investors make informed decisions when choosing mutual funds for their investment portfolios. Here are some of the key features of mutual funds:

- Professional Management: Mutual funds are managed by experienced fund managers or investment teams who make investment decisions on behalf of investors. These professionals conduct research, analyze market trends, and select investments to achieve the fund's investment objectives.

- Diversification: Mutual funds pool money from multiple investors and invest in a diversified portfolio of securities, such as stocks, bonds, money market instruments, and other assets. Diversification helps spread risk and minimize the impact of poor performance in any single investment.

- Liquidity: Mutual funds offer liquidity to investors, allowing them to buy or sell units/shares of the fund at the prevailing net asset value (NAV) on any business day. Investors can redeem their investments and access their funds relatively quickly and easily, providing flexibility and convenience.

- Accessibility: Mutual funds are accessible to investors of all sizes and levels of expertise, making them suitable for individual investors, institutions, retirement plans, and other entities. Investors can start investing in mutual funds with relatively small amounts of money and choose from a wide range of funds based on their investment goals and preferences.

- Transparency: Mutual funds provide regular updates, disclosures, and reports to investors, including NAV calculation, portfolio holdings, performance data, expenses, and other relevant information. Investors can monitor the fund's performance and track their investments effectively, promoting transparency and accountability.

- Regulation and Oversight: Mutual funds are regulated and supervised by government agencies or regulatory bodies to protect investors' interests and ensure compliance with securities laws and regulations. Regulatory oversight helps maintain integrity, transparency, and stability in the mutual fund industry.

- Tax Efficiency: Mutual funds offer tax benefits to investors, such as capital gains tax deferral and tax-efficient distribution of income. Certain types of mutual funds, such as index funds and ETFs, may have lower turnover and tax consequences compared to actively managed funds, enhancing tax efficiency.

Overall, mutual funds provide investors with a convenient, cost-effective, and professionally managed investment solution to achieve their financial goals and build wealth over the long term.

What are the advantages and disadvantages of mutual funds?

Advantages and Disadvantages of Mutual Funds:

Mutual funds offer several advantages and disadvantages that investors should consider when deciding whether to invest in them. Here's a closer look at both:

Advantages:

- Professional Management: Mutual funds are managed by experienced fund managers or investment teams who make investment decisions on behalf of investors. These professionals conduct research, analysis, and investment strategies to achieve the fund's objectives.

- Diversification: Mutual funds invest in a diversified portfolio of securities across different asset classes, industries, sectors, and geographic regions. Diversification helps spread risk and minimize the impact of poor performance in any single investment.

- Liquidity: Mutual funds offer liquidity to investors, allowing them to buy or sell units/shares of the fund at the prevailing net asset value (NAV) on any business day. Investors can redeem their investments and access their funds relatively quickly and easily.

- Accessibility: Mutual funds are accessible to investors of all sizes and levels of expertise, making them suitable for individual investors, institutions, retirement plans, and other entities. Investors can start investing in mutual funds with relatively small amounts of money.

- Transparency: Mutual funds provide regular updates, disclosures, and reports to investors, including NAV calculation, portfolio holdings, performance data, expenses, and other relevant information. Investors can monitor the fund's performance and track their investments effectively.

Disadvantages:

- Costs and Fees: Mutual funds may charge various fees and expenses, including management fees, administrative costs, sales loads, and transaction fees. These fees can reduce the overall returns earned by investors.

- Market Risk: Mutual funds are subject to market risk, including the risk of loss due to fluctuations in the value of the securities held in the fund's portfolio. Market volatility can affect the fund's performance and result in losses for investors.

- Dependency on Fund Manager: Mutual funds rely on the expertise and decisions of the fund manager or investment team. If the manager's performance is subpar or if there are changes in management, it can affect the fund's returns and performance.

- Over-Diversification: While diversification is a key advantage of mutual funds, over-diversification can lead to reduced potential returns. Holding too many securities may dilute the impact of strong performers in the portfolio.

- Tax Implications: Mutual fund investments may have tax implications for investors, including capital gains taxes on distributions and taxes on dividend income. Investors should consider the tax consequences of their investments and consult with a tax advisor if needed.

Overall, mutual funds offer investors a convenient and accessible way to participate in the financial markets and achieve their investment goals. However, investors should carefully consider the advantages and disadvantages of mutual funds and assess their suitability based on their individual financial circumstances and objectives.

What are the risk factors associated with mutual funds?

Risk Factors Associated with Mutual Funds:

While mutual funds offer the potential for investment returns, they also come with certain risks that investors should be aware of. Understanding these risk factors is essential for making informed investment decisions. Here are some common risk factors associated with mutual funds:

- Market Risk: Mutual funds are subject to market risk, which arises from fluctuations in the value of the securities held in the fund's portfolio. Market volatility can affect the fund's performance and result in losses for investors. Factors such as economic conditions, interest rates, corporate earnings, and geopolitical events can impact market prices.

- Stock-Specific Risk: Equity funds are exposed to stock-specific risk, also known as company risk or individual security risk. This risk arises from factors specific to individual companies, such as poor financial performance, management issues, competitive pressures, or regulatory changes. A decline in the value of a particular stock can negatively impact the fund's overall performance.

- Interest Rate Risk: Debt funds are exposed to interest rate risk, which refers to the impact of changes in interest rates on the value of fixed-income securities held in the fund's portfolio. When interest rates rise, bond prices fall, leading to a decline in the fund's NAV. Conversely, when interest rates fall, bond prices rise, resulting in an increase in the fund's NAV.

- Credit Risk: Debt funds are also exposed to credit risk, also known as default risk or creditworthiness risk. This risk arises from the possibility that the issuer of a fixed-income security may default on its payments of interest and principal. Lower-rated or unrated bonds are more susceptible to credit risk than higher-rated bonds.

- Liquidity Risk: Mutual funds may face liquidity risk, which refers to the risk of not being able to buy or sell securities in the fund's portfolio at favorable prices and in a timely manner. Illiquid securities or market conditions may hinder the fund's ability to meet redemption requests or adjust its portfolio efficiently.

- Operational Risk: Mutual funds are exposed to operational risk, which arises from errors, disruptions, or failures in the fund's operations, systems, processes, or personnel. Operational risks can include errors in NAV calculation, compliance violations, cybersecurity threats, legal disputes, or regulatory fines.

It's important for investors to assess their risk tolerance and investment objectives carefully before investing in mutual funds. By understanding the risk factors associated with mutual funds, investors can make informed decisions and construct well-diversified investment portfolios that align with their financial goals.

What is tax regime for mutual funds?

Tax Regime for Mutual Funds in India:

The tax treatment of mutual funds in India depends on various factors such as the type of mutual fund, the holding period, and the investor's tax status. Here's an overview of the tax regime for mutual funds:

- Equity Mutual Funds: Equity mutual funds invest primarily in stocks or equity-related instruments. Long-term capital gains (LTCG) on equity mutual funds held for more than one year are taxed at a flat rate of 10% on gains exceeding ₹1 lakh in a financial year. Short-term capital gains (STCG) on equity mutual funds held for one year or less are taxed at 15%.

- Debt Mutual Funds: Debt mutual funds invest primarily in fixed-income securities such as bonds, debentures, and government securities. Long-term capital gains (LTCG) on debt mutual funds held for more than three years are taxed at 20% with indexation benefit. Short-term capital gains (STCG) on debt mutual funds held for three years or less are taxed at the investor's applicable income tax slab rate.

- Hybrid and Balanced Mutual Funds: Hybrid and balanced mutual funds invest in a mix of equity and debt instruments. The tax treatment depends on the proportion of equity and debt in the fund's portfolio. The equity portion is taxed similar to equity mutual funds, while the debt portion is taxed similar to debt mutual funds.

- Systematic Investment Plans (SIPs): SIPs in mutual funds are treated similarly to lump-sum investments for tax purposes. Each SIP installment is considered a separate investment, and the holding period is calculated from the date of each installment.

- Dividend Distribution Tax (DDT): Dividends received from mutual funds are subject to dividend distribution tax (DDT) before distribution to investors. DDT rates vary depending on the type of mutual fund and the investor's tax status. However, dividends received from equity mutual funds are tax-free in the hands of the investors.

- Capital Gains Tax: Capital gains tax is applicable when investors redeem or sell their mutual fund units. The holding period determines whether the gains are treated as long-term or short-term capital gains, which are taxed at different rates.

It's essential for investors to understand the tax implications of investing in mutual funds and consult with a tax advisor if needed to optimize their tax planning strategies.

What are the Documents required to invest in mutual funds?

Documents Required to Invest in Mutual Funds:

Investing in mutual funds typically requires a few essential documents to verify the investor's identity, address, and other details. Here are the documents commonly required to invest in mutual funds in India:

- PAN Card: The Permanent Account Number (PAN) card is mandatory for all mutual fund investments in India. It serves as proof of identity and is required for KYC (Know Your Customer) verification.

- Proof of Address: Investors need to provide a valid proof of address document, such as Aadhaar card, passport, driving license, voter ID card, utility bills (electricity, telephone), or bank statement. The address proof is used to verify the investor's residential address.

- Bank Account Details: Investors need to provide their bank account details, including the account number, IFSC code, and MICR code, for transactions related to mutual fund investments, such as purchases, redemptions, and dividend payouts.

- Passport Size Photographs: Investors may be required to submit passport size photographs for completing the mutual fund application form and for KYC verification purposes.

- KYC (Know Your Customer) Documentation: As per regulatory requirements, investors need to complete the KYC process by submitting KYC documentation, which includes the PAN card, proof of address, and passport size photographs. KYC verification is mandatory for all mutual fund investors.

These are the basic documents required to invest in mutual funds in India. Depending on the mutual fund distributor or AMC (Asset Management Company), additional documents or information may be requested for specific transactions or regulatory compliance.